🔍 Short-Term Outlook (Next Few Days)

✅ Structure Breakdown:

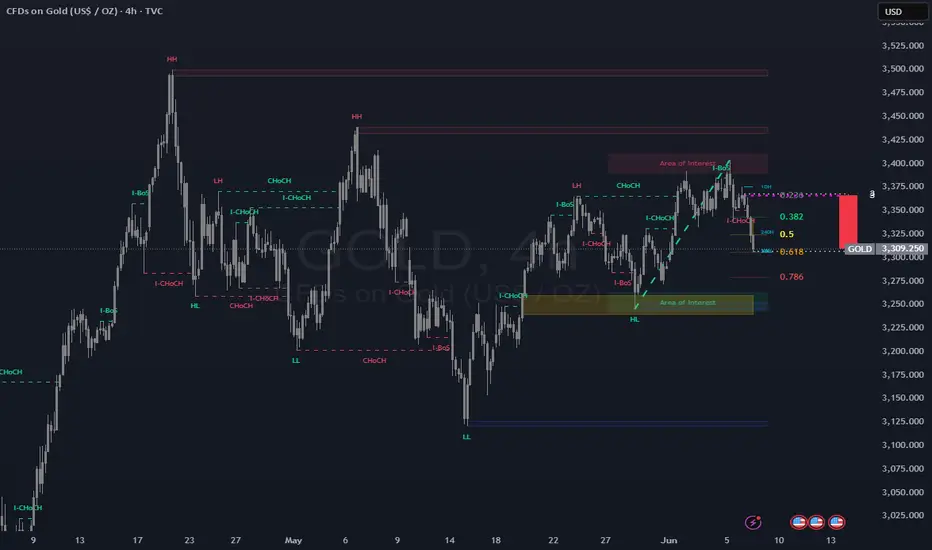

Price has made a lower high (LH) and recently a CHoCH to the downside, indicating short-term bearish pressure.

Rejection from the red supply zone / AOI near $3,375 confirms seller strength.

Price is currently retracing into the Fibonacci zone between 0.382–0.618, with:

0.5 Fib ≈ $3,308 (current level)

0.618 Fib ≈ $3,297

These levels align with possible short-term bounce or rejection zones.

⚠️ Key Short-Term Risks:

If price holds below $3,325, short-term momentum remains bearish.

A bounce could occur around $3,297–$3,275 (0.618 to 0.786 zone) due to demand and historical reaction.

📉 Short-Term Bias: Bearish → Potential Bullish Reversal

Expect possible continuation to $3,275 if support doesn't hold at 0.5 Fib.

Watch for bullish reversal structure (i.e., i-CHoCH + BOS) in the $3,275–$3,250 demand zone to go long.

📈 Long-Term Outlook (1–4 Weeks)

🧠 Macro Structure:

We’ve seen a solid uptrend from $3,125, but the market is stalling near previous highs.

The double top (HH) around $3,375–$3,400 and CHoCH down hint at potential trend exhaustion.

However, long-term trend is still intact unless price closes below $3,250.

📊 Fib Confluence and Demand:

Major demand zone (yellow AOI) sits at $3,250–$3,275.

This zone aligns with the 0.618–0.786 retracement, a typical long-term accumulation area.

💡 Long-Term Bias: Bullish (If $3,250 Holds)

If price reacts strongly from $3,250–$3,275 → Expect new rally attempts to:

$3,375 (resistance)

$3,400+ (breakout target)

If $3,250 breaks down, Gold could retrace to:

$3,200, and worst-case scenario, $3,125 (last strong demand area)

🧭 Key Levels to Watch

Type Price Note

Resistance $3,375 Key supply zone / top

Resistance $3,400–$3,425 Historical HH / exhaustion

Support $3,308–$3,297 0.5–0.618 Fib (short-term)

Support $3,275 0.786 Fib + AOI

Support $3,250 Break = trend shift

Major Support $3,125 Long-term bullish invalidation below here

✅ Structure Breakdown:

Price has made a lower high (LH) and recently a CHoCH to the downside, indicating short-term bearish pressure.

Rejection from the red supply zone / AOI near $3,375 confirms seller strength.

Price is currently retracing into the Fibonacci zone between 0.382–0.618, with:

0.5 Fib ≈ $3,308 (current level)

0.618 Fib ≈ $3,297

These levels align with possible short-term bounce or rejection zones.

⚠️ Key Short-Term Risks:

If price holds below $3,325, short-term momentum remains bearish.

A bounce could occur around $3,297–$3,275 (0.618 to 0.786 zone) due to demand and historical reaction.

📉 Short-Term Bias: Bearish → Potential Bullish Reversal

Expect possible continuation to $3,275 if support doesn't hold at 0.5 Fib.

Watch for bullish reversal structure (i.e., i-CHoCH + BOS) in the $3,275–$3,250 demand zone to go long.

📈 Long-Term Outlook (1–4 Weeks)

🧠 Macro Structure:

We’ve seen a solid uptrend from $3,125, but the market is stalling near previous highs.

The double top (HH) around $3,375–$3,400 and CHoCH down hint at potential trend exhaustion.

However, long-term trend is still intact unless price closes below $3,250.

📊 Fib Confluence and Demand:

Major demand zone (yellow AOI) sits at $3,250–$3,275.

This zone aligns with the 0.618–0.786 retracement, a typical long-term accumulation area.

💡 Long-Term Bias: Bullish (If $3,250 Holds)

If price reacts strongly from $3,250–$3,275 → Expect new rally attempts to:

$3,375 (resistance)

$3,400+ (breakout target)

If $3,250 breaks down, Gold could retrace to:

$3,200, and worst-case scenario, $3,125 (last strong demand area)

🧭 Key Levels to Watch

Type Price Note

Resistance $3,375 Key supply zone / top

Resistance $3,400–$3,425 Historical HH / exhaustion

Support $3,308–$3,297 0.5–0.618 Fib (short-term)

Support $3,275 0.786 Fib + AOI

Support $3,250 Break = trend shift

Major Support $3,125 Long-term bullish invalidation below here

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.