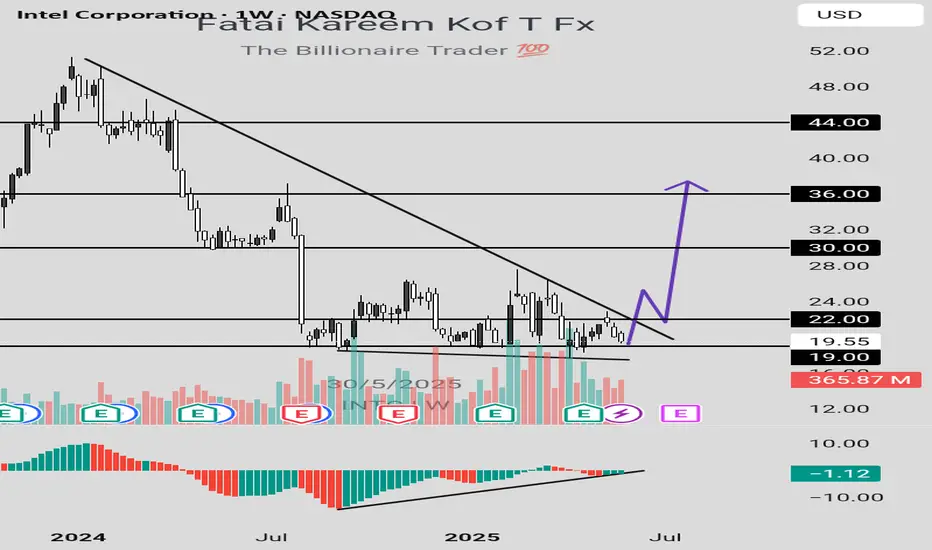

From the perspective of technical analysis, INTC is approaching a key psychological level at $19. In addition, it's in a downtrend. If the key level should hold by pushing price higher, leading to a break out of the downtrend line and closing with a strong bullish candle above the down trend line and resistance level around $22, this will indicate a strong bullish signal. Likewise, this is supported by a bullish divergence signal from the awesome oscillator. Otherwise, a failure of the psychological level of $19 may lead to price dropping further.

Furthermore, we need to look beyond technical analysis. Fundamental analysis also has some insights for our decisions.

Fundamentals for INTC established a bearish bias. The summary is as follows:

Financial Health:

• Negative EPS (-$4.47): Intel is losing money.

• High Debt ($50B): This can limit growth and increase risk.

• Declining Revenue: Sales dropped from $80B (2021) to $51B (2024).

Valuation:

• Cheap P/S (1.66x), but no P/E (due to negative earnings).

• Dividend yield (2.56%) is at risk of being cut.

Sentiment:

Stock price fell from $56 to $19.55 (65% drop). Institutional investors may be wary.

Fundamentally, INTC is weak — best suited for speculative, long-term bets (if you believe in a turnaround).

Strategy for Traders:

1. Conservative Approach:

- Wait for:

- Break out of downtrend line and resistance around $22 and positive earnings/news.

- Rising volume to confirm momentum.

- Target: $27–$30

- Stop-loss: Below $17 (apply proper risk management).

2. Aggressive Approach:

- Buy near $18–$19 with tight stop-loss ($16).

- Target resistance level at $22.

3. Avoid If:

- You’re risk-averse or prefer stable companies.

- Intel’s debt/revenue trends worsen.

Note:

- Short-Term Trade: Only if breakout confirms ($22+). High risk, but possible 20% bounce.

- Long-Term Investment: Avoid unless Intel shows profit/debt improvement.

Always use stop-losses —Intel’s fundamentals make it volatile.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you can't accept the risk.

Furthermore, we need to look beyond technical analysis. Fundamental analysis also has some insights for our decisions.

Fundamentals for INTC established a bearish bias. The summary is as follows:

Financial Health:

• Negative EPS (-$4.47): Intel is losing money.

• High Debt ($50B): This can limit growth and increase risk.

• Declining Revenue: Sales dropped from $80B (2021) to $51B (2024).

Valuation:

• Cheap P/S (1.66x), but no P/E (due to negative earnings).

• Dividend yield (2.56%) is at risk of being cut.

Sentiment:

Stock price fell from $56 to $19.55 (65% drop). Institutional investors may be wary.

Fundamentally, INTC is weak — best suited for speculative, long-term bets (if you believe in a turnaround).

Strategy for Traders:

1. Conservative Approach:

- Wait for:

- Break out of downtrend line and resistance around $22 and positive earnings/news.

- Rising volume to confirm momentum.

- Target: $27–$30

- Stop-loss: Below $17 (apply proper risk management).

2. Aggressive Approach:

- Buy near $18–$19 with tight stop-loss ($16).

- Target resistance level at $22.

3. Avoid If:

- You’re risk-averse or prefer stable companies.

- Intel’s debt/revenue trends worsen.

Note:

- Short-Term Trade: Only if breakout confirms ($22+). High risk, but possible 20% bounce.

- Long-Term Investment: Avoid unless Intel shows profit/debt improvement.

Always use stop-losses —Intel’s fundamentals make it volatile.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you can't accept the risk.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.