GOOGL Slips into Bearish Gamma Territory — Eyes on $190 Defense or Slide to $187.50

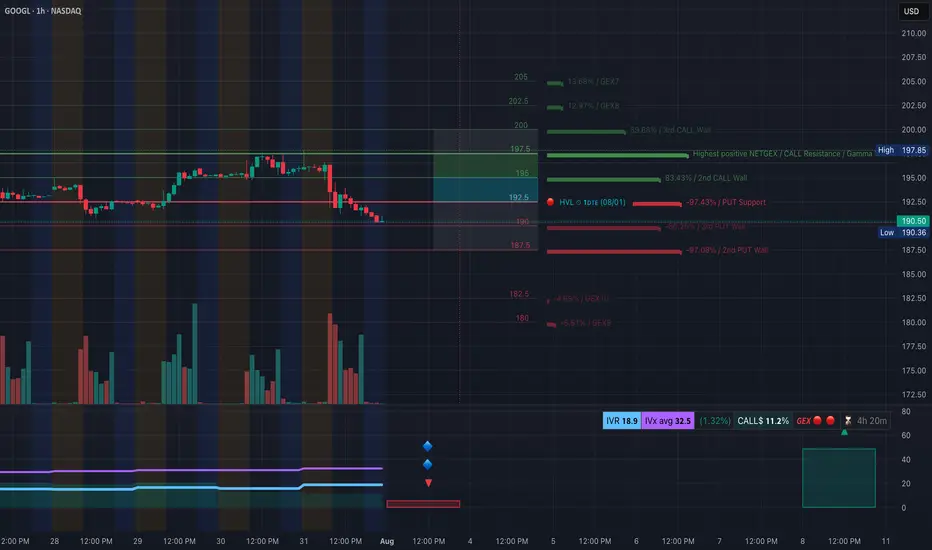

🔍 GEX & Options Flow Insight (1st Image Analysis)

GOOGL has broken down from its recent consolidation and is now testing the $190–$192 gamma support band. The GEX profile shows heavy negative gamma just below current price, increasing the risk of accelerated selling if $190 fails.

* Call Walls & Resistance:

* 📍 $194.91–$196.53 → First resistance zone

* 📍 $197.85 → Highest positive NET GEX / Gamma Wall

* 📍 $202.50+ → Out of immediate range unless a strong reversal occurs

* Put Walls & Support Zones:

* 🛡️ $190.50 → Current gamma pivot

* 🚨 $187.50 → 2nd Put Wall / Hard gamma floor

* 📉 Below $187.50 opens the door to $185–$182

* Volatility Insight:

* IVR 18.9, IVx Avg 32.5 → Slightly elevated IV

* Call flow 11.2% → Bearish leaning

* GEX sentiment: 🔴🔴🔴 = Negative gamma environment → more volatility to downside

✅ Option Trading Suggestion:

Bias: Bearish unless reclaiming $194+ Strategy: Bear put spread

* Entry Idea: Buy 190P / Sell 185P for Aug 2 or Aug 9 expiry

* Invalidation: Close above $194.91

* Target: $187.50 → $185

Why this works: Dealers in negative gamma hedge by selling into weakness, which can accelerate moves lower. Losing $190 likely brings $187.50 quickly into play.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 CHoCH confirmed after rejection from $197.85 supply

* ❌ Price broke BOS support from $194.91 area

* Trading in a descending structure toward $190 support

Trendline Dynamics:

* Broke short-term uptrend

* Now respecting a lower parallel channel toward $187.50

SMC Zones:

* 🟩 Demand Zone: $190.50–$187.50 → First defense zone

* 🟥 Supply Zone (Purple Box): $194.91–$197.85 → Immediate resistance

🔄 Price Action & Key Levels

* Support:

* ✅ $190.50 → Current hold line

* ✅ $187.50 → Gamma floor

* 🚨 Below $187.50 → $185 → $182

* Resistance:

* 🚩 $194.91 → First reclaim level for relief rally

* 🚩 $196.53–$197.85 → Supply + Gamma Wall

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Setup (Preferred):

* Entry: Failed bounce at $194–$195

* Target 1: $190.50

* Target 2: $187.50

* Stop: Above $196

🟩 Bullish Reversal Setup:

* Entry: Strong reclaim of $196.50 with volume

* Target 1: $197.85

* Target 2: $200+

* Stop: Back under $194

🔁 Summary Thoughts

* GOOGL has shifted from neutral to negative gamma, favoring continued downside pressure.

* $190.50 is the short-term line in the sand — losing it risks a swift trip to $187.50.

* Any bounce into $194–$196 is likely to face selling pressure unless backed by volume and a gamma flip.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

🔍 GEX & Options Flow Insight (1st Image Analysis)

GOOGL has broken down from its recent consolidation and is now testing the $190–$192 gamma support band. The GEX profile shows heavy negative gamma just below current price, increasing the risk of accelerated selling if $190 fails.

* Call Walls & Resistance:

* 📍 $194.91–$196.53 → First resistance zone

* 📍 $197.85 → Highest positive NET GEX / Gamma Wall

* 📍 $202.50+ → Out of immediate range unless a strong reversal occurs

* Put Walls & Support Zones:

* 🛡️ $190.50 → Current gamma pivot

* 🚨 $187.50 → 2nd Put Wall / Hard gamma floor

* 📉 Below $187.50 opens the door to $185–$182

* Volatility Insight:

* IVR 18.9, IVx Avg 32.5 → Slightly elevated IV

* Call flow 11.2% → Bearish leaning

* GEX sentiment: 🔴🔴🔴 = Negative gamma environment → more volatility to downside

✅ Option Trading Suggestion:

Bias: Bearish unless reclaiming $194+ Strategy: Bear put spread

* Entry Idea: Buy 190P / Sell 185P for Aug 2 or Aug 9 expiry

* Invalidation: Close above $194.91

* Target: $187.50 → $185

Why this works: Dealers in negative gamma hedge by selling into weakness, which can accelerate moves lower. Losing $190 likely brings $187.50 quickly into play.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 CHoCH confirmed after rejection from $197.85 supply

* ❌ Price broke BOS support from $194.91 area

* Trading in a descending structure toward $190 support

Trendline Dynamics:

* Broke short-term uptrend

* Now respecting a lower parallel channel toward $187.50

SMC Zones:

* 🟩 Demand Zone: $190.50–$187.50 → First defense zone

* 🟥 Supply Zone (Purple Box): $194.91–$197.85 → Immediate resistance

🔄 Price Action & Key Levels

* Support:

* ✅ $190.50 → Current hold line

* ✅ $187.50 → Gamma floor

* 🚨 Below $187.50 → $185 → $182

* Resistance:

* 🚩 $194.91 → First reclaim level for relief rally

* 🚩 $196.53–$197.85 → Supply + Gamma Wall

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Setup (Preferred):

* Entry: Failed bounce at $194–$195

* Target 1: $190.50

* Target 2: $187.50

* Stop: Above $196

🟩 Bullish Reversal Setup:

* Entry: Strong reclaim of $196.50 with volume

* Target 1: $197.85

* Target 2: $200+

* Stop: Back under $194

🔁 Summary Thoughts

* GOOGL has shifted from neutral to negative gamma, favoring continued downside pressure.

* $190.50 is the short-term line in the sand — losing it risks a swift trip to $187.50.

* Any bounce into $194–$196 is likely to face selling pressure unless backed by volume and a gamma flip.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.