Technical Analysis

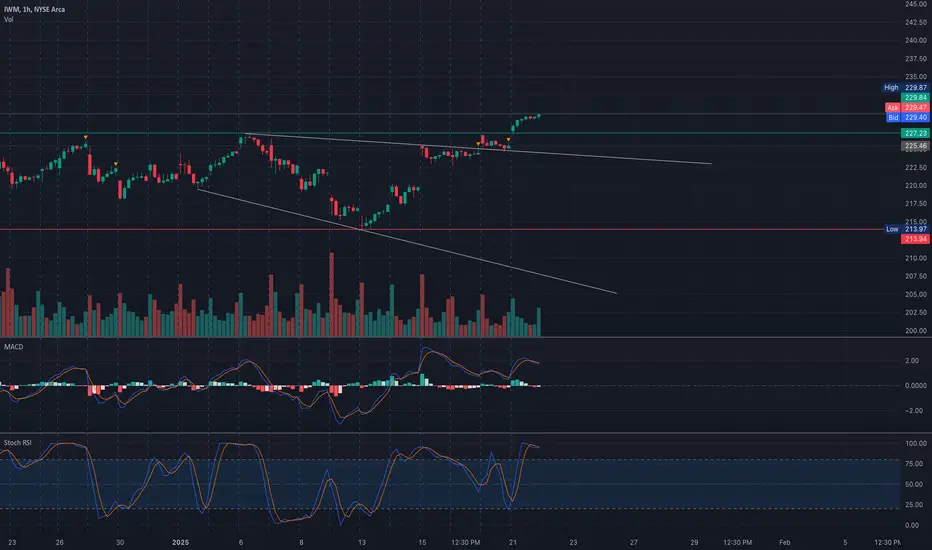

* Trend: IWM shows an upward momentum with a breakout above the previous resistance level at $227.

* Support and Resistance:

* Immediate Support: $227, previously a resistance level, may now act as support.

* Major Resistance: $230 is the next significant resistance level, aligned with the GEX 2nd

CALL Wall.

* Critical Support: $226 acts as a safety zone, below which the bearish sentiment might strengthen.

* Indicators:

* MACD: Positive momentum; however, the histogram shows slight consolidation.

* Stochastic RSI: Overbought zone, indicating caution for long entries in the short term.

Gamma Exposure (GEX)

* Key Levels:

* Highest Positive GEX (Call Resistance): $230 – Major resistance zone, where call option sellers may cap upward movement.

* Support Levels:

* $227: The 3rd CALL Wall level offering intermediate support.

* $226: HVL level aligned with GEX support zones.

* IVR & Sentiment:

* Implied Volatility Rank (IVR): 14.7 - Low IV, suggesting cheaper option premiums.

* GEX Sentiment: Positive skew with minimal PUT protection, indicating bullish sentiment overall.

Trading Plan

* Bullish Setup:

* Entry: Above $227 with volume confirmation.

* Target: $230.

* Stop-Loss: Below $226.

* Bearish Setup:

* Entry: Below $226 with high selling volume.

* Target: $224-$222 range.

* Stop-Loss: Above $228.

Disclaimer

This analysis is for educational purposes only. Always conduct your own due diligence and manage risk appropriately before trading.

* Trend: IWM shows an upward momentum with a breakout above the previous resistance level at $227.

* Support and Resistance:

* Immediate Support: $227, previously a resistance level, may now act as support.

* Major Resistance: $230 is the next significant resistance level, aligned with the GEX 2nd

CALL Wall.

* Critical Support: $226 acts as a safety zone, below which the bearish sentiment might strengthen.

* Indicators:

* MACD: Positive momentum; however, the histogram shows slight consolidation.

* Stochastic RSI: Overbought zone, indicating caution for long entries in the short term.

Gamma Exposure (GEX)

* Key Levels:

* Highest Positive GEX (Call Resistance): $230 – Major resistance zone, where call option sellers may cap upward movement.

* Support Levels:

* $227: The 3rd CALL Wall level offering intermediate support.

* $226: HVL level aligned with GEX support zones.

* IVR & Sentiment:

* Implied Volatility Rank (IVR): 14.7 - Low IV, suggesting cheaper option premiums.

* GEX Sentiment: Positive skew with minimal PUT protection, indicating bullish sentiment overall.

Trading Plan

* Bullish Setup:

* Entry: Above $227 with volume confirmation.

* Target: $230.

* Stop-Loss: Below $226.

* Bearish Setup:

* Entry: Below $226 with high selling volume.

* Target: $224-$222 range.

* Stop-Loss: Above $228.

Disclaimer

This analysis is for educational purposes only. Always conduct your own due diligence and manage risk appropriately before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.