🟡 GLD Swing Trade Setup – 6/18 $320 Call for 5–10 Day Breakout Move

📅 Trade Date: June 4, 2025 | 📈 Timeframe: 5–10 Day Swing

🎯 Playing a bullish continuation with defined risk & strong confidence

🧠 Multi-Model Consensus

Model Bias Strategy Strike Entry PT SL Confidence

Composite Mod. Bullish Long Call 320 1.68 2.52 0.84 75%

🔎 Technical & Sentiment Overview

Weekly Chart: Price > EMAs, clean bullish MACD crossover

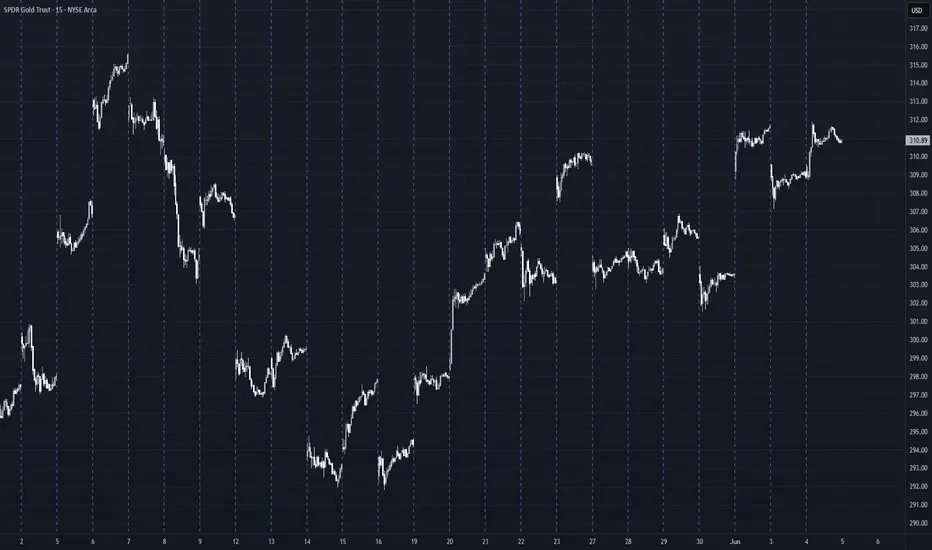

15-min Chart: Consolidating near $311–$313 support, breakout forming

Sentiment: Bullish news tailwinds (gold demand, USD weakening)

Max Pain: $308 = short-term pullback risk

Implied Volatility: Stable with limited crush risk

Options Flow: Moderate OI build in $313–$325 calls, upward bias

🎯 Trade Setup – Long GLD Call

Instrument: GLD

Direction: CALL (LONG)

Strike: $320.00

Expiry: 2025-06-18

Entry Price: $1.68

Profit Target: $2.52 (50% gain)

Stop Loss: $0.84 (50% loss)

Size: 1 contract

Entry Timing: Market open

Confidence: 75%

⚠️ Risk Management & Considerations

🛑 SL Discipline: Exit if premium drops to $0.84

🕒 Time Stop: Exit within 7–10 days if trade stagnates

🔁 News Risk: Watch for economic releases and dollar strength reversals

⚖️ Support Check: Must hold $310.50 zone on M15 chart

✅ Trade Thesis Summary

With GLD holding bullish structure on higher timeframes, models show strong agreement on upside continuation. We're targeting the $320 breakout with a controlled-risk weekly option.

📅 Trade Date: June 4, 2025 | 📈 Timeframe: 5–10 Day Swing

🎯 Playing a bullish continuation with defined risk & strong confidence

🧠 Multi-Model Consensus

Model Bias Strategy Strike Entry PT SL Confidence

Composite Mod. Bullish Long Call 320 1.68 2.52 0.84 75%

🔎 Technical & Sentiment Overview

Weekly Chart: Price > EMAs, clean bullish MACD crossover

15-min Chart: Consolidating near $311–$313 support, breakout forming

Sentiment: Bullish news tailwinds (gold demand, USD weakening)

Max Pain: $308 = short-term pullback risk

Implied Volatility: Stable with limited crush risk

Options Flow: Moderate OI build in $313–$325 calls, upward bias

🎯 Trade Setup – Long GLD Call

Instrument: GLD

Direction: CALL (LONG)

Strike: $320.00

Expiry: 2025-06-18

Entry Price: $1.68

Profit Target: $2.52 (50% gain)

Stop Loss: $0.84 (50% loss)

Size: 1 contract

Entry Timing: Market open

Confidence: 75%

⚠️ Risk Management & Considerations

🛑 SL Discipline: Exit if premium drops to $0.84

🕒 Time Stop: Exit within 7–10 days if trade stagnates

🔁 News Risk: Watch for economic releases and dollar strength reversals

⚖️ Support Check: Must hold $310.50 zone on M15 chart

✅ Trade Thesis Summary

With GLD holding bullish structure on higher timeframes, models show strong agreement on upside continuation. We're targeting the $320 breakout with a controlled-risk weekly option.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.