The Bull Case - Operational Excellence:

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

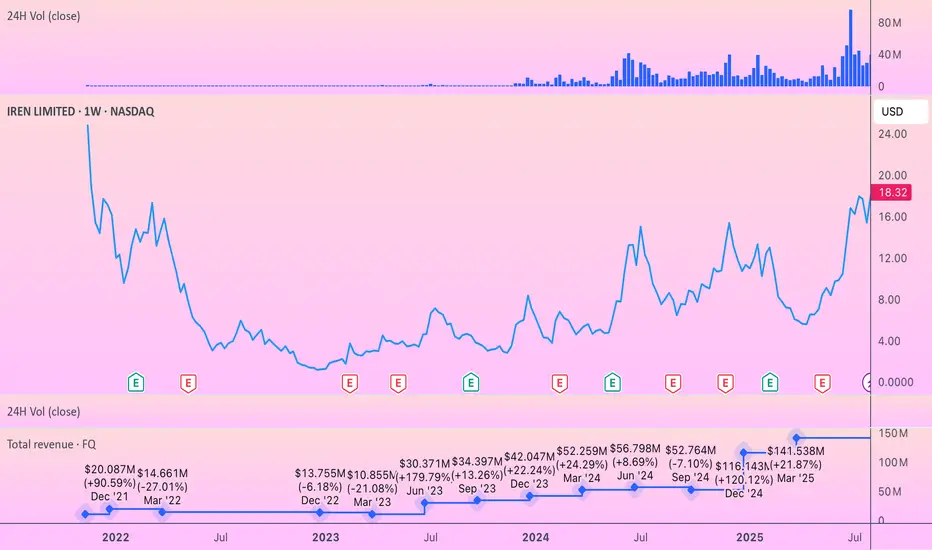

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

I am a research analyst specializing in Bitcoin mining and blockchain infrastructure. With a focus on mining economics, energy efficiency, and the evolving regulatory landscape, I provide data-driven insights into global mining trends.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am a research analyst specializing in Bitcoin mining and blockchain infrastructure. With a focus on mining economics, energy efficiency, and the evolving regulatory landscape, I provide data-driven insights into global mining trends.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.