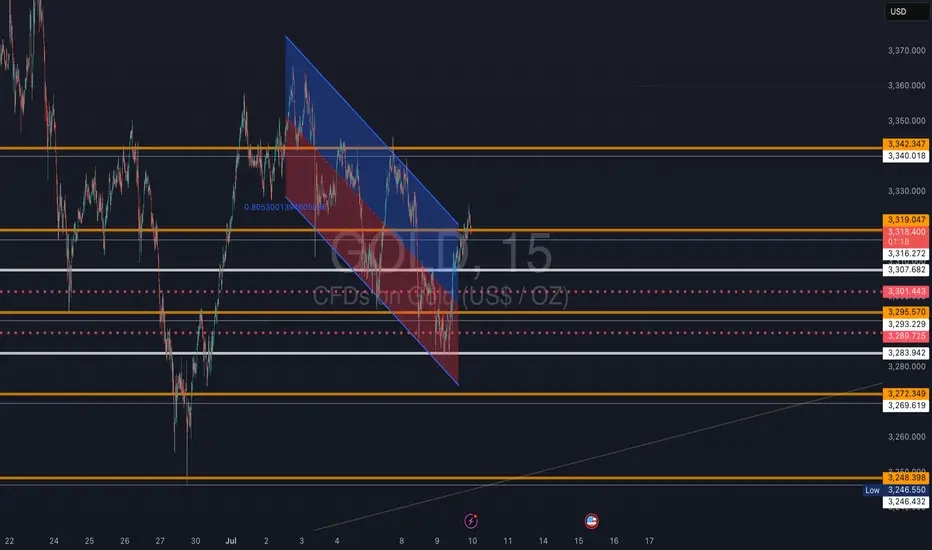

This 15-minute chart shows a clean technical breakout from a falling channel. Here's how to interpret and potentially trade this move:

🧠 Context: What Just Happened

I trade these support and resistance lines daily on micro gold futures.

What these lines represent:

Also, I can see a directional setup. Here is a hypothetical scenario that could play out:

📌 Key Zones to Watch

🔼 Resistance $3,342 Next major target / sell zone

🟧 Resistance $3,319 Current breakout level retest

⚪ Support $3,307–$3,316 Minor consolidation area

🔻 Support $3,295–$3,289 Strong demand / invalidation

🚨 Bear Pivot $3,272 Break below = bearish return

🧭 Trading Playbook

Bullish Bias (Preferred Scenario)

✅ Break and hold above $3,319 = potential move to $3,342

🎯 Target: $3,340–$3,342

🔒 SL below: $3,307

Optional re-entry on retest of $3,316 zone

Bearish Reversal (If Bulls Fail)

⚠️ If price fails $3,319 and breaks back below $3,307, sellers may reclaim control

📉 Look for short setups toward $3,295 and even $3,272

SL above: $3,319

📌 Key Tip

Watch for volume confirmation and 5m candle closes at each level. Don’t chase — let price come to your levels.

⏳ Validity

This setup remains valid through July 10, or until $3,342 target is hit or $3,272 is broken.

This is not financial advice; it's for educational purposes only.

🧠 Context: What Just Happened

- Price was locked inside a descending channel (blue) for multiple sessions.

- A breakout occurred above the channel, indicating a potential short-term bullish reversal.

- The bounce aligns with recent tariff-related headlines easing off and short-covering momentum building.

I trade these support and resistance lines daily on micro gold futures.

What these lines represent:

- Golden Line: Heavy Support or Resistance depending on the price direction towards the lines for major reversal or $10-$15 swings.

- Silver Lines: Consolidation areas or mid way support and resistance for a scalping few touches.

- Bronze dotted lines: Low volume days support and resistance for a quick $5 up or down.

Also, I can see a directional setup. Here is a hypothetical scenario that could play out:

📌 Key Zones to Watch

🔼 Resistance $3,342 Next major target / sell zone

🟧 Resistance $3,319 Current breakout level retest

⚪ Support $3,307–$3,316 Minor consolidation area

🔻 Support $3,295–$3,289 Strong demand / invalidation

🚨 Bear Pivot $3,272 Break below = bearish return

🧭 Trading Playbook

Bullish Bias (Preferred Scenario)

✅ Break and hold above $3,319 = potential move to $3,342

🎯 Target: $3,340–$3,342

🔒 SL below: $3,307

Optional re-entry on retest of $3,316 zone

Bearish Reversal (If Bulls Fail)

⚠️ If price fails $3,319 and breaks back below $3,307, sellers may reclaim control

📉 Look for short setups toward $3,295 and even $3,272

SL above: $3,319

📌 Key Tip

Watch for volume confirmation and 5m candle closes at each level. Don’t chase — let price come to your levels.

⏳ Validity

This setup remains valid through July 10, or until $3,342 target is hit or $3,272 is broken.

This is not financial advice; it's for educational purposes only.

How to trade OnePunch ALGO Scalper watch this video youtube.com/watch?v=5dU82w5Xb0Q

Join my Discord community and get 0dte option and breakout stocks alerts discord.com/invite/km3GFGKcQ7

DM for a free 30-day trial.

Join my Discord community and get 0dte option and breakout stocks alerts discord.com/invite/km3GFGKcQ7

DM for a free 30-day trial.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

How to trade OnePunch ALGO Scalper watch this video youtube.com/watch?v=5dU82w5Xb0Q

Join my Discord community and get 0dte option and breakout stocks alerts discord.com/invite/km3GFGKcQ7

DM for a free 30-day trial.

Join my Discord community and get 0dte option and breakout stocks alerts discord.com/invite/km3GFGKcQ7

DM for a free 30-day trial.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.