Detailed Analysis & Prediction:**

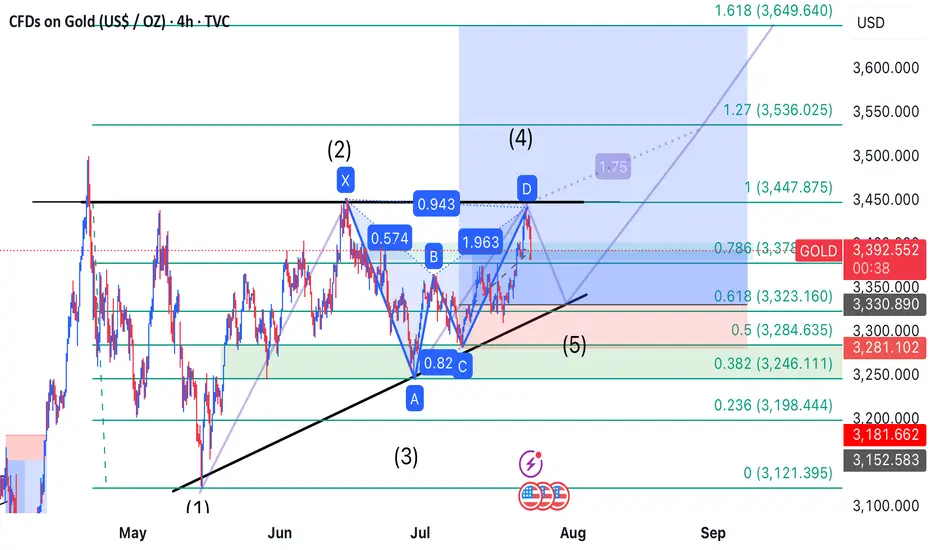

This trade setup merges two powerful frameworks: a **bearish Gartley pattern** indicating a short-term pullback, and an **Elliott Wave interpretation** suggesting bullish continuation via wave five.

---

### 🧠 Thought Process:

1. **Gartley Pattern Completion:**

- The chart shows a completed bearish Gartley pattern with point D aligning around the **3,372 level**.

- As per harmonic rules, point D typically signals a reversal zone, suggesting a short-term drop.

2. **Projected Pullback:**

- A drop is expected toward the **3,323 support zone**, which coincides with previous swing lows and Fibonacci retracement confluence.

- This area likely marks the start of **wave five** in the Elliott Wave count — indicating that the bearish move is simply the final corrective wave before continuation.

3. **Wave 5 Bullish Opportunity:**

- Once price reaches the 3,323 zone and shows reversal confirmation, a strong bullish push is expected to begin.

- This aligns with historical wave structures and momentum indicators showing possible trend exhaustion.

---

### 🎯 Profit Targets:

| Target | Type | Price (USD) |

|--------|-----------------------|---------------|

| TP1 | Fibonacci 1.0 | 3,447.875 |

| TP2 | Fibonacci 1.27 | 3,536.025 |

| TP3 | Fibonacci 1.618 | 3,649.640 |

---

### 🛑 Stop Loss Strategy:

| Level | Type | Price (USD) |

|-----------|---------------------|---------------|

| SL1 | Conservative | 3,246.111 |

| SL2 | Aggressive | 3,198.444 |

---

This trade setup merges two powerful frameworks: a **bearish Gartley pattern** indicating a short-term pullback, and an **Elliott Wave interpretation** suggesting bullish continuation via wave five.

---

### 🧠 Thought Process:

1. **Gartley Pattern Completion:**

- The chart shows a completed bearish Gartley pattern with point D aligning around the **3,372 level**.

- As per harmonic rules, point D typically signals a reversal zone, suggesting a short-term drop.

2. **Projected Pullback:**

- A drop is expected toward the **3,323 support zone**, which coincides with previous swing lows and Fibonacci retracement confluence.

- This area likely marks the start of **wave five** in the Elliott Wave count — indicating that the bearish move is simply the final corrective wave before continuation.

3. **Wave 5 Bullish Opportunity:**

- Once price reaches the 3,323 zone and shows reversal confirmation, a strong bullish push is expected to begin.

- This aligns with historical wave structures and momentum indicators showing possible trend exhaustion.

---

### 🎯 Profit Targets:

| Target | Type | Price (USD) |

|--------|-----------------------|---------------|

| TP1 | Fibonacci 1.0 | 3,447.875 |

| TP2 | Fibonacci 1.27 | 3,536.025 |

| TP3 | Fibonacci 1.618 | 3,649.640 |

---

### 🛑 Stop Loss Strategy:

| Level | Type | Price (USD) |

|-----------|---------------------|---------------|

| SL1 | Conservative | 3,246.111 |

| SL2 | Aggressive | 3,198.444 |

---

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.