This week's #CPI (Consumer Price Index) and #PPI (Producer Price Index) prints could significantly influence market direction across major indices —

1. Hot CPI or PPI (above expectations):

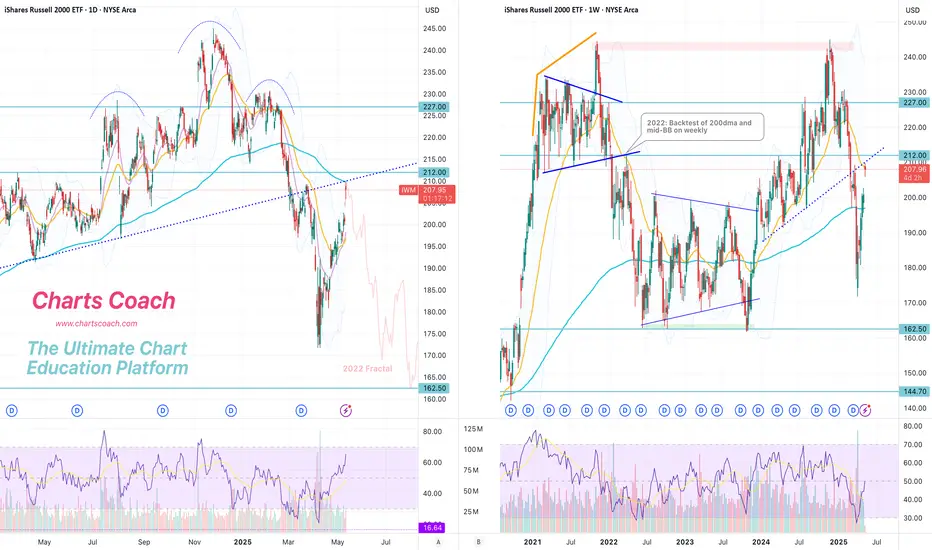

🟥 Result: Bearish across the board, with small caps underperforming.

2. Cool CPI or PPI (below expectations):

🟩 Result: Bullish, with small caps possibly leading a relief rally.

3. In-line CPI/PPI:

Markets may stay choppy or consolidate, with

With small caps already lagging, this week’s inflation data could either validate its bearish divergence or spark a rotation rally if inflation

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.