Parabolic rally recently in GME. Gained a lot of attention but, as of yet, it's not broken out of the simple downtrend structure.

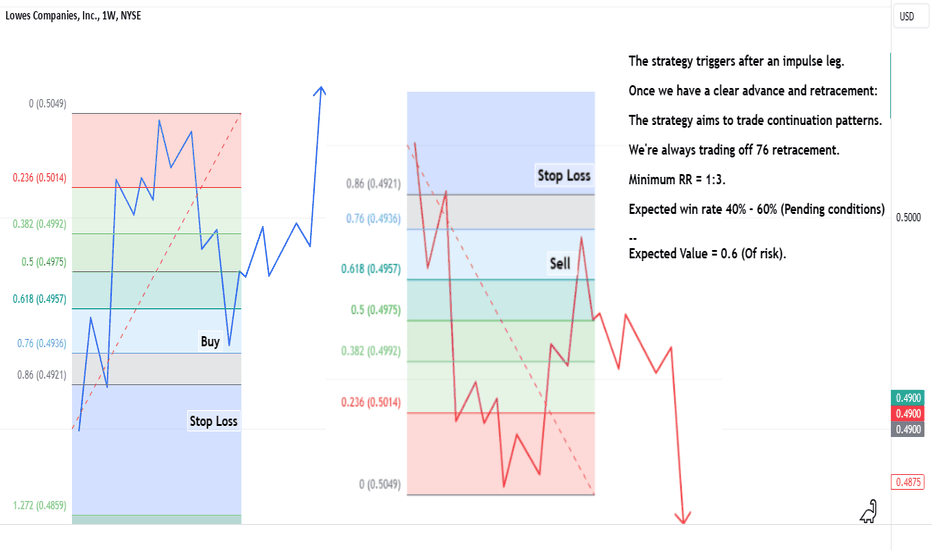

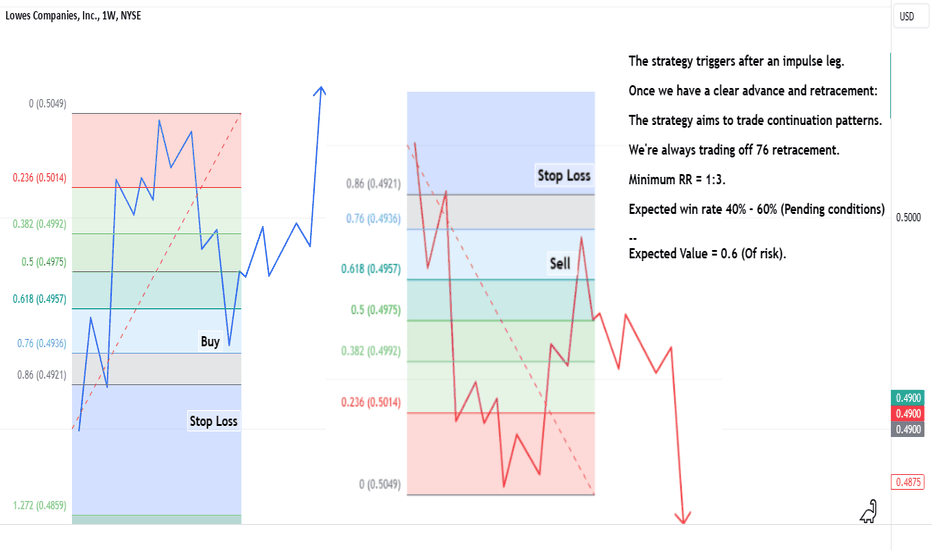

In setups like this there's always a 1:3 - 1:5 RR trade fading the rally into the 76 resistance (Caveat of gap risk in stocks).

If the downtrend is to continue, this should be about the end of the rally.

In setups like this there's always a 1:3 - 1:5 RR trade fading the rally into the 76 resistance (Caveat of gap risk in stocks).

If the downtrend is to continue, this should be about the end of the rally.

We may be inside of a crash event to 3000 in SPX.

Read the full case with backlog of historic analysis/forecasts here: holeyprofitnewsletter.substack.com/p/the-case-for-3000-in-spx

Read the full case with backlog of historic analysis/forecasts here: holeyprofitnewsletter.substack.com/p/the-case-for-3000-in-spx

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

We may be inside of a crash event to 3000 in SPX.

Read the full case with backlog of historic analysis/forecasts here: holeyprofitnewsletter.substack.com/p/the-case-for-3000-in-spx

Read the full case with backlog of historic analysis/forecasts here: holeyprofitnewsletter.substack.com/p/the-case-for-3000-in-spx

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.