Volatility, expressed through standard deviation, quantifies market elasticity and presents a level of probability and precision that humbles us all.

Now we move on to the world of BTC with a look at IBIT

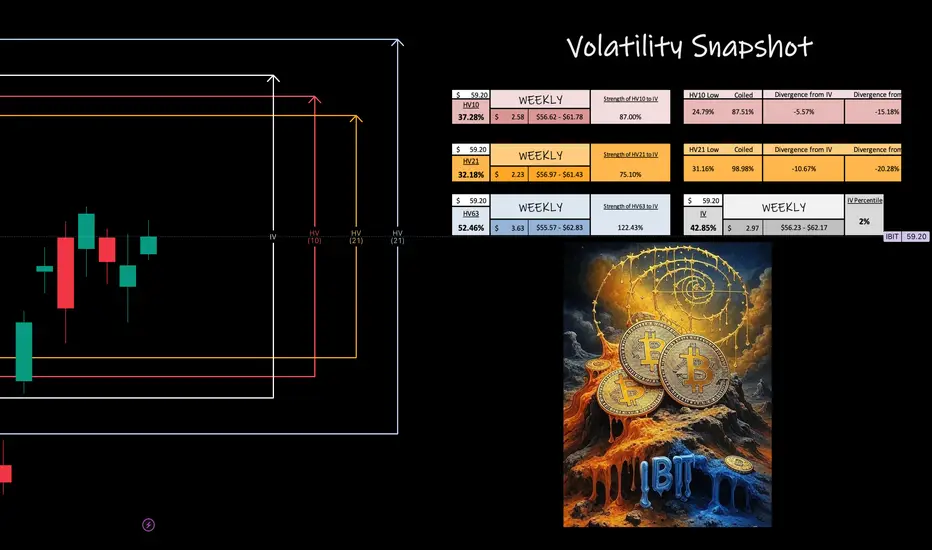

IBIT

Here, as we have been observing an ongoing regression, you see that HV10 has expanded past HV21 and now IV is predicting more range expansion leading toward the volatility at quarterly means. Stay tuned, and I hope this helps visualize what I do.

BOOST the post, drop a follow and comment, BUT don't forget to circle back at the end of the week to revisit and observe how our trending markets preformed!

Now we move on to the world of BTC with a look at

Here, as we have been observing an ongoing regression, you see that HV10 has expanded past HV21 and now IV is predicting more range expansion leading toward the volatility at quarterly means. Stay tuned, and I hope this helps visualize what I do.

BOOST the post, drop a follow and comment, BUT don't forget to circle back at the end of the week to revisit and observe how our trending markets preformed!

Trade closed manually

Same thing here as with BITX — Just our volatility here is not leveraged, it’s the best representation to BTC volatility itself..IBIT will always be a long hold but I track it weekly with the other funds.Please grab my charts onto your screen; ask questions if you have them about my ranges. Use the play button in review to see the volatility swing from HV10 to HV63 in past week.

CHEERS!

Dive deeper into the world of volatility with me — Post a comment, ask a question, and BOOST the post if you’d like.

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Dive deeper into the world of volatility with me — Post a comment, ask a question, and BOOST the post if you’d like.

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.