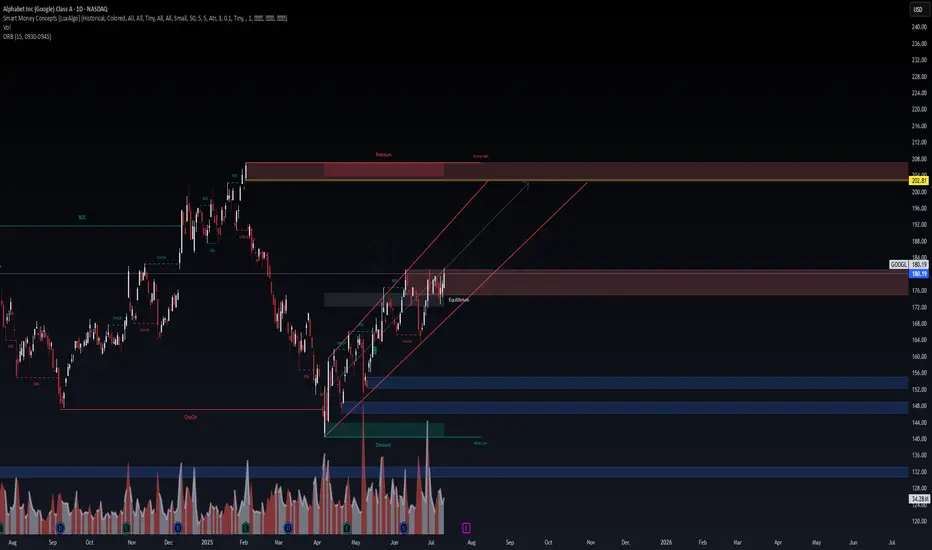

🔍 Technical Overview (Daily TF)

GOOGL is currently trading at $180.19, breaking upward inside a well-defined bullish channel, hugging equilibrium levels after consolidating just below the $184 resistance zone. This setup reflects classic Smart Money reaccumulation behavior:

🟩 Current Structure: CHoCH → BOS confirmed on higher lows

📊 Equilibrium: Mid-channel value alignment; strong price efficiency with low imbalance

🟧 Premium Zone: $202.81–208 marked for liquidity sweep (target zone)

🔴 Strong Highs: Not yet swept; draw on liquidity to the upside likely

Key price levels:

Resistance zone: $184.00–208.00

Support cluster: $172.00–168.00

Discount Block (Demand): $144.00–132.00

🤖 VolanX AI Models Forecast (as of July 12)

📌 Model 1 – Smart Money AI Trading Suite

LSTM Forecast: +9.0% gain expected over next 14 days

Target: $196.34

Market Condition: Overbought (No order blocks currently)

Volatility: 26.4%

Volume Shift: -15.5% (suggesting short-term supply exhaustion)

📌 Model 2 – WaverVanir DSS Platform

Sentiment Score: 78 (bullish bias)

15-Day Prediction: $182.34 (+1.2%)

30-Day Prediction: $184.36 (+2.3%)

📈 Note: The DSS is projecting slower upside in comparison to the Smart Money AI suite. This divergence suggests that while short-term price may rise, the major move could depend on external catalysts.

🌍 Macro & Catalyst Outlook

NASDAQ Tech Momentum: Q2 earnings in July will be a key macro driver

Yields & Dollar Index: Softening DXY supports tech; watch 10Y real yield inversion

AI Sector Beta: GOOGL is lagging NVDA/MSFT but may play catch-up into August

CPI/Inflation Watch: If inflation readings cool, it may trigger flows into mega-cap tech

Fed Policy Risk: September dot-plot shift could trigger volatility (Fed pivot vs sticky inflation)

🧠 WaverVanir DSS Conclusion:

📌 Bias: Bullish-to-Neutral

📌 Trade Zone: Watching for breakout above $184 to trigger sweep toward $196–202

📌 Invalidation: Break below $168 invalidates bullish structure; targets $144 liquidity pool

📌 Strategy: Standby mode; entry requires confirmation of volume breakout above range high.

📢 WaverVanir Insight:

"Smart Money has shown its hand — compression is a prelude to expansion. We're monitoring confluence between AI signal alignment and SMC structures. $196 target remains valid unless CHoCH flips bearish with volume."

#WaverVanir #VolanX #SmartMoneyConcepts #GOOGL #AITrading #InstitutionalFlow #LSTM #VolumeProfile #TradingView #MacroAnalysis #StockForecast #Alphabet #MarketForecast

GOOGL is currently trading at $180.19, breaking upward inside a well-defined bullish channel, hugging equilibrium levels after consolidating just below the $184 resistance zone. This setup reflects classic Smart Money reaccumulation behavior:

🟩 Current Structure: CHoCH → BOS confirmed on higher lows

📊 Equilibrium: Mid-channel value alignment; strong price efficiency with low imbalance

🟧 Premium Zone: $202.81–208 marked for liquidity sweep (target zone)

🔴 Strong Highs: Not yet swept; draw on liquidity to the upside likely

Key price levels:

Resistance zone: $184.00–208.00

Support cluster: $172.00–168.00

Discount Block (Demand): $144.00–132.00

🤖 VolanX AI Models Forecast (as of July 12)

📌 Model 1 – Smart Money AI Trading Suite

LSTM Forecast: +9.0% gain expected over next 14 days

Target: $196.34

Market Condition: Overbought (No order blocks currently)

Volatility: 26.4%

Volume Shift: -15.5% (suggesting short-term supply exhaustion)

📌 Model 2 – WaverVanir DSS Platform

Sentiment Score: 78 (bullish bias)

15-Day Prediction: $182.34 (+1.2%)

30-Day Prediction: $184.36 (+2.3%)

📈 Note: The DSS is projecting slower upside in comparison to the Smart Money AI suite. This divergence suggests that while short-term price may rise, the major move could depend on external catalysts.

🌍 Macro & Catalyst Outlook

NASDAQ Tech Momentum: Q2 earnings in July will be a key macro driver

Yields & Dollar Index: Softening DXY supports tech; watch 10Y real yield inversion

AI Sector Beta: GOOGL is lagging NVDA/MSFT but may play catch-up into August

CPI/Inflation Watch: If inflation readings cool, it may trigger flows into mega-cap tech

Fed Policy Risk: September dot-plot shift could trigger volatility (Fed pivot vs sticky inflation)

🧠 WaverVanir DSS Conclusion:

📌 Bias: Bullish-to-Neutral

📌 Trade Zone: Watching for breakout above $184 to trigger sweep toward $196–202

📌 Invalidation: Break below $168 invalidates bullish structure; targets $144 liquidity pool

📌 Strategy: Standby mode; entry requires confirmation of volume breakout above range high.

📢 WaverVanir Insight:

"Smart Money has shown its hand — compression is a prelude to expansion. We're monitoring confluence between AI signal alignment and SMC structures. $196 target remains valid unless CHoCH flips bearish with volume."

#WaverVanir #VolanX #SmartMoneyConcepts #GOOGL #AITrading #InstitutionalFlow #LSTM #VolumeProfile #TradingView #MacroAnalysis #StockForecast #Alphabet #MarketForecast

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.