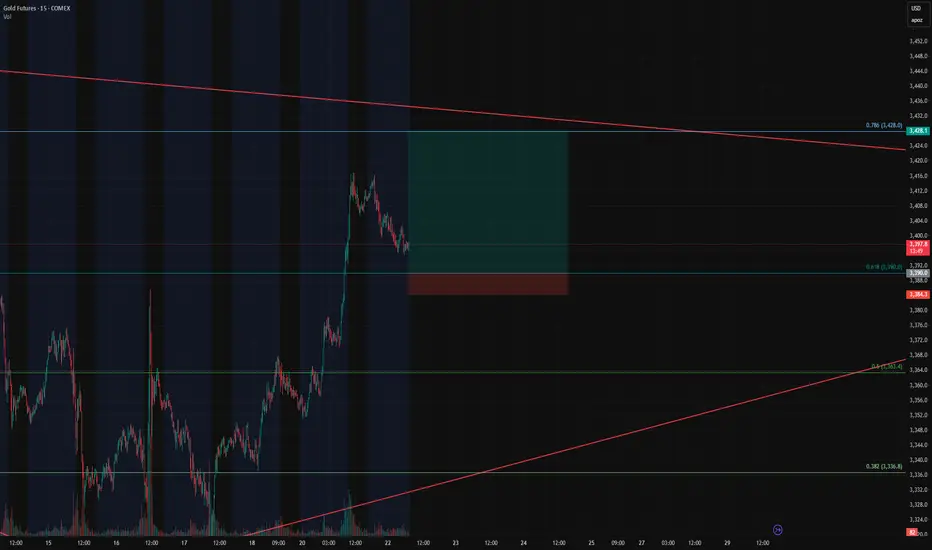

Gold Futures Long Setup – Breakout Continuation off the 0.618 Fib

Instrument: Gold Futures – COMEX ( GC1!)

GC1!)

Timeframe: 15-Minute

Trade Type: Long – Breakout Continuation

Entry Zone: 3390 (0.618 Fibonacci retracement)

Take Profit: 3428 (0.786 Fib)

Stop Loss: 3384

Risk/Reward Ratio: 6.68

Setup: Bullish Flag on Retest

🔍 Trade Thesis

This trade is part of an ongoing breakout continuation strategy we've been trading, and now we're eyeing a pullback entry as price returns to a key retracement level.

This is a high R:R continuation play, with targets set at the 0.786 Fib level (3428) — right before macro resistance kicks in.

🎯 Entry & Exit Strategy

📊 Why This Works

Instrument: Gold Futures – COMEX (

Timeframe: 15-Minute

Trade Type: Long – Breakout Continuation

Entry Zone: 3390 (0.618 Fibonacci retracement)

Take Profit: 3428 (0.786 Fib)

Stop Loss: 3384

Risk/Reward Ratio: 6.68

Setup: Bullish Flag on Retest

🔍 Trade Thesis

This trade is part of an ongoing breakout continuation strategy we've been trading, and now we're eyeing a pullback entry as price returns to a key retracement level.

- Price nearly exploded through the 0.618 Fibonacci level (3390) during the prior breakout.

- Now it's pulling back in a textbook bullish flag formation, suggesting healthy consolidation before the next leg.

- The 0.618 retracement is aligning with previous intraday structure and trendline support — making this an ideal level to scale in.

This is a high R:R continuation play, with targets set at the 0.786 Fib level (3428) — right before macro resistance kicks in.

🎯 Entry & Exit Strategy

- Entry: As price touches 3390 or forms bullish confirmation at the level.

- Stop Loss: 3384 – tight and below key fib/flag structure.

- Target: 3428 – based on 0.786 Fib extension and breakout continuation projection.

📊 Why This Works

- Breakout behavior: Price respected the breakout impulse and retraced cleanly into a bull flag.

- Fib confluence: 0.618 pullbacks are a classic entry in trending markets.

- R/R of 6.68: Excellent reward profile vs. limited risk.

🚀 Founder of SciQua | Strategy. Simulation. Signals.

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🚀 Founder of SciQua | Strategy. Simulation. Signals.

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.