I've been studying the markets since 2006. I always loved to collect data and trying to find patterns, fluxes, correlation, decorrelation, shifts in models...

Well, with some of the data I found available at TV, this is a quick analysis for the last 20 years (almost).

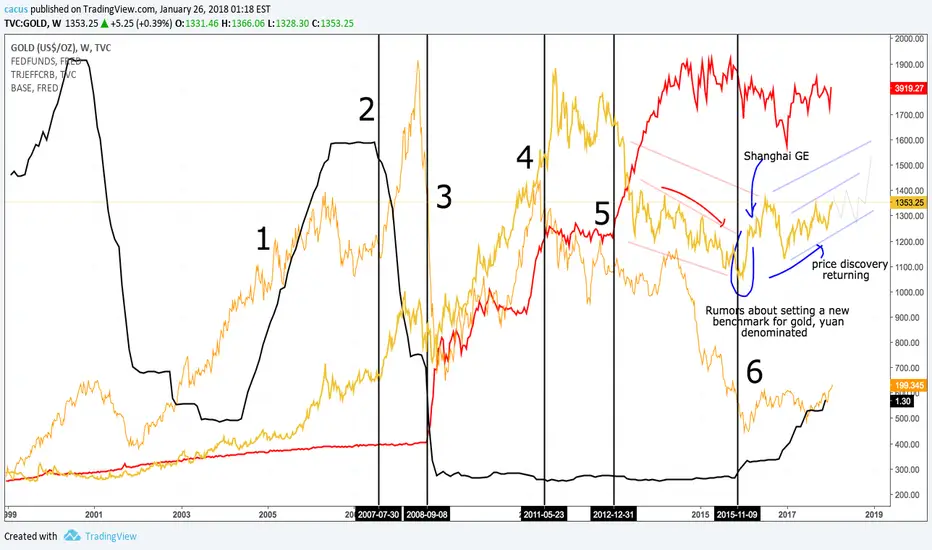

1) Notice interest rates, price of gold and commodities are NOT CORRELATED at all, there is no correlation and is based on empirical data. So everytime you hear/read anybody repeating this FALLACY, respond accordingly. Actually, one could easily say that RATE HIKES use to cause rise in commodities as clearly visible in 1-2 and since 5.

Also notice that until 3rd mark, monetary base was rising constantly but at a reasonable pace.

2) Rates starting to be lowered in reaction to the increasing delinquency in the housing market. Commodities rise.

Monetary base, steady growth but contained.

3) Rates to lowest values in history, markets going down, risk OFF scenario, commodities tanking, later to rise on monetary base skyrocketing (QE1).

4) QE2 halted, commodities started ranging.

5) QE3 printing started, commodities and gold DECREASING. What happened? Where has all that money gone? Rate stood negative (adjusting by inflation)

6) After rumors, the new price fix magically started a new trend for gold, commodities and apparently forced FED to start increasing rates to avoid inflation to rise (egg vs chicken, who's first?).

Apparently Shanghai Gold Exchange new benchmark denominated in yuan made it harder to manipulate gold and commodities prices overall. USA is now limited in abusive money printing and some variables start to adjust and normalize.

Questions:

Which data do you think brings some answers to question No 5 about where might have all that money gone to during the shift?

What could happen to stock and bonds markets once rates rise resulting in an inverted yield curve?

Where is gold price more likely to head after these variables adjust?

Could we be entering a new high commodity prices cycle? How much could it last?

What would happen to inflation?

What about the world's benchmark currency (USD)?

Well, with some of the data I found available at TV, this is a quick analysis for the last 20 years (almost).

1) Notice interest rates, price of gold and commodities are NOT CORRELATED at all, there is no correlation and is based on empirical data. So everytime you hear/read anybody repeating this FALLACY, respond accordingly. Actually, one could easily say that RATE HIKES use to cause rise in commodities as clearly visible in 1-2 and since 5.

Also notice that until 3rd mark, monetary base was rising constantly but at a reasonable pace.

2) Rates starting to be lowered in reaction to the increasing delinquency in the housing market. Commodities rise.

Monetary base, steady growth but contained.

3) Rates to lowest values in history, markets going down, risk OFF scenario, commodities tanking, later to rise on monetary base skyrocketing (QE1).

4) QE2 halted, commodities started ranging.

5) QE3 printing started, commodities and gold DECREASING. What happened? Where has all that money gone? Rate stood negative (adjusting by inflation)

6) After rumors, the new price fix magically started a new trend for gold, commodities and apparently forced FED to start increasing rates to avoid inflation to rise (egg vs chicken, who's first?).

Apparently Shanghai Gold Exchange new benchmark denominated in yuan made it harder to manipulate gold and commodities prices overall. USA is now limited in abusive money printing and some variables start to adjust and normalize.

Questions:

Which data do you think brings some answers to question No 5 about where might have all that money gone to during the shift?

What could happen to stock and bonds markets once rates rise resulting in an inverted yield curve?

Where is gold price more likely to head after these variables adjust?

Could we be entering a new high commodity prices cycle? How much could it last?

What would happen to inflation?

What about the world's benchmark currency (USD)?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.