The price of gold, a classic safe-haven asset, is currently in a state of flux due to several interconnected factors. Looking at future events and fundamentals, we can anticipate how they might impact its price points.

Powell's Rate Cut

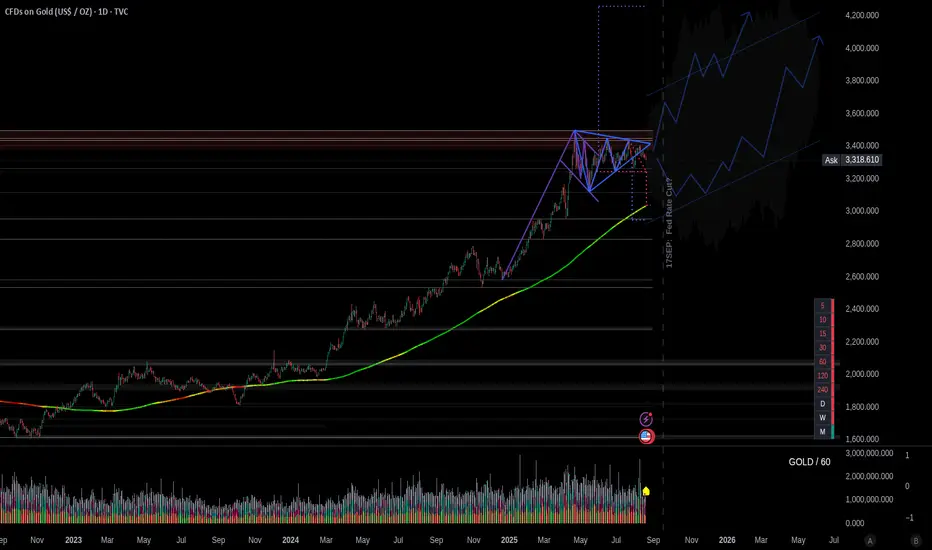

An anticipated rate cut from Federal Reserve Chairman Jerome Powell on 17SEP25 is a key bullish signal for gold. Lower interest rates typically decrease the opportunity cost of holding non-yielding assets like gold, making them more attractive compared to interest-bearing bonds. If JPow begins to drop rates in September (and is dovish in comments regarding further cuts), we could begin to see the beginning of gold's next measured move to around $4200 (see purple target). If JPow doesn't cut, doesn't cut enough, or cuts but is extremely hawkish towards further cuts; expect a pullback towards the 200-day moving average and further ranging for a period until the next Fed Chairman is confirmed.

President Trump has recently called for the Federal Reserve to make significant cuts; in one instance stating that rates should be lowered by three percentage points from their current range. As of 19AUG25, Treasury Secretary Scott Bessent has indicated 11 possible candidates for the next Fed Chair position; expect that when confirmed, the next Fed Chair may significantly reduce rates (but do not assume the next Fed Chair will cut as deep as three percentage points).

BRICS Monetary Competition

Additionally, the push for de-dollarization by BRICS nations is a significant long-term driver for gold. Countries like China and Russia are actively increasing their gold reserves to diversify away from the U.S. dollar, creating sustained demand. This monetary competition fundamentally alters gold's role, positioning it as a key component of a new, multi-polar financial system. As central banks continue to accumulate gold, it strengthens the metal's standing as a universal reserve asset. This trend is likely to provide a strong floor for gold prices around its 200-day moving average, and any significant moves toward a gold-backed BRICS currency could lead to a monumental re-evaluation of gold's value, potentially pushing its price to the $4,000/oz range or higher over time.

Powell's Rate Cut

An anticipated rate cut from Federal Reserve Chairman Jerome Powell on 17SEP25 is a key bullish signal for gold. Lower interest rates typically decrease the opportunity cost of holding non-yielding assets like gold, making them more attractive compared to interest-bearing bonds. If JPow begins to drop rates in September (and is dovish in comments regarding further cuts), we could begin to see the beginning of gold's next measured move to around $4200 (see purple target). If JPow doesn't cut, doesn't cut enough, or cuts but is extremely hawkish towards further cuts; expect a pullback towards the 200-day moving average and further ranging for a period until the next Fed Chairman is confirmed.

President Trump has recently called for the Federal Reserve to make significant cuts; in one instance stating that rates should be lowered by three percentage points from their current range. As of 19AUG25, Treasury Secretary Scott Bessent has indicated 11 possible candidates for the next Fed Chair position; expect that when confirmed, the next Fed Chair may significantly reduce rates (but do not assume the next Fed Chair will cut as deep as three percentage points).

BRICS Monetary Competition

Additionally, the push for de-dollarization by BRICS nations is a significant long-term driver for gold. Countries like China and Russia are actively increasing their gold reserves to diversify away from the U.S. dollar, creating sustained demand. This monetary competition fundamentally alters gold's role, positioning it as a key component of a new, multi-polar financial system. As central banks continue to accumulate gold, it strengthens the metal's standing as a universal reserve asset. This trend is likely to provide a strong floor for gold prices around its 200-day moving average, and any significant moves toward a gold-backed BRICS currency could lead to a monumental re-evaluation of gold's value, potentially pushing its price to the $4,000/oz range or higher over time.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.