HPE Earnings Trade Idea – Moderately Bullish Setup into 6/6 Expi

📈 HPE Earnings Trade Idea – Moderately Bullish Setup into 6/6 Expiry

🗓️ Earnings Date: June 4 (AMC) | 🧮 Expected Move: ±7.3%

🎯 Targeting breakout past $18.00 resistance with call option sweep

🧠 Multi-Model Summary & Sentiment

Model Bias Strategy Strike Entry PT SL Conf.

Grok Mod. Bullish Buy Call 18.00 0.58 1.00 0.25 70%

Claude Mod. Bearish Buy Put 17.50 0.69 1.00 0.45 68%

Llama Neutral/No Edge No Trade — — — — <60%

Gemini Mod. Bullish Buy Call 18.00 0.58 1.16 0.58 65%

DeepSeek Mod. Bullish Buy Call 18.00 0.58 1.16 0.25 70%

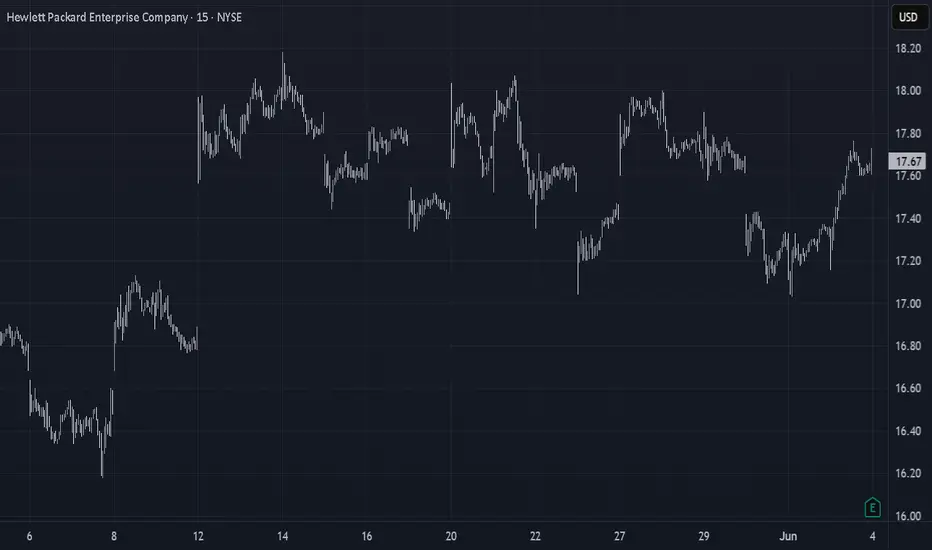

📊 Key Technicals & Setup

Historical EPS moves: ±4.5%–8.6% range typical

Current setup: Coiled between 50/200-day MAs

Open Interest: Clustered at $17.50–$18.00

IV Rank: 0.75 (elevated, but tradable)

Max Pain: $17.50 — possible pin risk

AI Narrative Tailwinds: Target price $19.98 (per Gemini model)

🧠 Strategy Logic

Majority model consensus = Moderately Bullish

We're targeting a single-leg, short-term call to capture upside earnings momentum

🎯 Trade Setup

Instrument: HPE

Direction: CALL (LONG)

Strike: $18.00

Expiry: 2025-06-06

Entry Price: $0.58

Profit Target: $1.16 (100% gain)

Stop Loss: $0.25 (~43% loss)

Entry Timing: Before earnings close (June 4, AMC)

⚠️ Risk Management & Exit Plan

⛔ Stop-loss: Hard stop at $0.25

🎯 Profit-taking: Scale out at $1.00–$1.16

📆 Time-based exit: Close before Friday if no momentum

💼 Size: Max 2–3% of total portfolio due to IV crush risk

🚩 Key Risks

IV crush post-earnings could negate even correct directional bets

Earnings miss or weak guidance = breakdown toward $17.00

Max pain gravity around $17.50 could suppress movement into Friday

🗓️ Earnings Date: June 4 (AMC) | 🧮 Expected Move: ±7.3%

🎯 Targeting breakout past $18.00 resistance with call option sweep

🧠 Multi-Model Summary & Sentiment

Model Bias Strategy Strike Entry PT SL Conf.

Grok Mod. Bullish Buy Call 18.00 0.58 1.00 0.25 70%

Claude Mod. Bearish Buy Put 17.50 0.69 1.00 0.45 68%

Llama Neutral/No Edge No Trade — — — — <60%

Gemini Mod. Bullish Buy Call 18.00 0.58 1.16 0.58 65%

DeepSeek Mod. Bullish Buy Call 18.00 0.58 1.16 0.25 70%

📊 Key Technicals & Setup

Historical EPS moves: ±4.5%–8.6% range typical

Current setup: Coiled between 50/200-day MAs

Open Interest: Clustered at $17.50–$18.00

IV Rank: 0.75 (elevated, but tradable)

Max Pain: $17.50 — possible pin risk

AI Narrative Tailwinds: Target price $19.98 (per Gemini model)

🧠 Strategy Logic

Majority model consensus = Moderately Bullish

We're targeting a single-leg, short-term call to capture upside earnings momentum

🎯 Trade Setup

Instrument: HPE

Direction: CALL (LONG)

Strike: $18.00

Expiry: 2025-06-06

Entry Price: $0.58

Profit Target: $1.16 (100% gain)

Stop Loss: $0.25 (~43% loss)

Entry Timing: Before earnings close (June 4, AMC)

⚠️ Risk Management & Exit Plan

⛔ Stop-loss: Hard stop at $0.25

🎯 Profit-taking: Scale out at $1.00–$1.16

📆 Time-based exit: Close before Friday if no momentum

💼 Size: Max 2–3% of total portfolio due to IV crush risk

🚩 Key Risks

IV crush post-earnings could negate even correct directional bets

Earnings miss or weak guidance = breakdown toward $17.00

Max pain gravity around $17.50 could suppress movement into Friday

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.