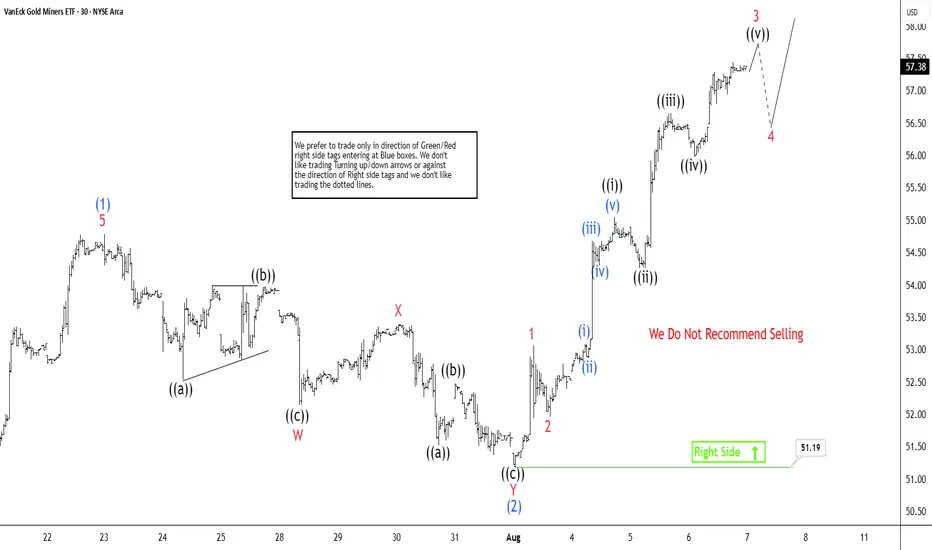

The Gold Miners ETF (GDX) continues its upward trajectory, forming a pattern of higher highs and higher lows since its September 2022 bottom, signaling a robust bullish market. From the July 17, 2025 low, GDX has embarked on a five-wave impulse Elliott Wave structure in the shorter cycle. The hourly chart shows wave (1) peaking at 54.79, followed by a wave (2) dip concluding at 51.19. Wave (2) unfolded as a double three Elliott Wave pattern, with wave W declining to 52.15, wave X rallying to 53.41, and wave Y completing the correction at 51.19.

GDX has since surged within wave (3), structured as a lower-degree impulse. From wave (2), wave 1 climbed to 53.06, and a brief wave 2 pullback ended at 51.96. The ETF then advanced in wave 3, with sub-wave ((i)) reaching 55.05 and sub-wave ((ii)) retracing to 54.26. Sub-wave ((iii)) pushed higher to 56.66, followed by a sub-wave ((iv)) dip to 55.99. The ETF should soon complete sub-wave ((v)) of wave 3, followed by a wave 4 pullback before resuming upward in wave 5 of (3). As long as the 51.19 pivot holds, pullbacks should find support in a 3, 7, or 11-swing sequence, paving the way for further gains. The bullish momentum remains strong, with 58.3 as a potential target.

GDX has since surged within wave (3), structured as a lower-degree impulse. From wave (2), wave 1 climbed to 53.06, and a brief wave 2 pullback ended at 51.96. The ETF then advanced in wave 3, with sub-wave ((i)) reaching 55.05 and sub-wave ((ii)) retracing to 54.26. Sub-wave ((iii)) pushed higher to 56.66, followed by a sub-wave ((iv)) dip to 55.99. The ETF should soon complete sub-wave ((v)) of wave 3, followed by a wave 4 pullback before resuming upward in wave 5 of (3). As long as the 51.19 pivot holds, pullbacks should find support in a 3, 7, or 11-swing sequence, paving the way for further gains. The bullish momentum remains strong, with 58.3 as a potential target.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.