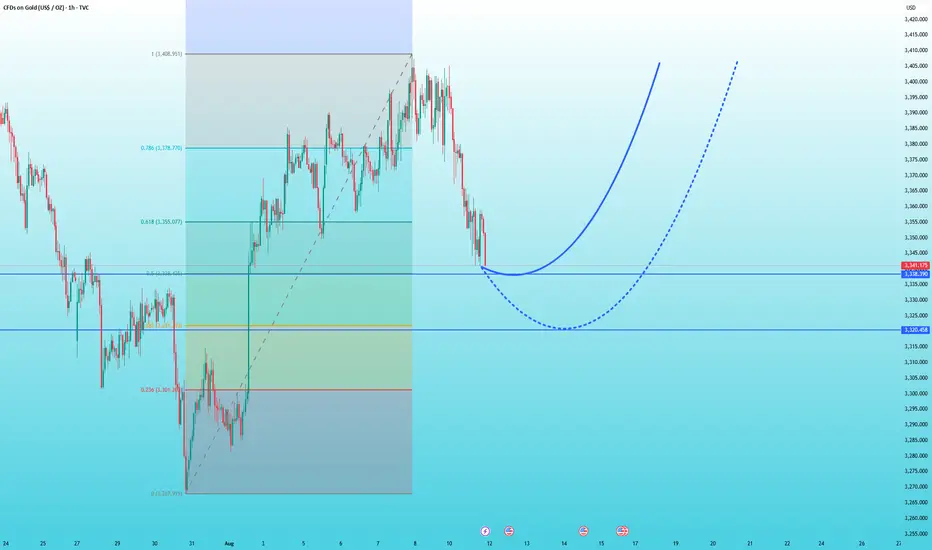

Last week, news of US tariffs on gold caused market volatility, sending gold prices surging to a high of 3,408.

Gold prices continued to fall today, dropping from the opening price of 3,400 to around 3,340. This $60 drop appears to be a response to the White House's clarification that the gold tariff information was false, as well as the reduction in risk aversion caused by the resumption of Russia-Ukraine negotiations on the 15th of this month.

However, regarding the gold tariff issue, my view is that the US's intention in imposing tariffs on gold is to disrupt the existing pricing mechanism, leaving it with complete control over the final price and price. While the US is not currently imposing tariffs, there's no guarantee that they won't be levied later or through other channels.

Furthermore, the resumption of Russia-Ukraine negotiations is merely a meeting between Trump and Putin on the 15th, with Ukraine and the EU once again excluded. This type of negotiation isn't very substantial, as this has happened before. Therefore, the idea that the end of the Russia-Ukraine conflict will lead to a significant drop in gold prices is not currently plausible.

Thus, from a macroeconomic perspective, the overall trend of gold remains unaffected, and the overall bullish trend remains.

I think there will not be much room for decline in this correction before the CPI data. For the support below, we can first look at the 3338 support level, and then the 3320 support level. As long as these two points stabilize, you can buy with confidence, because once there is a rebound, the profit space will be very considerable.

Gold prices continued to fall today, dropping from the opening price of 3,400 to around 3,340. This $60 drop appears to be a response to the White House's clarification that the gold tariff information was false, as well as the reduction in risk aversion caused by the resumption of Russia-Ukraine negotiations on the 15th of this month.

However, regarding the gold tariff issue, my view is that the US's intention in imposing tariffs on gold is to disrupt the existing pricing mechanism, leaving it with complete control over the final price and price. While the US is not currently imposing tariffs, there's no guarantee that they won't be levied later or through other channels.

Furthermore, the resumption of Russia-Ukraine negotiations is merely a meeting between Trump and Putin on the 15th, with Ukraine and the EU once again excluded. This type of negotiation isn't very substantial, as this has happened before. Therefore, the idea that the end of the Russia-Ukraine conflict will lead to a significant drop in gold prices is not currently plausible.

Thus, from a macroeconomic perspective, the overall trend of gold remains unaffected, and the overall bullish trend remains.

I think there will not be much room for decline in this correction before the CPI data. For the support below, we can first look at the 3338 support level, and then the 3320 support level. As long as these two points stabilize, you can buy with confidence, because once there is a rebound, the profit space will be very considerable.

Trade active

🔥🔥🔥Welcome to join

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥🔥🔥Welcome to join

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Get free daily high-quality trading signals

Free Gold Signal Channels📲:t.me/Quality_Gold_Signal

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.