Today we are looking at GIGA, which has just undergone a brutal capitulation event, wiping out the recent gains. While the bearish momentum has been fierce, such violent moves often culminate in extreme exhaustion, presenting rare opportunities for high-reward reversal trades.

This analysis will break down the compelling confluence of signals that suggest the selling pressure has reached its limit and that the current price level could be a significant, long-term bottom. We will outline the bullish case for entering a long position, targeting a powerful "V-shaped" recovery.

The Analysis: The Case for a Major Reversal

While buying into such a steep drop is inherently risky, the data suggests that the risk-to-reward profile is now heavily skewed to the upside. Here’s why:

1. CRITICAL - The Capitulation Signal (Extreme Multi-Timeframe Exhaustion):

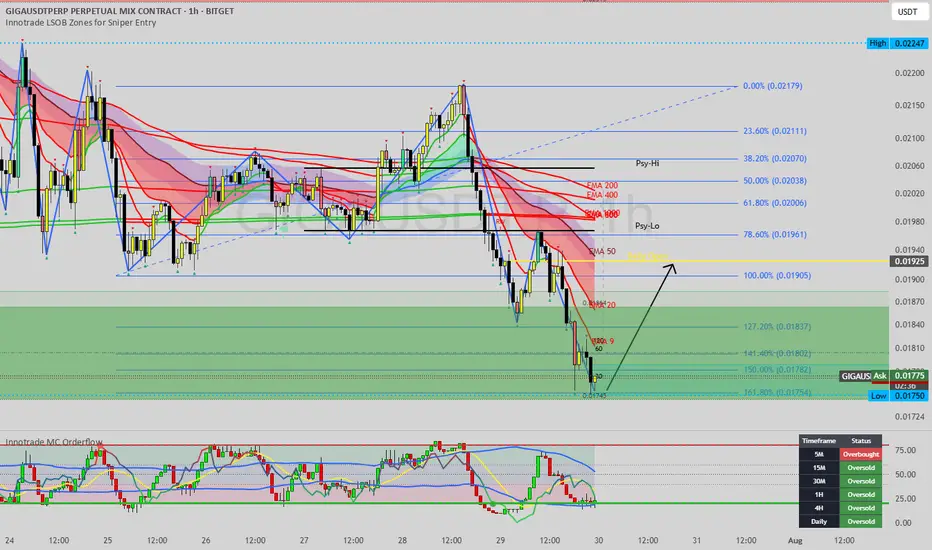

This is the single most powerful argument for a bottom. Our momentum dashboard is showing a rare and profound alignment: the 15M, 30M, 1H, 4H, and—most importantly—the Daily timeframe are all simultaneously deep in "Oversold" territory. When the daily chart becomes this oversold, it often signals a macro bottom, not just a temporary pause. This is a textbook sign of seller capitulation.

2. The Reversal Zone (Fibonacci Extension & New Demand):

Price has crashed through the 100% level and found its footing deep within the Fibonacci extension zone (127.2% - 161.8%). Historically, these deep extension levels are common termination points for corrective waves, as they represent points of maximum fear and panic. Concurrently, a new demand zone (labeled "120" / "80") is being carved out, indicating that smart money may be starting to accumulate at these depressed prices.

3. Asymmetric Risk-to-Reward:

From a trade management perspective, this setup is highly attractive. By entering near the lows, a trader can define their risk with a very tight stop loss placed just below the absolute low. The potential upside, however, is massive, with the first major target being a reclaim of the prior range. This creates a highly asymmetric opportunity where the potential reward vastly outweighs the initial risk.

The Potential Trade Plan

This is an aggressive, counter-trend trade that aims to capture the start of a new bullish impulse.

Entry Zone: The current area between $0.01750 and $0.01800 represents the point of maximum opportunity. Look for signs of a bottom forming, such as price starting to hold the lows and make small higher lows on the lower timeframes.

