🔍 Market Structure:

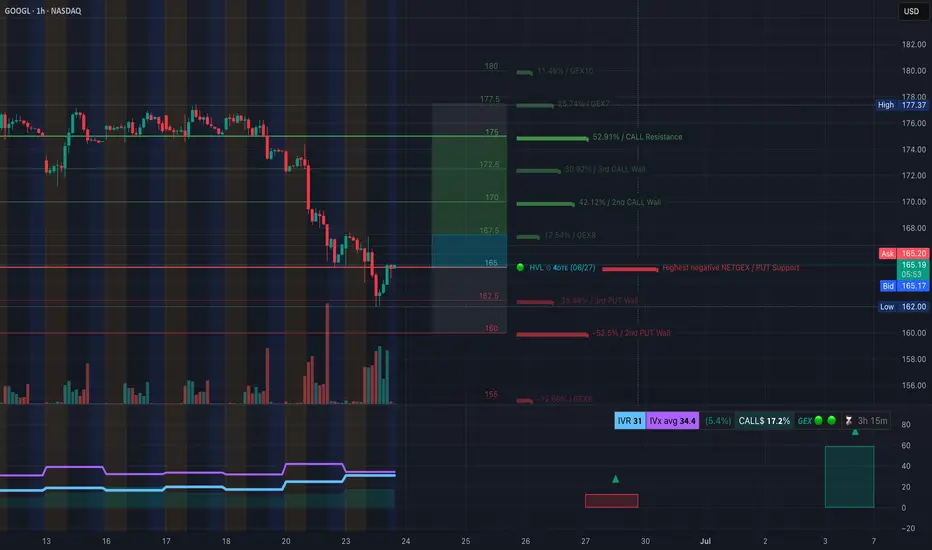

GOOGL has been in a clear downtrend, printing multiple BOS (Break of Structure) on the 15-min and 1H charts. However, today we’ve seen a CHoCH (Change of Character) after price bounced from the key 162 zone. This signals a potential short-term reversal or at least a relief rally.

🧭 Key Zones (Price Action + SMC):

* Support (Demand Zone):

* 162.00 → Major liquidity zone & 3rd PUT Wall

* 160.00 → Highest Put Wall, strong support

* Resistance (Supply Zone):

* 165.20–166.00 → Minor supply & CHoCH test zone

* 167.34–167.65 → Major Supply & 2nd Call Wall

* 170.00–172.5 → Critical resistance stack w/ 3rd Call Wall

🧠 GEX + Options Sentiment:

* GEX Zones:

* Strongest Put Wall: 160 (–52.5%)

* Highest NET GEX (Support): 165

* Call Resistance Wall: 175 (52.91%)

* IVX avg: 34.4

* IVR: 31

* Calls Interest: 17.2% (moderate bullish positioning)

This tells us that 165 is acting as a magnet and bounce zone, while 175 is where market makers are likely to keep a lid on the rally.

📊 Indicators & Volume:

* Volume on the bounce was decent—indicating some real buyer interest.

* If price consolidates above 165 and holds into tomorrow, it could trigger a push toward 167.5 and 170.

* A breakdown back below 162 would invalidate this bounce and resume bearish flow toward 160.

🎯 Trade Scenarios:

🔼 Bullish Case (Relief Rally Setup):

* Trigger: Hold above 165 + reclaim 167.5

* Targets: 170 → 172.5 → 175

* Stop: <162 (invalidates the structure)

🔽 Bearish Case (Fade Setup):

* Trigger: Reject at 167.5 or 165 and break below 162

* Targets: 160 → 155

* Stop: >168 (if breakout traps)

🧩 Scalping Setup:

* Above 165.20: Quick scalp to 166.64 / 167.34

* Below 162.50: Breakdown scalp to 160.00

⚠️ Final Thoughts:

GOOGL is in the early stages of a potential reversal — but it’s still fighting under multiple resistance layers. Unless 167.5 breaks clean, this may still be a sell-the-rip environment. Watch how it behaves at the HVL (165) — it’s the pivot for both bulls and bears.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk properly before trading.

GOOGL has been in a clear downtrend, printing multiple BOS (Break of Structure) on the 15-min and 1H charts. However, today we’ve seen a CHoCH (Change of Character) after price bounced from the key 162 zone. This signals a potential short-term reversal or at least a relief rally.

🧭 Key Zones (Price Action + SMC):

* Support (Demand Zone):

* 162.00 → Major liquidity zone & 3rd PUT Wall

* 160.00 → Highest Put Wall, strong support

* Resistance (Supply Zone):

* 165.20–166.00 → Minor supply & CHoCH test zone

* 167.34–167.65 → Major Supply & 2nd Call Wall

* 170.00–172.5 → Critical resistance stack w/ 3rd Call Wall

🧠 GEX + Options Sentiment:

* GEX Zones:

* Strongest Put Wall: 160 (–52.5%)

* Highest NET GEX (Support): 165

* Call Resistance Wall: 175 (52.91%)

* IVX avg: 34.4

* IVR: 31

* Calls Interest: 17.2% (moderate bullish positioning)

This tells us that 165 is acting as a magnet and bounce zone, while 175 is where market makers are likely to keep a lid on the rally.

📊 Indicators & Volume:

* Volume on the bounce was decent—indicating some real buyer interest.

* If price consolidates above 165 and holds into tomorrow, it could trigger a push toward 167.5 and 170.

* A breakdown back below 162 would invalidate this bounce and resume bearish flow toward 160.

🎯 Trade Scenarios:

🔼 Bullish Case (Relief Rally Setup):

* Trigger: Hold above 165 + reclaim 167.5

* Targets: 170 → 172.5 → 175

* Stop: <162 (invalidates the structure)

🔽 Bearish Case (Fade Setup):

* Trigger: Reject at 167.5 or 165 and break below 162

* Targets: 160 → 155

* Stop: >168 (if breakout traps)

🧩 Scalping Setup:

* Above 165.20: Quick scalp to 166.64 / 167.34

* Below 162.50: Breakdown scalp to 160.00

⚠️ Final Thoughts:

GOOGL is in the early stages of a potential reversal — but it’s still fighting under multiple resistance layers. Unless 167.5 breaks clean, this may still be a sell-the-rip environment. Watch how it behaves at the HVL (165) — it’s the pivot for both bulls and bears.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk properly before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.