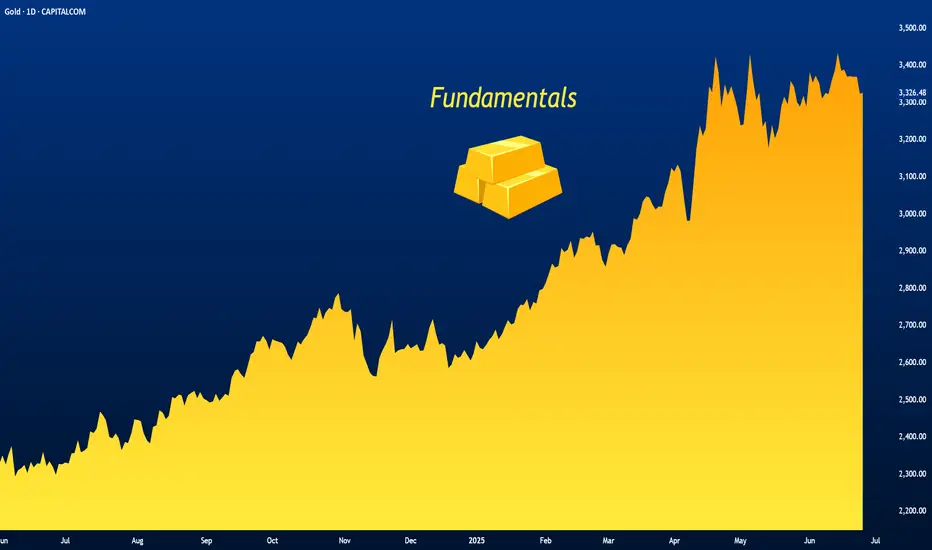

Gold is holding steady and posting a modest rebound today after notable losses yesterday, though it continues to struggle to reclaim the $3,330 per ounce level.

The precious metal’s ability to resume gains stems from continued market uncertainty surrounding both geopolitical and trade-related risks, which could sustain demand for safe-haven assets.

On the geopolitical front, despite the optimism sparked by the surprise ceasefire agreement that ended the twelve-day war between Israel and Iran, the possibility of renewed escalation remains on the table.

Media outlets have been abuzz with a leaked intelligence report to CNN that was about that the U.S. strike only managed to delay Iran’s nuclear program by a few months and did not eliminate its stockpile of enriched uranium. In other words, the war ended before achieving its core objective—let alone dismantling Iran’s ballistic missile capabilities.

This could also complicate any future negotiations, as Israel may double down on its demands for a complete dismantling of Iran’s nuclear and missile programs, while Tehran may cling even more tightly to these programs following the recent conflict.

On the other hand, New York Times columnist Thomas Friedman expressed hope that the political fallout for both sides might generate internal pressure strong enough to prevent another confrontation.

In any case, should escalation resume, markets may enter a new cycle of geopolitical risk. However, such episodes are unlikely to last long unless the red line is crossed, namely, direct attacks on key oil and gas export infrastructure or on global shipping routes. This logic explains the fragile nature of the risk premiums that both oil and gold gained during earlier waves of escalation.

Now that the latest round of conflict has ended, the market's attention could shift back to trade tensions, which remain unresolved. The suspension of U.S. tariffs on the European Union is set to expire in early July, with the deadline for China following in mid-August.

This comes at a time when businesses still face considerable uncertainty over tariffs and inflationary pressures, as highlighted in recent S&P Global PMI surveys across the Eurozone and the United States.

A return to tariffs or the collapse of trade negotiations could once again ignite fears of persistent inflation, which would likely keep interest rates elevated for longer in the U.S. This, in turn, poses a threat to economic growth. This is the dynamic that has historically been supportive for gold. Conversely, resolving these concerns may strip gold of one of its main drivers, making previous record highs harder to reach.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.