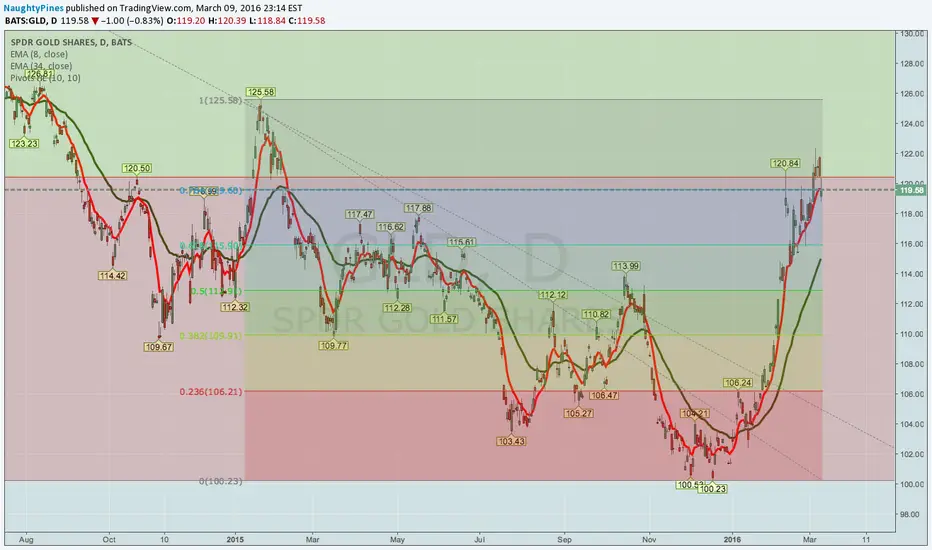

Taking on a little bit of extra GLD risk here, primarily to finance the improvement of my short call side of my June 112/115/115/118 iron fly (using the .70 credit I hope to receive here to finance the roll of the 115/118 side of the iron fly to higher strikes (same expiry)).

Here are the metrics for the setup:

GLD April 15th 109/112/127/130 iron condor

Probability of Profit: 66%

Max Profit: $70/contract

Buying Power Effect: $230/contract

Here are the metrics for the setup:

GLD April 15th 109/112/127/130 iron condor

Probability of Profit: 66%

Max Profit: $70/contract

Buying Power Effect: $230/contract

Note

Unfortunately, no fill. Will look at other possible setups to finance improved strikes next week ... .Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.