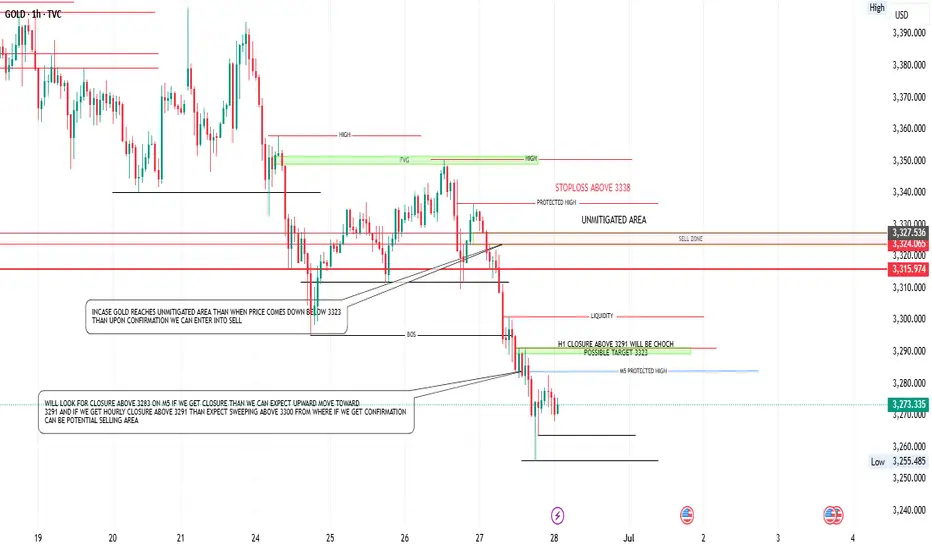

On the M5 timeframe, a confirmed candle closure above 3283 would signal a shift toward short-term bullish momentum. In this scenario, the market is likely to attract buyers looking to capitalize on upward continuation. A logical strategy would be to wait for a pullback toward the 3264 or 3278 zone all depending upon price action ie swing lows, It's important to maintain a tight stop loss just below the pullback low, as the expected targets in this bullish leg are first 3291, followed by the psychological level of 3300. These levels may offer minor resistance, and partial profit-taking around them could be considered.

If buying pressure remains strong and the price closes decisively above 3303, this would confirm a continuation of bullish intent. At that point, the market is likely to push toward the unmitigated supply zone marked on the chart. This zone has not been fully tested and may act as a key inflection point where institutional selling could re-enter the market. we should watch price behavior closely in this area, as signs of rejection—such as a bearish engulfing candle or a failure to hold above 3323—would suggest exhaustion of bullish momentum.

If the market fails to hold above 3323 and instead closes below it, this would shift the bias to bearish. Such a rejection would present a high-probability sell opportunity, with the expectation of a move back toward this week’s low. This bearish move would likely be driven by a combination of profit-taking and reactivation of supply from the unmitigated zone, aligning well with smart money principles targeting liquidity beneath recent lows.

Note: Only for educational purpose not a financial advice

If buying pressure remains strong and the price closes decisively above 3303, this would confirm a continuation of bullish intent. At that point, the market is likely to push toward the unmitigated supply zone marked on the chart. This zone has not been fully tested and may act as a key inflection point where institutional selling could re-enter the market. we should watch price behavior closely in this area, as signs of rejection—such as a bearish engulfing candle or a failure to hold above 3323—would suggest exhaustion of bullish momentum.

If the market fails to hold above 3323 and instead closes below it, this would shift the bias to bearish. Such a rejection would present a high-probability sell opportunity, with the expectation of a move back toward this week’s low. This bearish move would likely be driven by a combination of profit-taking and reactivation of supply from the unmitigated zone, aligning well with smart money principles targeting liquidity beneath recent lows.

Note: Only for educational purpose not a financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.