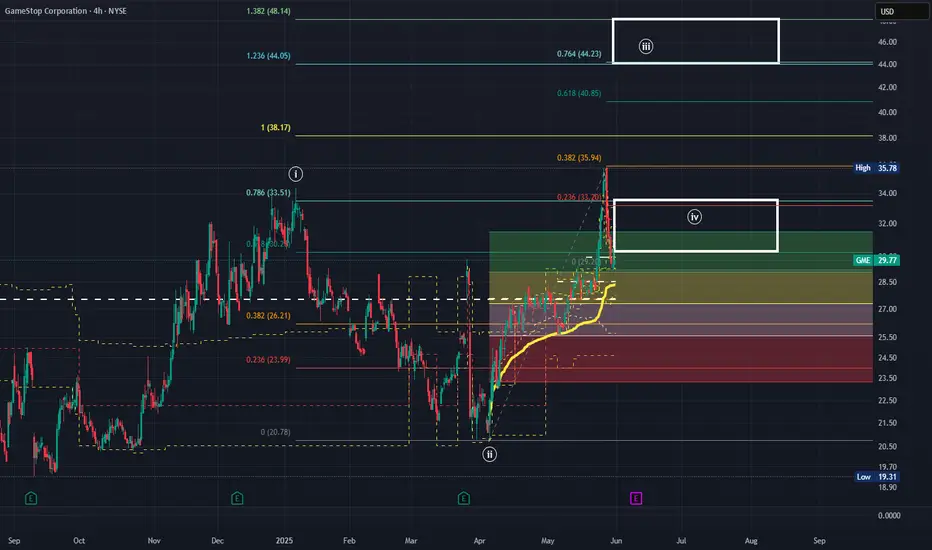

As I reminded everyone in the youtube video earlier this week we are dealing with a large Diagonal structure in GME

There is nothing unusual AT ALL about the decline we saw this week

That is the nature of diagonals

Now we seem to be bottoming again around 30 which if that continues should see price rise to the 38 level then ultimately the 45 region

I also gave you 2 days to watch leading up to and during the week of 06/09:

06/05 and 06/11

Expecting to again see strong volume after those dates

I have no idea obviously but I would also expect The Cat to make an appearance around 06/09..probably on 06/08 if his Sunday posting pattern continues..but who really knows

At the end of the day im just watching FIBS, VOLUME and Indicator Confluence/Divergence

I'll leave the hopium to someone else...i'm strictly business from here out

GOOD TRADING TO YOU ALL

There is nothing unusual AT ALL about the decline we saw this week

That is the nature of diagonals

Now we seem to be bottoming again around 30 which if that continues should see price rise to the 38 level then ultimately the 45 region

I also gave you 2 days to watch leading up to and during the week of 06/09:

06/05 and 06/11

Expecting to again see strong volume after those dates

I have no idea obviously but I would also expect The Cat to make an appearance around 06/09..probably on 06/08 if his Sunday posting pattern continues..but who really knows

At the end of the day im just watching FIBS, VOLUME and Indicator Confluence/Divergence

I'll leave the hopium to someone else...i'm strictly business from here out

GOOD TRADING TO YOU ALL

Note

And thats a wrapWell another overlapping day which is par for the course dealing diagonals regardless of the broader market drama

Didnt get the volume I expected today but thinking we get it the day tomorrow which is similar to my 05/21 call for volume which saw it actually come in on 05/22

Either way the week of 06/09 is looming and we are about to see how valid this 20 week cycle stuff really is

TICK TOCK

Note

Volume is anemic..hmmmnNote

Im a fan of many different TA disciplines..although EWT is my baseIn elliott wave sometimes is difficult to clearly count waves when the price action is consolidating and "going sideways:

Typically you will see Elliotticians broadly count that type of price action as a "combination" pattern- meaning its a mixture of many different motive/impulsive/corrective waves

I personally have found that Wyckoff does a good job of explaining that price action and subsequently Ive added it to my TA tool bag

Note

And thats a wrap!Green day but its obvious they were doing what they could to keep things under Max pain

Volume/Volatility was extremely muted along with sending 60% off exchange

But guess what next week is? The WEEK OF 06/09

Tomorrow is my LAST PLANNED VIDEO on GME...

I plan to run down what I expect coming up and drop some new info on the 20 week cycle (the new stuff DOESNT CHANGE ANYTHING..just new nuggets to chew on)

BTW- I still think if The Cat comes back soon it will be Sunday 06/08

So TICK TOCK shorties

TIME TO SEE HOW REAL THIS 20 WEEK CYCLE STUFF REALLY IS

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.