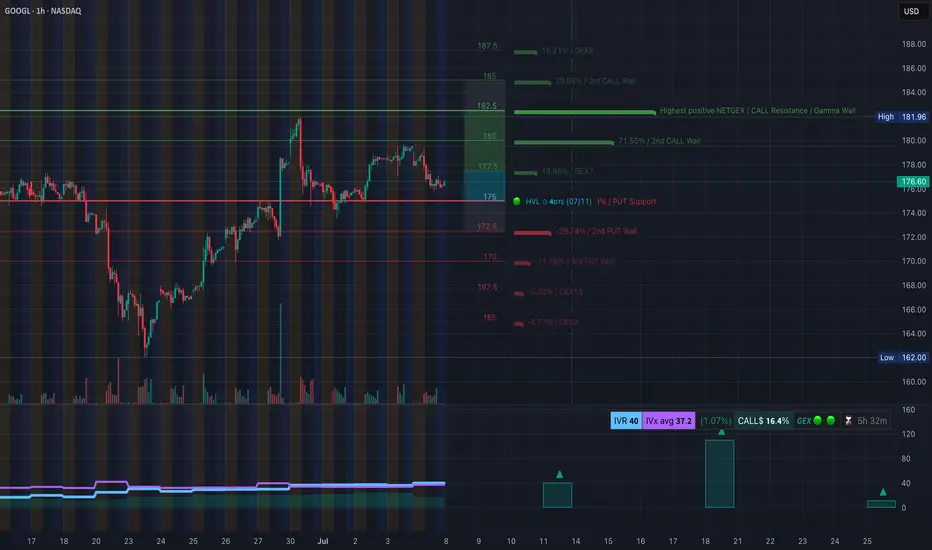

📊 GEX Analysis – Options Sentiment Insight:

* Call Resistance Wall: Strongest resistance at 180–182.5 area (High GEX%, Gamma Wall, 2nd & 3rd CALL Wall). A breakout above this may trigger a gamma squeeze.

* Support Zone: HVL @ 174.39 — aligned with PUT support and GEX10 (-6.92%) at 167.5, forming a key downside guardrail.

* Gamma Exposure (GEX): Green double-dot 🟢🟢 = supportive for bullish bias but nearing exhaustion.

* IVR/IVx: IVR 40, IVx avg 37.2 — Neutral to slightly bullish. Options aren't overly expensive, risk-reward still good for directional plays.

* Call Participation: 16.4% CALLS = Moderate bullish activity but not extreme greed.

🔥 Options Strategy Idea:

* Bullish case: If price holds above 174–175, consider 7/12 or 7/19 180C debit spread (e.g., Buy 175C / Sell 180C).

* Bearish case: Break below 173.5 and you can play PUT debit spread down to 170 or 167.5.

📉 1-Hour Chart Analysis (Intraday/Swing):

* Structure: Bearish CHoCH confirmed. Price has pulled back after rejecting from red OB zone (~179.5–180).

* Current Action: Price hovering below trendline and sitting above demand zone (173.5–174.4). Break and close below this could lead to continuation down toward 170.5 / 167.5.

* Bias:

* Bearish under 177.06.

* Neutral chop zone between 174–176.6.

* Bullish recovery only above 177.5–179.5 reclaim.

🎯 Scenarios & Trade Setups:

* Scalp BUY Setup:

* Entry: Hold above 175

* Target: 177 / 179.5

* Stop: Below 173.5

* Scalp SELL Setup:

* Entry: Break and retest below 173.5

* Target: 171 → 167.5

* Stop: Back above 175

📌 Thoughts & Suggestions:

* GOOGL’s options positioning suggests a potential bounce, but the bearish CHoCH and rejection at resistance urges caution.

* If bulls reclaim 177.5, we may see a push to test the heavy CALL walls at 180–182.5.

* Trade defensively inside chop zone, don’t force full directional plays unless you see clean BOS or demand failure.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

* Call Resistance Wall: Strongest resistance at 180–182.5 area (High GEX%, Gamma Wall, 2nd & 3rd CALL Wall). A breakout above this may trigger a gamma squeeze.

* Support Zone: HVL @ 174.39 — aligned with PUT support and GEX10 (-6.92%) at 167.5, forming a key downside guardrail.

* Gamma Exposure (GEX): Green double-dot 🟢🟢 = supportive for bullish bias but nearing exhaustion.

* IVR/IVx: IVR 40, IVx avg 37.2 — Neutral to slightly bullish. Options aren't overly expensive, risk-reward still good for directional plays.

* Call Participation: 16.4% CALLS = Moderate bullish activity but not extreme greed.

🔥 Options Strategy Idea:

* Bullish case: If price holds above 174–175, consider 7/12 or 7/19 180C debit spread (e.g., Buy 175C / Sell 180C).

* Bearish case: Break below 173.5 and you can play PUT debit spread down to 170 or 167.5.

📉 1-Hour Chart Analysis (Intraday/Swing):

* Structure: Bearish CHoCH confirmed. Price has pulled back after rejecting from red OB zone (~179.5–180).

* Current Action: Price hovering below trendline and sitting above demand zone (173.5–174.4). Break and close below this could lead to continuation down toward 170.5 / 167.5.

* Bias:

* Bearish under 177.06.

* Neutral chop zone between 174–176.6.

* Bullish recovery only above 177.5–179.5 reclaim.

🎯 Scenarios & Trade Setups:

* Scalp BUY Setup:

* Entry: Hold above 175

* Target: 177 / 179.5

* Stop: Below 173.5

* Scalp SELL Setup:

* Entry: Break and retest below 173.5

* Target: 171 → 167.5

* Stop: Back above 175

📌 Thoughts & Suggestions:

* GOOGL’s options positioning suggests a potential bounce, but the bearish CHoCH and rejection at resistance urges caution.

* If bulls reclaim 177.5, we may see a push to test the heavy CALL walls at 180–182.5.

* Trade defensively inside chop zone, don’t force full directional plays unless you see clean BOS or demand failure.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.