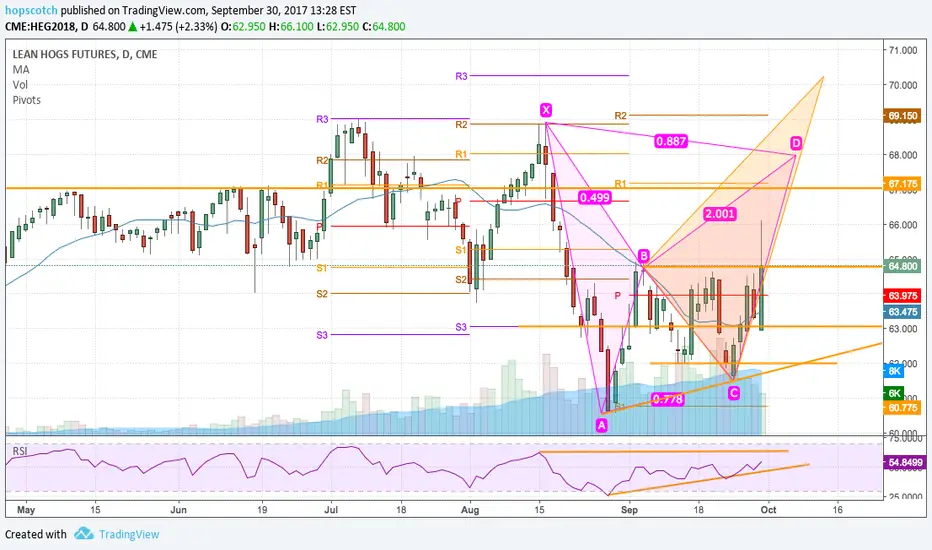

Feb Hogs looks like it is creating a bearish Bat. RSI is nearing top level of previous climb. Thursday's downside held at 20 day MA and now we are above that. Next upside target for Hogs is 67.15 at R1, then 68 at Bat with a possible run at triple top at 68.875. Pivots should remain similar for this next round. Volume bars are low so this could be a nice run. Hog index for December is falling so all these combined could be a great setup for a bearish fall at top. There is a significant overhead at R1 looking back a few months that will challenge hogs. Two new slaughter houses haven't got up to peak production yet, but even so, where are the buyers for pig?

Note

Hogs made another leap today. Closing in on Bat. Next upside target is 68.00 then possibly 68.875 triple top. RSI has come to 63.5. Highest RSI since May was 67.5. Looking for red doji or red spinning top for reversal.Note

Hogs extended itself even further and running out of gas with smaller bars. No doji reversal yet.Note

Feb Hogs has created a double tweezer top suggesting a fall is imminent. Bat has been achieved and RSI has hit August high. Downside target for bears is 67 and then 65.900Note

There was over 500 sell orders today at 69, but the market held. Still see more upside potential in this market to at least 70. Hog index (63.625) is rising and is very close to Dec market right now, so I would suspect more upside to Hogs. Also November US Thanksgiving will attract ham purchases. There is now tremendous support at 67 for February.Note

We have an uptrend on hogs. Market is rising with index. Index now at 66.10 for Dec contract. Still a little more RSI. Feb could rise to 71Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.