📉 Elliott Wave Analysis – Bearish Wave 5 Setup in Progress 🔍

Watchlist: Short Opportunity at Completion of Wave 4

⸻

✅ Wave Count Overview

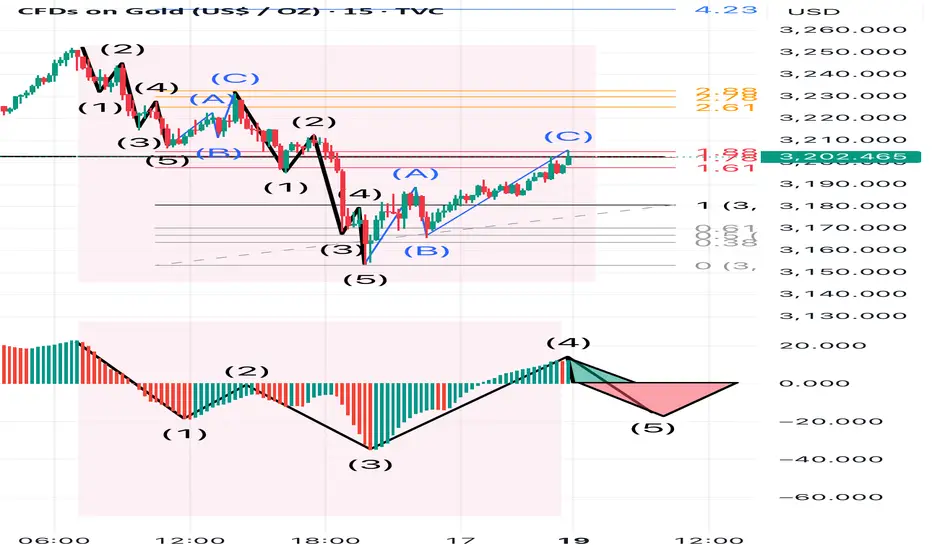

As illustrated in the chart, we have a clear impulsive Elliott Wave structure unfolding. Waves 1, 2, 3, and 4 have been successfully completed, as confirmed by the Awesome Oscillator (AO) displaying healthy wave divergence and convergence throughout the formation.

• Wave 3 extended beautifully, and now Wave 4 appears to have completed its corrective phase.

• AO shows classic convergence during this retracement, confirming weakening bullish momentum — a hallmark sign of Wave 4 development nearing exhaustion.

⸻

📌 Key Technical Levels:

• Wave 4 Top: Completed near the 1.618 Fibonacci extension, a textbook resistance zone for the end of a corrective wave.

• Critical Resistance / SNR Level: 3202.465 – This zone acts as a major resistance, aligning perfectly with prior structure and fib confluence.

• Important Rule: Wave 4 must not overlap with Wave 1 territory. So far, this rule remains respected. A break below this would invalidate the current count.

⸻

🎯 Wave 5 Trade Setup – Bearish Bias

Looking ahead, I’m anticipating the final leg down – Wave 5 – to unfold from this resistance region. This presents a potential shorting opportunity for high-probability traders.

• Wave 5 Target Zone:

🔻 1.618 - 1.88 Fibonacci extension from Wave 3

🔻 Expect strong bearish momentum to kick in as Wave 5 progresses

🔻 AO should shift strongly red again, confirming impulse resumption

⸻

💡 Summary & Trading Plan:

• ✅ Wave 4 looks completed based on Fibonacci confluence + AO convergence

• 🔥 Resistance at 3202.465 is the key level to watch

• 📉 Enter short once price confirms rejection and momentum shifts

• 🎯 Target zone: 1.618 - 1.88 fib extension below

• ❗ Risk: Setup invalidated if Wave 4 enters Wave 1’s price zone

👉 Let’s ride Wave 5 together! 🚀💥

#elliottwave #tradingviewanalysis #wavecount #shortsetup #technicalanalysis #priceaction #aoindicator #wave5incoming

Watchlist: Short Opportunity at Completion of Wave 4

⸻

✅ Wave Count Overview

As illustrated in the chart, we have a clear impulsive Elliott Wave structure unfolding. Waves 1, 2, 3, and 4 have been successfully completed, as confirmed by the Awesome Oscillator (AO) displaying healthy wave divergence and convergence throughout the formation.

• Wave 3 extended beautifully, and now Wave 4 appears to have completed its corrective phase.

• AO shows classic convergence during this retracement, confirming weakening bullish momentum — a hallmark sign of Wave 4 development nearing exhaustion.

⸻

📌 Key Technical Levels:

• Wave 4 Top: Completed near the 1.618 Fibonacci extension, a textbook resistance zone for the end of a corrective wave.

• Critical Resistance / SNR Level: 3202.465 – This zone acts as a major resistance, aligning perfectly with prior structure and fib confluence.

• Important Rule: Wave 4 must not overlap with Wave 1 territory. So far, this rule remains respected. A break below this would invalidate the current count.

⸻

🎯 Wave 5 Trade Setup – Bearish Bias

Looking ahead, I’m anticipating the final leg down – Wave 5 – to unfold from this resistance region. This presents a potential shorting opportunity for high-probability traders.

• Wave 5 Target Zone:

🔻 1.618 - 1.88 Fibonacci extension from Wave 3

🔻 Expect strong bearish momentum to kick in as Wave 5 progresses

🔻 AO should shift strongly red again, confirming impulse resumption

⸻

💡 Summary & Trading Plan:

• ✅ Wave 4 looks completed based on Fibonacci confluence + AO convergence

• 🔥 Resistance at 3202.465 is the key level to watch

• 📉 Enter short once price confirms rejection and momentum shifts

• 🎯 Target zone: 1.618 - 1.88 fib extension below

• ❗ Risk: Setup invalidated if Wave 4 enters Wave 1’s price zone

👉 Let’s ride Wave 5 together! 🚀💥

#elliottwave #tradingviewanalysis #wavecount #shortsetup #technicalanalysis #priceaction #aoindicator #wave5incoming

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.