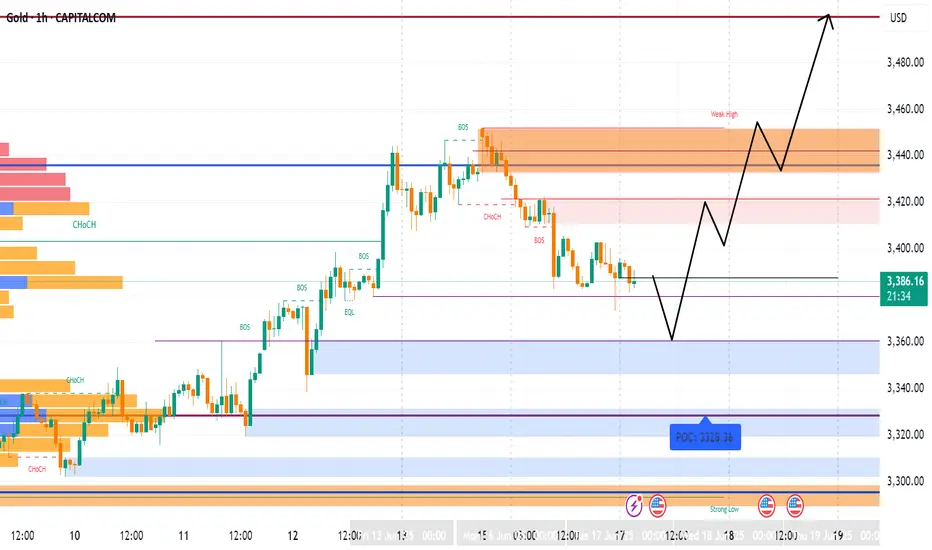

Gold Trade Idea – Long Bias (Q2 Swing Setup)

Market Context:

Gold remains bullish on both the quarterly and monthly timeframes, supported by strong institutional accumulation. The current sharp retracement is viewed as a healthy pullback within a broader uptrend, offering a low-risk entry opportunity.

Technical Outlook:

Price is approaching a key Weekly Bullish Order Block (OB) around 3356, which is expected to act as a demand zone.

This OB coincides with prior structure and a likely liquidity pool beneath recent swing lows.

A bounce from this zone aligns with higher timeframe bullish structure.

🔑 Trade Parameters

Entry Price:

Ideal entry at 3360, just above the weekly order block.

Look for bullish confirmation (e.g., bullish engulfing, breaker structure, or SMT divergence vs. Silver/XAU pairs if desired).

Stop Loss:

3350 (below the OB and key liquidity threshold)

Take Profits:

TP1: 3450 – near recent structure highs / FVG fill

TP2: 3500 – psychological round number and probable premium zone

Trade Management:

Partials off at TP1, shift stop to breakeven.

Trail remaining position based on H4 market structure shifts.

Holding Period:

Hold through to Friday’s New York AM Session close to capture full week’s expansion.

✅ Trade Justification

High timeframe bias aligns (Q2 + Monthly)

Deep retracement into Weekly OB = ideal smart money entry

Clean risk:reward ratio (~1:9 for TP2)

Friday NY session close is often used by institutions to finalize weekly moves

Market Context:

Gold remains bullish on both the quarterly and monthly timeframes, supported by strong institutional accumulation. The current sharp retracement is viewed as a healthy pullback within a broader uptrend, offering a low-risk entry opportunity.

Technical Outlook:

Price is approaching a key Weekly Bullish Order Block (OB) around 3356, which is expected to act as a demand zone.

This OB coincides with prior structure and a likely liquidity pool beneath recent swing lows.

A bounce from this zone aligns with higher timeframe bullish structure.

🔑 Trade Parameters

Entry Price:

Ideal entry at 3360, just above the weekly order block.

Look for bullish confirmation (e.g., bullish engulfing, breaker structure, or SMT divergence vs. Silver/XAU pairs if desired).

Stop Loss:

3350 (below the OB and key liquidity threshold)

Take Profits:

TP1: 3450 – near recent structure highs / FVG fill

TP2: 3500 – psychological round number and probable premium zone

Trade Management:

Partials off at TP1, shift stop to breakeven.

Trail remaining position based on H4 market structure shifts.

Holding Period:

Hold through to Friday’s New York AM Session close to capture full week’s expansion.

✅ Trade Justification

High timeframe bias aligns (Q2 + Monthly)

Deep retracement into Weekly OB = ideal smart money entry

Clean risk:reward ratio (~1:9 for TP2)

Friday NY session close is often used by institutions to finalize weekly moves

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.