Hello dear Traders,

Here is my idea for #Immutable

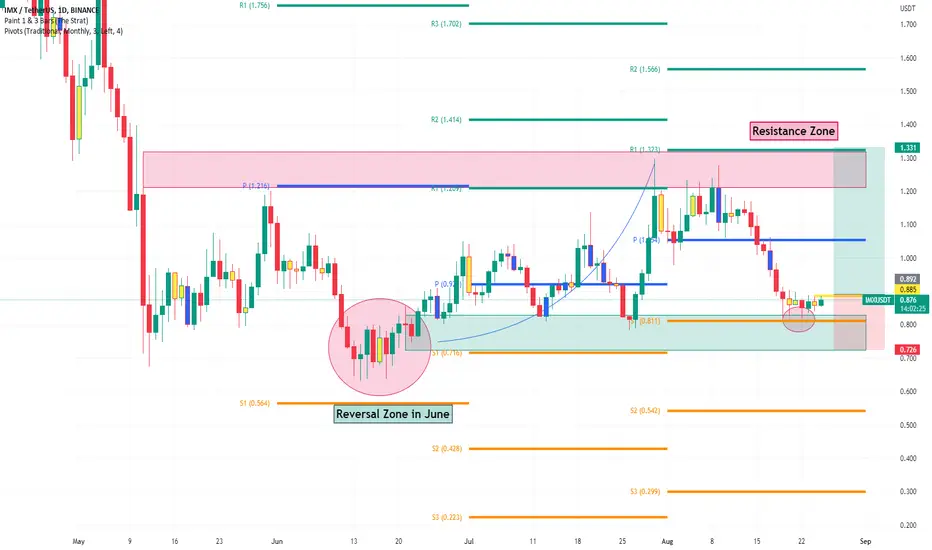

Price finds support at monthly pivot S1 line – we had the same scenario at the June S1 pivot line.

Daily inside bar has been formed and we will wait for a close above the yellow trigger line (0.884$) in the 4h chart to enter the trade.

Profit target 1.3310$ and stop 0.7260$.

Risk Reward ratio 2.6

Please feel free to ask any question in comments. I will try to answer all! Thank you.

About #Immutable

Rank 136 by marked cap

Immutable X positions itself as the first layer-two scaling solution for NFTs on Ethereum. According to Immutable X, its blockchain does away with Ethereum’s limitations like low scalability, a poor user experience, illiquidity, and a slow developer experience. Instead, users benefit from instant trading and massive scalability while enjoying zero gas fees for minting and trading NFTs without compromising user or asset security. To achieve that, Immutable X is built with STARK zk-rollups, a technology that Vitalik Buterin considers Ethereum to be “all-in on.”

Thanks to this technology, users will be able to create and distribute assets like ERC-20 and ERC-721 tokens on a massive scale. Chris Clay, the game Director of Gods Unchained, a project already building on Immutable X, stated that Immutable X allows Gods Unchained to implement a new meta-system that was previously impossible. In this fashion, Immutable X aims to create a world-class experience for users and developers alike.

Source: Immutable X price today, IMX to USD live, marketcap and chart | CoinMarketCap

About Pivot Lines

The term monthly indicates that the pivot levels are calculated using the prior month’s high, low and closing price. The basic formulas are now well-known and pivot calculators are readily available on Tradingview.

If a market closes above the monthly pivot, then the trend is positive, and closing below the pivot is negative. In a positive market, you look for prices to pause, or maybe even reverse, at the first pivot resistance level (R1). If that level is exceeded, then the R2 is the next level to watch. Conversely, when a market drops below the monthly pivot, then the first downside target is the first pivot support (S1), and the second support is S2.

Source: Learn How To Use Monthly Pivot Analysis (forbes.com)

Here is my idea for #Immutable

Price finds support at monthly pivot S1 line – we had the same scenario at the June S1 pivot line.

Daily inside bar has been formed and we will wait for a close above the yellow trigger line (0.884$) in the 4h chart to enter the trade.

Profit target 1.3310$ and stop 0.7260$.

Risk Reward ratio 2.6

Please feel free to ask any question in comments. I will try to answer all! Thank you.

About #Immutable

Rank 136 by marked cap

Immutable X positions itself as the first layer-two scaling solution for NFTs on Ethereum. According to Immutable X, its blockchain does away with Ethereum’s limitations like low scalability, a poor user experience, illiquidity, and a slow developer experience. Instead, users benefit from instant trading and massive scalability while enjoying zero gas fees for minting and trading NFTs without compromising user or asset security. To achieve that, Immutable X is built with STARK zk-rollups, a technology that Vitalik Buterin considers Ethereum to be “all-in on.”

Thanks to this technology, users will be able to create and distribute assets like ERC-20 and ERC-721 tokens on a massive scale. Chris Clay, the game Director of Gods Unchained, a project already building on Immutable X, stated that Immutable X allows Gods Unchained to implement a new meta-system that was previously impossible. In this fashion, Immutable X aims to create a world-class experience for users and developers alike.

Source: Immutable X price today, IMX to USD live, marketcap and chart | CoinMarketCap

About Pivot Lines

The term monthly indicates that the pivot levels are calculated using the prior month’s high, low and closing price. The basic formulas are now well-known and pivot calculators are readily available on Tradingview.

If a market closes above the monthly pivot, then the trend is positive, and closing below the pivot is negative. In a positive market, you look for prices to pause, or maybe even reverse, at the first pivot resistance level (R1). If that level is exceeded, then the R2 is the next level to watch. Conversely, when a market drops below the monthly pivot, then the first downside target is the first pivot support (S1), and the second support is S2.

Source: Learn How To Use Monthly Pivot Analysis (forbes.com)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.