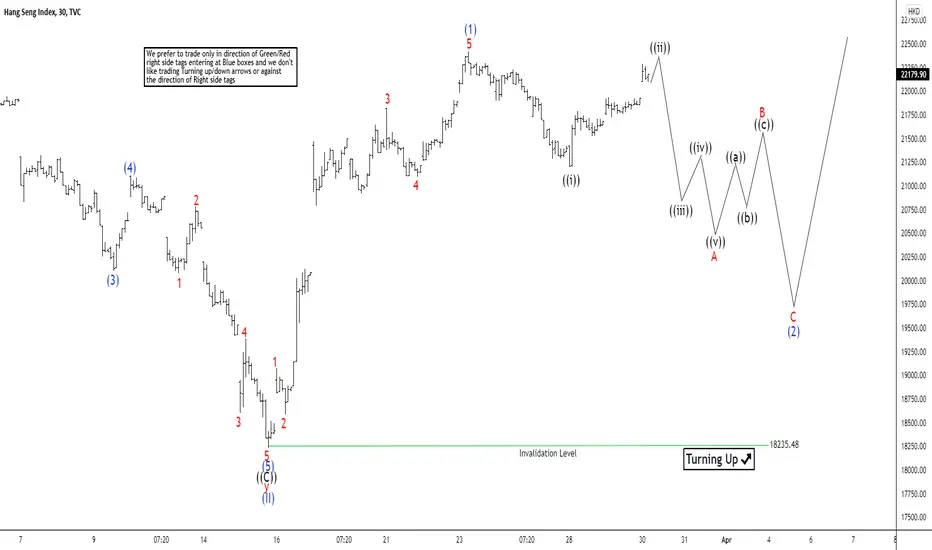

Short Term outlook in Hangseng Index suggests pullback to 18235.48 ended super cycle wave (II). This is a 4 year correction which started from January 2018 high. Super cycle wave (III) is currently in progress with internal subdivision as a 5 waves impulse Elliott Wave structure. Up from wave (II) low, wave 1 ended at 19075.75 and dips in wave 2 ended at 18584.04. Index then resumes higher in wave 3 towards 21823.07 and pullback in wave 4 ended at 21096.31. Final leg higher wave 5 ended at 22423.51 which also completed wave (1). Wave (2) pullback is currently in progress to correct cycle from March 15, 2022 low.

Wave (2) pullback should unfold in 3, 7, or 11 swing and while the pullback stays above 18235.48, expect the Index to resume higher again. The 60 minutes chart below shows a possible zigzag corrective internal structure within wave (2). If the Index instead rallies and breaks above wave (1) at 22423.51 without doing further pullback, this may suggest wave (2) has ended at 21202.69. In the alternate scenario, the Index should then continue higher against 21202.69 in wave (3) already.

Wave (2) pullback should unfold in 3, 7, or 11 swing and while the pullback stays above 18235.48, expect the Index to resume higher again. The 60 minutes chart below shows a possible zigzag corrective internal structure within wave (2). If the Index instead rallies and breaks above wave (1) at 22423.51 without doing further pullback, this may suggest wave (2) has ended at 21202.69. In the alternate scenario, the Index should then continue higher against 21202.69 in wave (3) already.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.