Stop Loss: A tight stop loss can be placed just below the absolute low, around $0.01720. A break of this low would invalidate the immediate reversal thesis.

Potential Targets:

Target 1: A reclaim of the Daily Open / 100% Fib level at $0.01925. This would be the first sign that bulls are back in control.

Target 2: A move back to the major resistance cluster and prior breakdown point around $0.02050 - $0.02100.

Target 3: A full retest of the major swing high at $0.02534.

Conclusion

While the recent price action has been bearish, the overwhelming evidence of multi-timeframe seller exhaustion, combined with the price hitting a key Fibonacci reversal zone, presents a powerful case for a major bottom. For traders with a higher risk appetite, the current levels on GIGA offer a rare, high-reward opportunity to catch the potential start of a massive recovery.

Disclaimer:

This analysis is for educational purposes only and is not financial advice. Trading involves a high level of risk, especially when attempting to trade against a strong trend. Always conduct your own thorough research and consult with a licensed financial advisor before making any trading decisions.

This analysis will break down the compelling confluence of signals that suggest the selling pressure has reached its limit and that the current price level could be a significant, long-term bottom. We will outline the bullish case for entering a long position, targeting a powerful "V-shaped" recovery.

The Analysis: The Case for a Major Reversal

While buying into such a steep drop is inherently risky, the data suggests that the risk-to-reward profile is now heavily skewed to the upside. Here’s why:

1. CRITICAL - The Capitulation Signal (Extreme Multi-Timeframe Exhaustion):

This is the single most powerful argument for a bottom. Our momentum dashboard is showing a rare and profound alignment: the 15M, 30M, 1H, 4H, and—most importantly—the Daily timeframe are all simultaneously deep in "Oversold" territory. When the daily chart becomes this oversold, it often signals a macro bottom, not just a temporary pause. This is a textbook sign of seller capitulation.

2. The Reversal Zone (Fibonacci Extension & New Demand):

Price has crashed through the 100% level and found its footing deep within the Fibonacci extension zone (127.2% - 161.8%). Historically, these deep extension levels are common termination points for corrective waves, as they represent points of maximum fear and panic. Concurrently, a new demand zone (labeled "120" / "80") is being carved out, indicating that smart money may be starting to accumulate at these depressed prices.

3. Asymmetric Risk-to-Reward:

From a trade management perspective, this setup is highly attractive. By entering near the lows, a trader can define their risk with a very tight stop loss placed just below the absolute low. The potential upside, however, is massive, with the first major target being a reclaim of the prior range. This creates a highly asymmetric opportunity where the potential reward vastly outweighs the initial risk.

The Potential Trade Plan

This is an aggressive, counter-trend trade that aims to capture the start of a new bullish impulse.

Entry Zone: The current area between $0.01750 and $0.01800 represents the point of maximum opportunity. Look for signs of a bottom forming, such as price starting to hold the lows and make small higher lows on the lower timeframes.

Stop Loss: A tight stop loss can be placed just below the absolute low, around $0.01720. A break of this low would invalidate the immediate reversal thesis.

Potential Targets:

Target 1: A reclaim of the Daily Open / 100% Fib level at $0.01925. This would be the first sign that bulls are back in control.

Target 2: A move back to the major resistance cluster and prior breakdown point around $0.02050 - $0.02100.

Target 3: A full retest of the major swing high at $0.02534.

Conclusion

While the recent price action has been bearish, the overwhelming evidence of multi-timeframe seller exhaustion, combined with the price hitting a key Fibonacci reversal zone, presents a powerful case for a major bottom. For traders with a higher risk appetite, the current levels on GIGA offer a rare, high-reward opportunity to catch the potential start of a massive recovery.

Disclaimer:

This analysis is for educational purposes only and is not financial advice. Trading involves a high level of risk, especially when attempting to trade against a strong trend. Always conduct your own thorough research and consult with a licensed financial advisor before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.