🎯 Trade: Long (Buy)

📊 Timeframe: Daily (D1) / Swing Trade (Pre-Earnings)

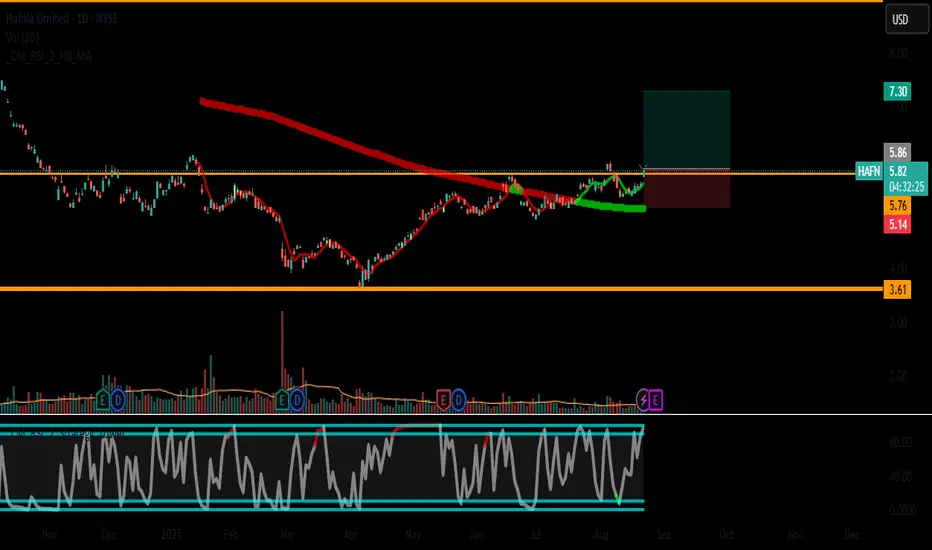

💰 Entry: $5.80 (Breakout above consolidation)

🛑 Stop Loss: $5.14 (Below key support & SMA 50)

🎯 Take Profit: $7.46 (Major resistance zone)

⏰ Catalyst: Earnings Date: August 27, 2025

📉 Risk/Reward Ratio: 1 : 2.5

🔍 Technical & Catalyst Analysis

✅ Strong Uptrend Intact:

Price is in a clear uptrend across all timeframes (Daily, 4H, 1H), trading above key moving averages.

✅ Breakout Setup into Earnings:

Entry at $5.80 anticipates a breakout above the recent range ($5.40 - $5.70).

A successful breakout could see momentum build ahead of earnings as traders position for strong results.

✅ Fundamental Backing for Optimism:

Impeccable Balance Sheet: Debt-to-Asset ratio only 8.7% (Best in class).

High Interest Coverage: Ratio of 19.67 – company easily services its debt.

Sector Tailwinds: Product tanker rates have remained firm, supporting positive earnings expectations.

🎯 Why These Levels?

Entry ($5.80): A breakout above this level confirms buyer strength and could trigger a run towards earnings.

Stop Loss ($5.14): Placed below the SMA50 and key support. A break here invalidates the bullish structure.

Take Profit ($7.46): A previous major resistance level. The trade aims to capture the pre-earnings momentum move.

⚠️ Major Risk Consideration: EARNINGS VOLATILITY

High Volatility Expected: The stock will be highly volatile around earnings on August 27, 2025.

Binary Outcome: The actual earnings report and guidance are a binary event. Even strong results can be sold on a "sell-the-news" reaction if expectations are too high.

Recommendation: This is a pre-earnings momentum play. The plan should be to manage risk actively and consider taking profits or tightening stops as the event approaches.

STRATEGY ADJUSTMENT: Consider closing all or part of the position before the earnings announcement on August 27 to avoid the unpredictable event risk.

📢 Conclusion: A Calculated Gamble

HAFN presents a high-R/R setup with strong technicals and fundamentals heading into a catalyst.

✅ Strong fundamentals justify the bullish thesis.

✅ Technical breakout confirms momentum.

✅ Clear risk management levels.

However, this is a trade heavily influenced by an upcoming event. The key is to capture the pre-earnings move and avoid the event risk itself.

I am long on a breakout above $5.80, but I will be closing my position before August 27.

🔔 What's your plan? Riding the momentum into earnings or playing it safe?

#Trading #Stocks #HAFN #Shipping #Breakout #Earnings #EventTrading

Disclaimer: This is not financial advice. Earnings trades are high-risk. Do your own research and manage your risk accordingly.

📊 Timeframe: Daily (D1) / Swing Trade (Pre-Earnings)

💰 Entry: $5.80 (Breakout above consolidation)

🛑 Stop Loss: $5.14 (Below key support & SMA 50)

🎯 Take Profit: $7.46 (Major resistance zone)

⏰ Catalyst: Earnings Date: August 27, 2025

📉 Risk/Reward Ratio: 1 : 2.5

🔍 Technical & Catalyst Analysis

✅ Strong Uptrend Intact:

Price is in a clear uptrend across all timeframes (Daily, 4H, 1H), trading above key moving averages.

✅ Breakout Setup into Earnings:

Entry at $5.80 anticipates a breakout above the recent range ($5.40 - $5.70).

A successful breakout could see momentum build ahead of earnings as traders position for strong results.

✅ Fundamental Backing for Optimism:

Impeccable Balance Sheet: Debt-to-Asset ratio only 8.7% (Best in class).

High Interest Coverage: Ratio of 19.67 – company easily services its debt.

Sector Tailwinds: Product tanker rates have remained firm, supporting positive earnings expectations.

🎯 Why These Levels?

Entry ($5.80): A breakout above this level confirms buyer strength and could trigger a run towards earnings.

Stop Loss ($5.14): Placed below the SMA50 and key support. A break here invalidates the bullish structure.

Take Profit ($7.46): A previous major resistance level. The trade aims to capture the pre-earnings momentum move.

⚠️ Major Risk Consideration: EARNINGS VOLATILITY

High Volatility Expected: The stock will be highly volatile around earnings on August 27, 2025.

Binary Outcome: The actual earnings report and guidance are a binary event. Even strong results can be sold on a "sell-the-news" reaction if expectations are too high.

Recommendation: This is a pre-earnings momentum play. The plan should be to manage risk actively and consider taking profits or tightening stops as the event approaches.

STRATEGY ADJUSTMENT: Consider closing all or part of the position before the earnings announcement on August 27 to avoid the unpredictable event risk.

📢 Conclusion: A Calculated Gamble

HAFN presents a high-R/R setup with strong technicals and fundamentals heading into a catalyst.

✅ Strong fundamentals justify the bullish thesis.

✅ Technical breakout confirms momentum.

✅ Clear risk management levels.

However, this is a trade heavily influenced by an upcoming event. The key is to capture the pre-earnings move and avoid the event risk itself.

I am long on a breakout above $5.80, but I will be closing my position before August 27.

🔔 What's your plan? Riding the momentum into earnings or playing it safe?

#Trading #Stocks #HAFN #Shipping #Breakout #Earnings #EventTrading

Disclaimer: This is not financial advice. Earnings trades are high-risk. Do your own research and manage your risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.