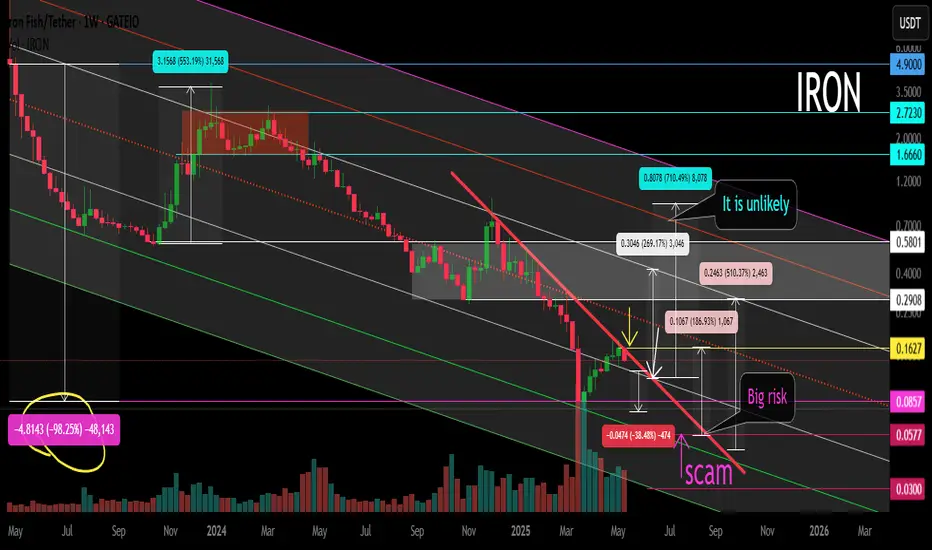

Logarithm. Time frame 1 week. Down from the listing price -98%. Dying asset. Suitable for pump/dump strategy work, without reference to the ticker name in the spot, with down-to-earth goals, but understanding the high volatility of these assets due to low liquidity (“dying assets”). Work without stops (they are destructive for such assets with such volatility), from the average price of the set/dump. It is advisable to work on a breakthrough of key zones (understanding the liquidity of the asset, and the amount of the entry amount).

Asset as an example, crypto wrappers of such liquidity and work on them now. There are thousands of similar ones on the crypto market. Therefore, there is no point in considering them separately. One similar one, projection - if not thousands of dying scams (created under the hype of the distribution of the last cycle), then hundreds.

🟢A “Dragon” pattern may form if the downward secondary trend is broken. More precisely, it will be broken if a short alt season starts now for alts. The target is in the previous consolidation zone, and to cross the dynamic resistance of the inner zone of the descending channel (zone of decreasing highs). It is rational to work for a breakthrough, understanding the liquidity of the dying asset.

🔴If the market is negative, then the rollback from this descending line will continue to the dynamic support of the channel in the designated zone. If below, then it is a scam and delists from other exchanges where it is traded.

Asset as an example, crypto wrappers of such liquidity and work on them now. There are thousands of similar ones on the crypto market. Therefore, there is no point in considering them separately. One similar one, projection - if not thousands of dying scams (created under the hype of the distribution of the last cycle), then hundreds.

🟢A “Dragon” pattern may form if the downward secondary trend is broken. More precisely, it will be broken if a short alt season starts now for alts. The target is in the previous consolidation zone, and to cross the dynamic resistance of the inner zone of the descending channel (zone of decreasing highs). It is rational to work for a breakthrough, understanding the liquidity of the dying asset.

🔴If the market is negative, then the rollback from this descending line will continue to the dynamic support of the channel in the designated zone. If below, then it is a scam and delists from other exchanges where it is traded.

Note

🧠 This IRON is a dying asset, you need to understand this. The decline from the listing price is -98%. It is suitable for working with a pump/dump strategy, without being tied to the name of the ticker in the spot, with down-to-earth goals, but understanding the high volatility of these assets due to low liquidity ("dying assets"). They pulled out the movements and forgot.1️⃣ Work without stop-Loss (they are destructive for such assets with such volatility), from the average price of the set/dump.

2️⃣ It is advisable to work on a breakthrough of key zones (understanding the liquidity of the asset, and the amount of the entry amount). It is collected in advance before the reversal (accumulation) in more liquid instruments, and where there are more guarantees. But, all this, how to act and what work tactics to choose depends on what risks you are willing to take in order to earn.

3️⃣✔️The amount for working on such assets from the deposit is allocated in advance, and it is limited.

4️⃣✔️10-20 wrappers are selected for monitoring. A limited amount of money is allocated from this amount for each. It is not necessary to enter the wrappers in advance, even destructively. As a rule, it is worked with pending limit orders, or stops on a breakout.

✔️Recently, exchanges have introduced #triggerOrders, this is very convenient and money is not frozen, but scattered across many assets that can "shoot".

💸 That is, everything, as always, the effectiveness of such a strategy depends only on how well you can control your risks (in fact, this is the only thing you can control in trading), and manage to take what they give (volatility + logic), and not guessing prices.

5️⃣⚠️🐹 The names of the wrapper and the invented legends of imitation of usefulness do not matter. The graphs of their prices (thousands of cryptocurrencies) are a projection of these real utilities -96-99% of pumps, and a gradual scam. That is, the meaning of all the legends for fools, pardon, of what the project does is real money out of nothing, on beliefs in something that does not exist... To sell, you need to make volatility and interest. You use this volatility, that's all. You also need to understand that from time to time crypto "wrappers" die, and this is normal. Risk control, and not choosing a "special crypto wrapper" solves this problem.

✅ Telegram. Finance + Trading: t.me/SpartaBTC_1318

✅ Telegram. Сrypto trading only: t.me/SpartaBTC_tradingview

✅ Instagram: instagram.com/spartabtc_1318

✅ YouTube (Rus): goo.su/vpRzRa2

✅ Telegram. Сrypto trading only: t.me/SpartaBTC_tradingview

✅ Instagram: instagram.com/spartabtc_1318

✅ YouTube (Rus): goo.su/vpRzRa2

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Telegram. Finance + Trading: t.me/SpartaBTC_1318

✅ Telegram. Сrypto trading only: t.me/SpartaBTC_tradingview

✅ Instagram: instagram.com/spartabtc_1318

✅ YouTube (Rus): goo.su/vpRzRa2

✅ Telegram. Сrypto trading only: t.me/SpartaBTC_tradingview

✅ Instagram: instagram.com/spartabtc_1318

✅ YouTube (Rus): goo.su/vpRzRa2

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.