1.Growing Global Demand: Rising infrastructure projects and renewable energy initiatives (like EVs and energy storage systems) are boosting copper demand.

2.Supply Constraints: Declining reserves in major mines, production disruptions in key producers (e.g., Chile, Peru), and limited new investments are tightening supply.

3.Weaker USD: If the Fed cuts interest rates, a weaker US dollar (as copper is dollar-denominated) could push prices higher.

4.China’s Recovery: Economic stimulus in China (the world’s top copper consumer) is expected to drive stronger demand.

5.Inflation Hedge: Copper is seen as a hedge against inflation, attracting more investor inflows if global inflation persists.

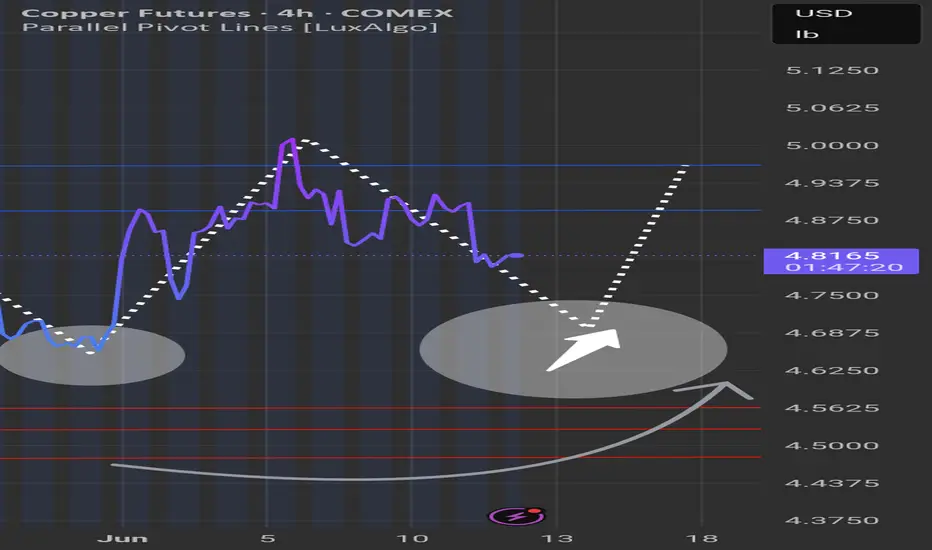

Strong demand, tight supply, and supportive macro trends could drive copper prices upward in the coming months.

Sasha Charkhchian

2.Supply Constraints: Declining reserves in major mines, production disruptions in key producers (e.g., Chile, Peru), and limited new investments are tightening supply.

3.Weaker USD: If the Fed cuts interest rates, a weaker US dollar (as copper is dollar-denominated) could push prices higher.

4.China’s Recovery: Economic stimulus in China (the world’s top copper consumer) is expected to drive stronger demand.

5.Inflation Hedge: Copper is seen as a hedge against inflation, attracting more investor inflows if global inflation persists.

Strong demand, tight supply, and supportive macro trends could drive copper prices upward in the coming months.

Sasha Charkhchian

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.