GOOGL Hanging by a Thread! Breakdown Below $174.50 Could Trigger a Drop to $171–170 Gamma Zone

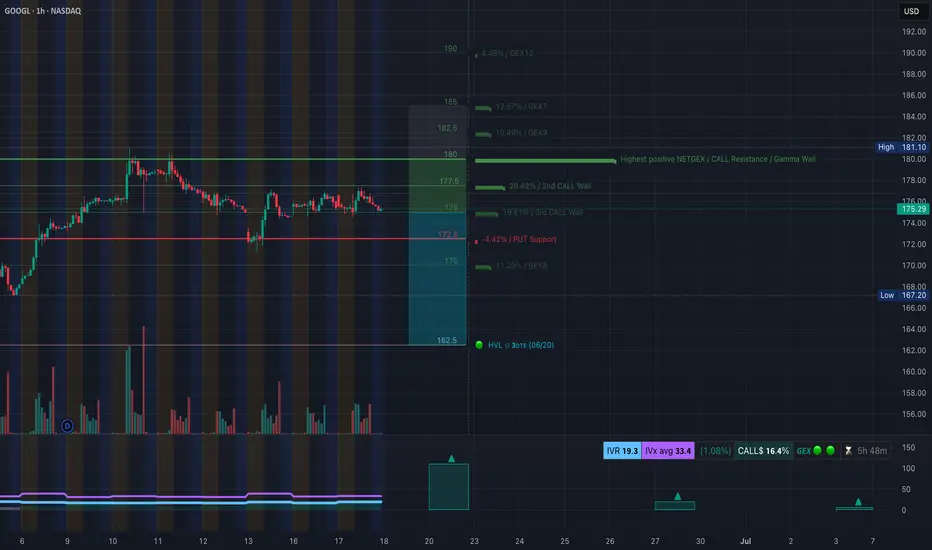

🔬 GEX (Options Sentiment) Breakdown:

* Resistance (CALL Walls):

* $177.5 = 2nd CALL Wall

* $180.00 = Highest Positive NET GEX (Gamma Wall)

* $182.5+ = Outer GEX resistance cluster (low odds near-term)

* Support (PUT Zones):

* $172.50 = Current key PUT Support Wall — being tested

* $170.00 = GEX8 and structure support

* $167 = HVL + deep PUT interest floor

* Options Flow Metrics:

* IVR: 19.3 (stable)

* IVx avg: 33.4

* CALL Flow: 16.4% (slightly bullish skew)

* GEX Sentiment: 🟢🟢 (lightly bullish but fragile under $174.50)

* Interpretation:

* Price is compressed right above $172.50 PUT Wall.

* If this support breaks with volume, dealers may de-hedge aggressively, opening a quick drop to $170 or $167.

🧠 15-Min SMC & Price Action Analysis:

* Current Price: $175.29

* Structure:

* CHoCH and BOS confirmations show structure breakdown from supply zone near $177.30

* Several CHoCH levels around $175.50 and $174.50 now acting as short-term resistances

* Demand zone sits between $171.90–$172.50 — last bounce area before flush risk

* Trend/Pattern:

* Breakdown from a broad wedge formation

* Rejection from supply zone (pink box)

* Currently testing major support trendline (drawn from June 13 lows)

🧭 Scenarios for June 18:

🟥 Bearish Breakdown Setup:

* Trigger: Break and 15-min close below $174.50

* Target 1: $172.50 (GEX floor)

* Target 2: $170.00

* Stop-loss: Above $176.50

A flush is likely if market-wide selling continues — this is the most probable scenario given current setup.

🟩 Bullish Reversal Setup (Needs Strong Market Help):

* Trigger: Bounce off $174.50 with reclaim above $176.50

* Target 1: $177.50 (CALL wall)

* Target 2: $180 (Gamma Wall)

* Stop-loss: Below $174.00

Would need a strong tech rally or macro catalyst. Risky unless confirmed by SPY/QQQ bounce.

💭 My Thoughts:

* GOOGL looks weak structurally and is sitting right on top of key PUT support — not a place to go long blindly.

* If $174.50 breaks, it likely attracts momentum sellers and gamma pressure toward $170–171.

* Call flow is light, and IV remains tame — cheap options = opportunity for directional plays.

* Monitor volume spike + candle body close under $174.50 for confirmation.

✅ Summary for June 18:

* Bias: Bearish under $174.50

* Key Breakdown Level: $174.50

* Downside Target: $172.50 → $170.00

* Upside Reversal Target: $177.50 → $180.00

* Setup Confidence: 🔻 High if breakdown confirmed

Disclaimer: This content is for educational use only. Always assess your own risk and trading plan.

🔬 GEX (Options Sentiment) Breakdown:

* Resistance (CALL Walls):

* $177.5 = 2nd CALL Wall

* $180.00 = Highest Positive NET GEX (Gamma Wall)

* $182.5+ = Outer GEX resistance cluster (low odds near-term)

* Support (PUT Zones):

* $172.50 = Current key PUT Support Wall — being tested

* $170.00 = GEX8 and structure support

* $167 = HVL + deep PUT interest floor

* Options Flow Metrics:

* IVR: 19.3 (stable)

* IVx avg: 33.4

* CALL Flow: 16.4% (slightly bullish skew)

* GEX Sentiment: 🟢🟢 (lightly bullish but fragile under $174.50)

* Interpretation:

* Price is compressed right above $172.50 PUT Wall.

* If this support breaks with volume, dealers may de-hedge aggressively, opening a quick drop to $170 or $167.

🧠 15-Min SMC & Price Action Analysis:

* Current Price: $175.29

* Structure:

* CHoCH and BOS confirmations show structure breakdown from supply zone near $177.30

* Several CHoCH levels around $175.50 and $174.50 now acting as short-term resistances

* Demand zone sits between $171.90–$172.50 — last bounce area before flush risk

* Trend/Pattern:

* Breakdown from a broad wedge formation

* Rejection from supply zone (pink box)

* Currently testing major support trendline (drawn from June 13 lows)

🧭 Scenarios for June 18:

🟥 Bearish Breakdown Setup:

* Trigger: Break and 15-min close below $174.50

* Target 1: $172.50 (GEX floor)

* Target 2: $170.00

* Stop-loss: Above $176.50

A flush is likely if market-wide selling continues — this is the most probable scenario given current setup.

🟩 Bullish Reversal Setup (Needs Strong Market Help):

* Trigger: Bounce off $174.50 with reclaim above $176.50

* Target 1: $177.50 (CALL wall)

* Target 2: $180 (Gamma Wall)

* Stop-loss: Below $174.00

Would need a strong tech rally or macro catalyst. Risky unless confirmed by SPY/QQQ bounce.

💭 My Thoughts:

* GOOGL looks weak structurally and is sitting right on top of key PUT support — not a place to go long blindly.

* If $174.50 breaks, it likely attracts momentum sellers and gamma pressure toward $170–171.

* Call flow is light, and IV remains tame — cheap options = opportunity for directional plays.

* Monitor volume spike + candle body close under $174.50 for confirmation.

✅ Summary for June 18:

* Bias: Bearish under $174.50

* Key Breakdown Level: $174.50

* Downside Target: $172.50 → $170.00

* Upside Reversal Target: $177.50 → $180.00

* Setup Confidence: 🔻 High if breakdown confirmed

Disclaimer: This content is for educational use only. Always assess your own risk and trading plan.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.