Target: $155

GLD Wave Count:

Wave 1: 350% Gain, 2313 Days, 6.3 years, ended: 9/11

Gains:

Wave 2: (46.07%), 1552 Days, 4.3 year, ended: 12/15

Impulse Waves:

1- 74.84% (Normal=Retrace>.236)

3-80.81% (Normal=1-1.618)

5-181% (200% of Wave 3)

Correction Waves:

2-(23.12%) - 212 days

4-(34.29%) - 154 days

Currently, GLD has formed a Bullish Leading Diagonal.

Primary Wave:

Impulse Waves:

1-5.68%

3-19.39%

5-14.04%

Complex Correction: ZigZag & Zigzag

ZigZag: (18.41%), 163 days

Second ZigZag: (14.25%), 202 days

Primary Wave 3 Target: $135-$155

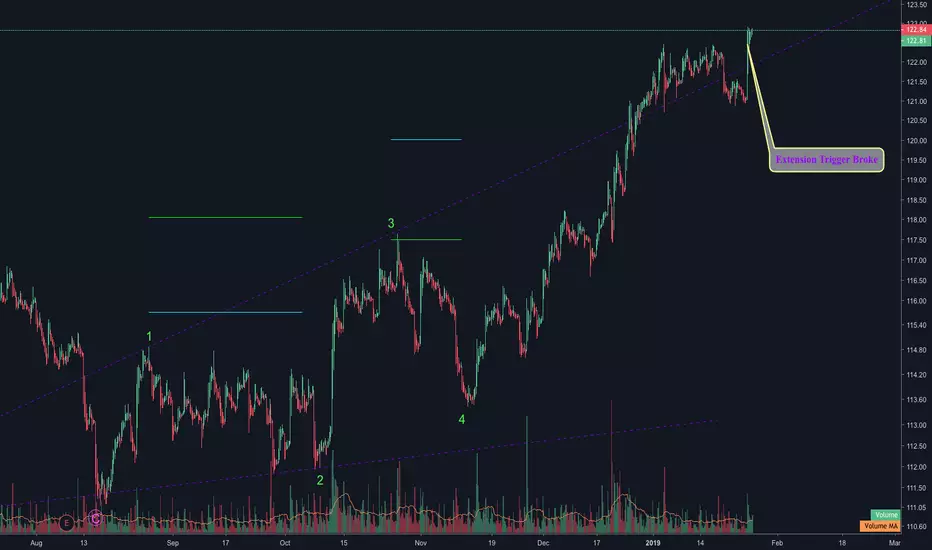

Minor Wave Count:

Currently, in the Minor wave count we have completed waves 1,2,3, and 4. The 5th Primary Wave broke the extension trigger (.618/$117) which is causing the 5th impulse wave to extend. Also, if you draw a channel trend line from Terminal 1 to Terminal Wave 3 you will see that the 5th Wave has broken through the top of the channel. This is another indication of an extended 5th wave.

Will update.

-AB

Trade active

Note

Option Trade: 15 FEB 19 125 CALL: $.45Sell entire position or at least 2/3 position at $1.00.

Note

15 FEB 19 125 CALL: .49 (Current Price)Note

15 FEB 19 125 CALL: .62 (Current Price)Note

Option check: .72Note

Option Check: .68Note

Sold Position. Trade was a double.

Trade closed: target reached

Note

Still Long Gold! Option Trade over.Trade active

Note

18 APR 19 125 CALL $2.52Note

Sell 1/2 postion @ $5.04Note

New option trade.Trade closed: target reached

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.