The CPI data released this week was lower than market expectations, which is considered positive news. However, since it was the same as the previous reading, gold prices only rebounded briefly before entering another period of volatile consolidation.

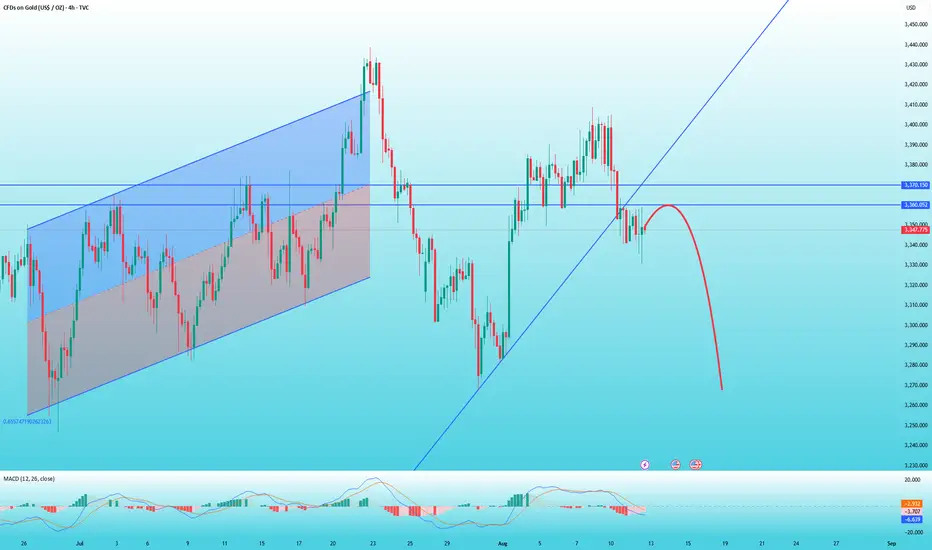

From the 4-hour chart, gold prices have already broken through support levels. If they fail to break back above 3370 in the short term, they may continue to test the bottom.

Gold's rebound is weak in the short term, and it's trending downward. The K-line indicator is showing a bearish pattern, and the MACD indicator has formed a death cross.

Therefore, if you want to trade short, wait for a rebound around 3360. Set a stop-loss at 3370, with a target of 3340 and then 3330.

From the 4-hour chart, gold prices have already broken through support levels. If they fail to break back above 3370 in the short term, they may continue to test the bottom.

Gold's rebound is weak in the short term, and it's trending downward. The K-line indicator is showing a bearish pattern, and the MACD indicator has formed a death cross.

Therefore, if you want to trade short, wait for a rebound around 3360. Set a stop-loss at 3370, with a target of 3340 and then 3330.

Trade active

Gold hits 3360 and encounters resistance. If it fails to break through, it will fall.Note

Sell 3355-3360TP1: 3340

TP2: 3330

TP3: 3320

Good luck everyone

🔥🔥🔥Welcome to join

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥🔥🔥Welcome to join

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.