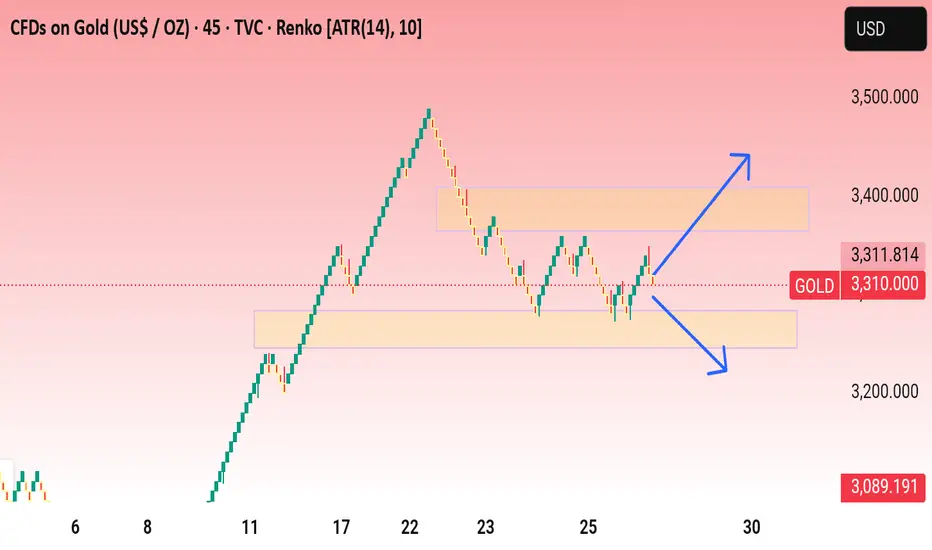

The chart you've shared is a Renko chart for Gold CFDs (US$/OZ) using ATR(14), 3 settings on a 5-minute timeframe. Here's a detailed analysis based on the visual:

Key Observations:

1. Sideways Consolidation:

Price is currently moving in a horizontal channel between approximately 3,280 and 3,360 USD.

The yellow-shaded boxes mark this range-bound zone, suggesting indecision in the market.

2. Support and Resistance:

Support zone: Around 3,280–3,290 USD.

Resistance zone: Around 3,360–3,370 USD.

3. Buy/Sell Levels:

Sell price: 3,310.710

Buy price: 3,310.940

Current spot price is around 3,306 USD.

4. Arrows Suggest a Breakout:

Blue arrows indicate potential breakout directions:

If price breaks above resistance → Potential bullish trend continuation.

If price breaks below support → Possible bearish movement.

5. ATR-based Renko Chart:

This chart type smooths out noise, focusing only on price movement, ignoring time.

ATR(14), box size 3 means each Renko block forms when price moves 3 USD, filtered by 14-period ATR.

What This Means for Traders:

Neutral/balanced sentiment: No strong trend—wait for breakout confirmation.

Trading idea:

Buy above 3,370 with a stop-loss below breakout point.

Sell below 3,280 with a stop-loss above the breakdown.

Would you like me to generate a trading plan or provide historical context on similar setups?

Key Observations:

1. Sideways Consolidation:

Price is currently moving in a horizontal channel between approximately 3,280 and 3,360 USD.

The yellow-shaded boxes mark this range-bound zone, suggesting indecision in the market.

2. Support and Resistance:

Support zone: Around 3,280–3,290 USD.

Resistance zone: Around 3,360–3,370 USD.

3. Buy/Sell Levels:

Sell price: 3,310.710

Buy price: 3,310.940

Current spot price is around 3,306 USD.

4. Arrows Suggest a Breakout:

Blue arrows indicate potential breakout directions:

If price breaks above resistance → Potential bullish trend continuation.

If price breaks below support → Possible bearish movement.

5. ATR-based Renko Chart:

This chart type smooths out noise, focusing only on price movement, ignoring time.

ATR(14), box size 3 means each Renko block forms when price moves 3 USD, filtered by 14-period ATR.

What This Means for Traders:

Neutral/balanced sentiment: No strong trend—wait for breakout confirmation.

Trading idea:

Buy above 3,370 with a stop-loss below breakout point.

Sell below 3,280 with a stop-loss above the breakdown.

Would you like me to generate a trading plan or provide historical context on similar setups?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.