Intel, once synonymous with cutting-edge computing power, has long been recognized for its innovation in processor technology. In the early 2000s and 2010s, the release of Intel’s i5 and i7 chips marked significant milestones in consumer and enterprise computing. These products were benchmarks of performance and efficiency, and for many—including myself—each release felt like a leap forward in personal computing.

However, over the past decade, Intel has lost significant ground to its primary competitors, notably AMD and Nvidia. AMD has emerged as a strong contender in both consumer and enterprise CPU markets with its Ryzen and EPYC series, while Nvidia has dominated the GPU space and positioned itself at the forefront of AI and machine learning applications. Intel, by contrast, has struggled with delays in adopting smaller nanometer process nodes and lost market share across multiple segments. To some, this decline signals the slow erosion of a once-great technology company.

Yet, despite its setbacks, it would be premature to dismiss Intel as a fading relic. In fact, recent developments suggest the company may be in the early stages of a significant turnaround.

Strategically, Intel remains a critical player in the global semiconductor supply chain. Unlike many of its competitors, Intel both designs and manufactures its own chips—a capability that gives it a unique position, especially in the context of increasing geopolitical tensions and growing concerns about dependence on overseas manufacturing, particularly in East Asia. In response, the U.S. government has demonstrated a growing interest in reviving domestic chip production. Rumoured reports suggest a potential 10% stake in Intel may be under consideration as part of a broader initiative to boost American-made semiconductors through subsidies, public-private partnerships, and national security-driven policy.

This kind of institutional backing—both from private capital and potentially the federal government—could provide Intel with the financial and political support necessary to accelerate its turnaround. CEO Pat Gelsinger’s renewed vision includes aggressive investments in leading-edge foundry services (Intel Foundry Services), AI, and advanced packaging technologies. If successful, these efforts could not only stabilize Intel's position but also allow it to reemerge as a technological leader.

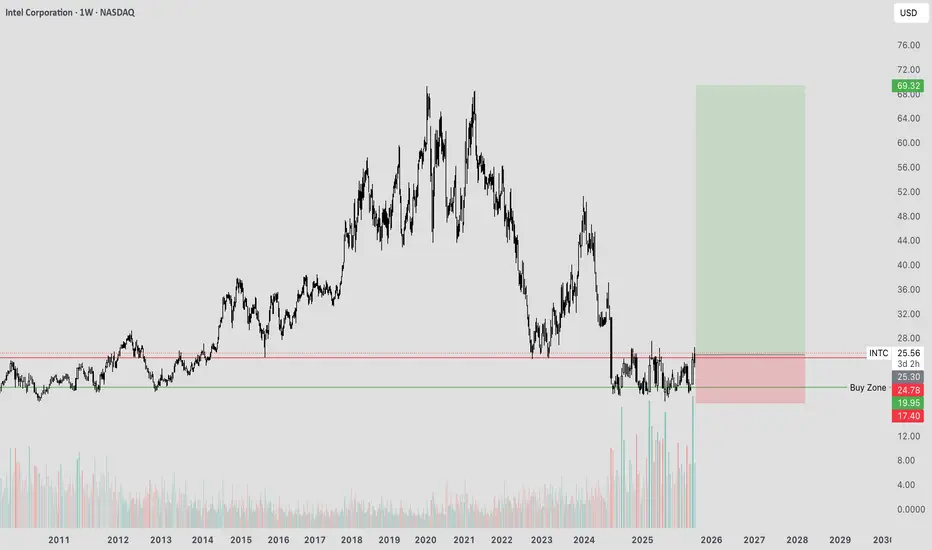

From an investor’s perspective, Intel’s current valuation—trading close to book value—offers a compelling risk-reward ratio. While the company faces clear challenges, its intrinsic value, legacy infrastructure, and strategic importance create a margin of safety. If Intel is able to regain technological momentum and secure meaningful market share in AI or foundry services, the upside could be substantial.

In summary, while Intel is no longer the market darling it once was, its story is far from over. With strong institutional interest, potential government involvement, and a bold transformation plan underway, Intel represents an attractive long-term investment. At today’s prices, the risk appears asymmetric—with significant potential for recovery and growth. I am confident in taking this position and believe patient investors may be rewarded in the years to come.

However, over the past decade, Intel has lost significant ground to its primary competitors, notably AMD and Nvidia. AMD has emerged as a strong contender in both consumer and enterprise CPU markets with its Ryzen and EPYC series, while Nvidia has dominated the GPU space and positioned itself at the forefront of AI and machine learning applications. Intel, by contrast, has struggled with delays in adopting smaller nanometer process nodes and lost market share across multiple segments. To some, this decline signals the slow erosion of a once-great technology company.

Yet, despite its setbacks, it would be premature to dismiss Intel as a fading relic. In fact, recent developments suggest the company may be in the early stages of a significant turnaround.

Strategically, Intel remains a critical player in the global semiconductor supply chain. Unlike many of its competitors, Intel both designs and manufactures its own chips—a capability that gives it a unique position, especially in the context of increasing geopolitical tensions and growing concerns about dependence on overseas manufacturing, particularly in East Asia. In response, the U.S. government has demonstrated a growing interest in reviving domestic chip production. Rumoured reports suggest a potential 10% stake in Intel may be under consideration as part of a broader initiative to boost American-made semiconductors through subsidies, public-private partnerships, and national security-driven policy.

This kind of institutional backing—both from private capital and potentially the federal government—could provide Intel with the financial and political support necessary to accelerate its turnaround. CEO Pat Gelsinger’s renewed vision includes aggressive investments in leading-edge foundry services (Intel Foundry Services), AI, and advanced packaging technologies. If successful, these efforts could not only stabilize Intel's position but also allow it to reemerge as a technological leader.

From an investor’s perspective, Intel’s current valuation—trading close to book value—offers a compelling risk-reward ratio. While the company faces clear challenges, its intrinsic value, legacy infrastructure, and strategic importance create a margin of safety. If Intel is able to regain technological momentum and secure meaningful market share in AI or foundry services, the upside could be substantial.

In summary, while Intel is no longer the market darling it once was, its story is far from over. With strong institutional interest, potential government involvement, and a bold transformation plan underway, Intel represents an attractive long-term investment. At today’s prices, the risk appears asymmetric—with significant potential for recovery and growth. I am confident in taking this position and believe patient investors may be rewarded in the years to come.

Note

Should price breakdown to $20, I will look at this as a final opportunity to buy the dip, marked as the buy zone on my chart. However, I have currently built a significant position as the drop is not guaranteed to materialize. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.