📈  IT (Gartner) – Discount Rally Setup Forming

IT (Gartner) – Discount Rally Setup Forming

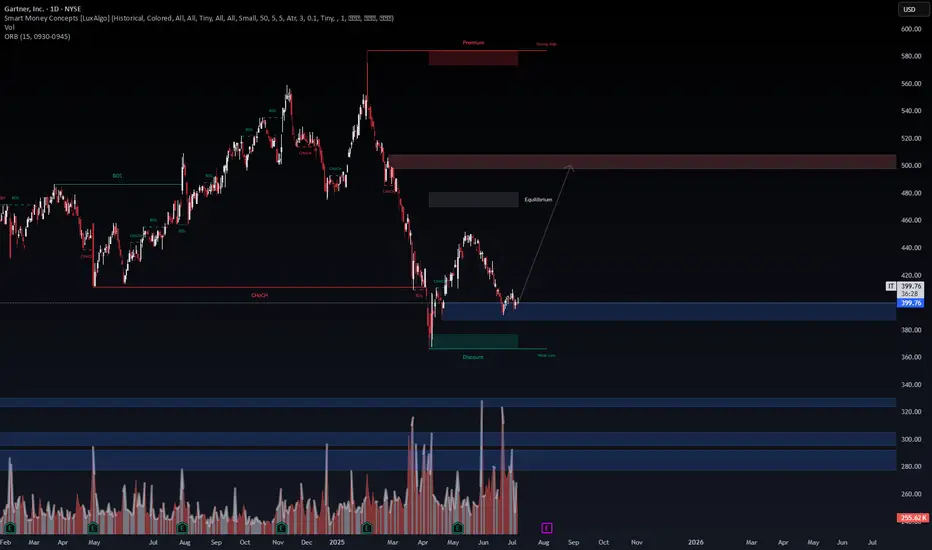

Timeframe: 1D | Date: July 8, 2025 | VolanX DSS Scan – SMC + Liquidity Framework

Gartner ( IT) is exhibiting a textbook reaccumulation structure off the Discount Zone, following a series of CHoCH + BOS confirmations. Price is now pushing off a demand zone with volume stability and technical alignment for a larger move toward the Equilibrium and Premium supply block.

IT) is exhibiting a textbook reaccumulation structure off the Discount Zone, following a series of CHoCH + BOS confirmations. Price is now pushing off a demand zone with volume stability and technical alignment for a larger move toward the Equilibrium and Premium supply block.

🔍 Trade Thesis

🔄 CHoCH → BOS confirms shift in market structure

🟦 Discount Zone Rejection near $380

⚙️ Volume reset after a capitulative leg into prior BOS level

🔲 Equilibrium Pivot: ~$440

🟥 Premium Supply Zone: $500–$520

⛔️ Invalidation: Daily close below $384 support base

🧠 Macro Narrative

Enterprise IT budgets are recovering as macro uncertainty fades.

Gartner’s analytics and research subscriptions may see reacceleration in 2H25.

Elevated institutional interest likely on earnings reversion themes.

IT also serves as a proxy for global SaaS and IT trend strength.

IT also serves as a proxy for global SaaS and IT trend strength.

✅ Long Bias | Target: $500+

VolanX Confidence Score: 75%

Expected Move Horizon: 3–5 weeks

Risk Level: Moderate (event-driven catalysts likely by late July)

Timeframe: 1D | Date: July 8, 2025 | VolanX DSS Scan – SMC + Liquidity Framework

Gartner (

🔍 Trade Thesis

🔄 CHoCH → BOS confirms shift in market structure

🟦 Discount Zone Rejection near $380

⚙️ Volume reset after a capitulative leg into prior BOS level

🔲 Equilibrium Pivot: ~$440

🟥 Premium Supply Zone: $500–$520

⛔️ Invalidation: Daily close below $384 support base

🧠 Macro Narrative

Enterprise IT budgets are recovering as macro uncertainty fades.

Gartner’s analytics and research subscriptions may see reacceleration in 2H25.

Elevated institutional interest likely on earnings reversion themes.

✅ Long Bias | Target: $500+

VolanX Confidence Score: 75%

Expected Move Horizon: 3–5 weeks

Risk Level: Moderate (event-driven catalysts likely by late July)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.