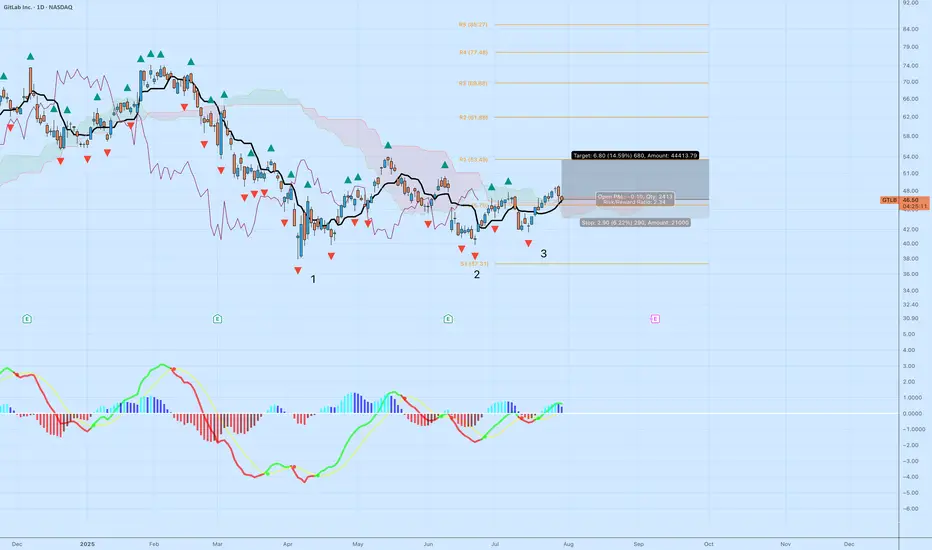

GitLab (GTLB) is setting up for a potential trend reversal following a textbook triple bottom pattern and a clean breakout above the cloud. Here's the technical breakdown:

Why This Setup Matters

Triple Bottom Pattern: Reversal structure is clear with three defined lows at ~$38, ~$40, and ~$41. The most recent leg up confirms buyers defending that zone.

Ichimoku Cloud: Price has broken above the Kumo with bullish Tenkan-Kijun cross. The leading span A is pointing up, and the cloud ahead is flat and thin — ideal conditions for continuation.

MACD Momentum: Histogram flipped positive again with green signal line crossover — a momentum shift from accumulation to breakout phase.

Trade Parameters

Entry: $46.53

Stop: $43.63 (below Tenkan and the neckline zone)

Target: $53.33

Risk:Reward Ratio: 2.34

Projected Move: +14.59%

Additional Confluence

Daily closes above cloud show growing strength from buyers.

Each bottom was followed by increasing MACD strength — a bullish divergence over time.

Pivot zone at R1 ($53.49) aligns with the price target, adding structure to the exit plan.

Risk Notes

Failure to hold $46 with volume could invalidate the breakout — watch for a retest.

If price closes below Tenkan, reevaluate the setup for weakness.

Volume confirmation needed on the next daily candle for strong conviction.

This is a technical breakout aligned with pattern recognition and trend metrics. Ideal for swing setups with controlled downside.

Why This Setup Matters

Triple Bottom Pattern: Reversal structure is clear with three defined lows at ~$38, ~$40, and ~$41. The most recent leg up confirms buyers defending that zone.

Ichimoku Cloud: Price has broken above the Kumo with bullish Tenkan-Kijun cross. The leading span A is pointing up, and the cloud ahead is flat and thin — ideal conditions for continuation.

MACD Momentum: Histogram flipped positive again with green signal line crossover — a momentum shift from accumulation to breakout phase.

Trade Parameters

Entry: $46.53

Stop: $43.63 (below Tenkan and the neckline zone)

Target: $53.33

Risk:Reward Ratio: 2.34

Projected Move: +14.59%

Additional Confluence

Daily closes above cloud show growing strength from buyers.

Each bottom was followed by increasing MACD strength — a bullish divergence over time.

Pivot zone at R1 ($53.49) aligns with the price target, adding structure to the exit plan.

Risk Notes

Failure to hold $46 with volume could invalidate the breakout — watch for a retest.

If price closes below Tenkan, reevaluate the setup for weakness.

Volume confirmation needed on the next daily candle for strong conviction.

This is a technical breakout aligned with pattern recognition and trend metrics. Ideal for swing setups with controlled downside.

Trade closed: stop reached

This is why we use stop loss If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.