🚀🇯🇵 JP225 (JAPAN 225) CFD - THIEF STRATEGY BULLISH PLAN [SWING/DAY TRADE] 🇯🇵🚀

🎯 Core Trading Idea

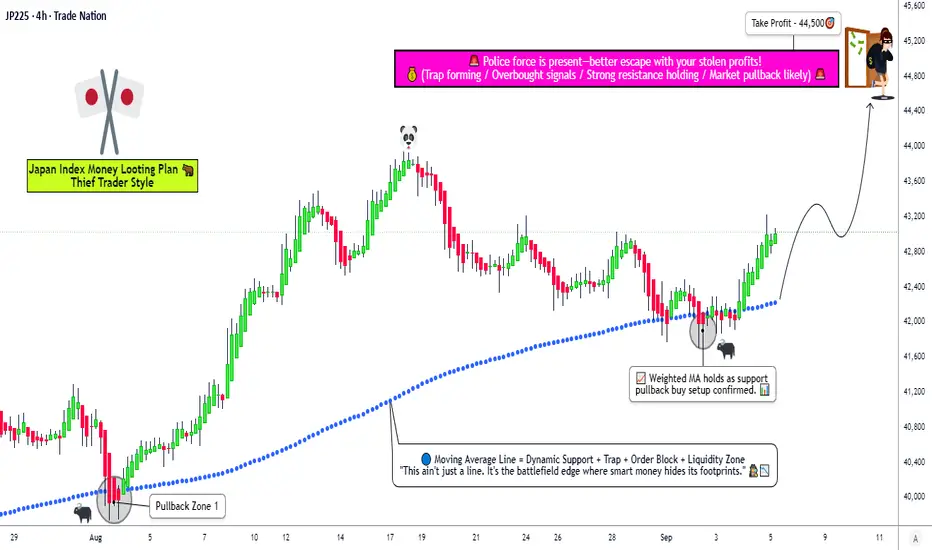

The "Thief Strategy" uses layered limit orders to stealthily accumulate positions during bullish momentum, targeting a swift escape before key resistance levels. This approach maximizes entry efficiency while minimizing market impact – perfect for the current JP225 setup!

📊 THIEF STRATEGY EXECUTION PLAN

⚡ Entry Protocol (Layered Limit Orders)

🔰 Layer 1: 42,200

🔰 Layer 2: 42,400

🔰 Layer 3: 42,600

🔰 Layer 4: 42,800

💡 Pro Tip: Add more layers based on your risk tolerance and capital allocation

🛑 Stop Loss Configuration

Thief OG SL: 41,800 (Strategic support breach level)

⚠️ Disclaimer: Adjust SL based on your personal risk management rules. This is NOT financial advice.

🎯 Profit-Taking Target

Primary Escape Zone: 44,500 (Take profits before police barricade resistance at 45,000)

Remember: Escape with your stolen money wisely! Partial profits at 43,800 and 44,200 recommended

📈 WHY THIS PLAN? MARKET CONTEXT & ANALYSIS

🎯 Real-Time Index Snapshot (Sep 05, 2025)

Current Price: 43,002.00 (+423.82 / +1.00% 📈)

Monthly Gain: +5.48% (Strong momentum ✅)

Yearly Gain: +18.24% (Bullish trend intact ✅)

All-Time High: 43,876.42 (August 2025 🏆)

😰😊 Market Sentiment: Fear & Greed Index

Current Reading: Greed (Score ~70/100) 😊

Momentum: Strong (Above 125-day MA) 📈

Volatility: Low to Moderate 😌

Safe Haven Demand: Low 🚫

Options Activity: Neutral 📊

✅ Fundamental Drivers (BULLISH CATALYSTS)

🏎️ Trade Policy Win: U.S. auto tariffs reduced to 15% (from 27.5%) - massive boost for Japanese exporters

💰 Wage Growth Breakthrough: Real wages turned positive (+0.5%) for first time since December 2024

💵 Investment Surge: $550B Japanese investments in U.S. projects announced

🌍 Global Liquidity Support: Fed rate cut expectations supporting risk assets

🏢 Corporate Strength: Toyota (+1.98%), Honda (+1.14%), and Mitsubishi UFJ (+0.93%) leading gains

⚠️ Key Risks (BE AWARE)

💴 Yen Appreciation Risk: Potential JPY strength if U.S. accelerates rate cuts

🎯 Inflation Pressure: Consumer inflation at 3.6% (above BoJ's 2% target)

📉 Mixed Economic Signals: Coincident index dropped to 113.3 (from 116.7)

📊 Technical Assessment

🎯 Trend Structure: Bullish above 41,500 support

📊 Momentum: Strong upward trajectory with occasional consolidation

🧱 Resistance Levels: 43,900 (Recent high), 45,000 (Psychological barrier)

🛡️ Support Levels: 41,800 (Strategy SL), 41,200 (Strong weekly support)

🌐 RELATED PAIRS TO WATCH

USDJPY - Critical for exporter competitiveness

USDJPY - Critical for exporter competitiveness

NKY - Nikkei 225 futures correlation

NKY - Nikkei 225 futures correlation

SPX - Global risk sentiment gauge

SPX - Global risk sentiment gauge

EURJPY - Yen strength indicator

EURJPY - Yen strength indicator

📊 BULLISH/BEARISH SCORECARD

Technical: 80% Bullish ✅ | 20% Bearish

Fundamental: 75% Bullish ✅ | 25% Bearish

Sentiment: 70% Bullish ✅ | 30% Bearish

Risk/Reward: 80% Favorable ✅ | 20% Unfavorable

OVERALL: 76% BULLISH ✅ | 24% BEARISH

👑 TRADER PERSPECTIVES

🎯 Retail Traders: Optimistic but cautious near ATHs. Watch for breakout above 43,900

🏦 Institutional Flow: Accumulating on dips, focusing on exporters and tech names

🇯🇵 Domestic Investors: Positive on wage growth and trade developments

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ RISK DISCLAIMER

This idea is for educational purposes only. I am not a financial advisor. The "Thief Strategy" is a personal approach and may not suit all traders. Always conduct your own analysis and manage risk appropriately. Past performance doesn't guarantee future results. Trading CFDs carries substantial risk of loss.

#JP225 #Japan225 #NIKKEI #TradingSetup #SwingTrading #DayTrading #TradingStrategy #CFD #MarketAnalysis #TechnicalAnalysis #TradingView #ThiefStrategy #Bullish #Investing #Stocks #Finance

🎯 Core Trading Idea

The "Thief Strategy" uses layered limit orders to stealthily accumulate positions during bullish momentum, targeting a swift escape before key resistance levels. This approach maximizes entry efficiency while minimizing market impact – perfect for the current JP225 setup!

📊 THIEF STRATEGY EXECUTION PLAN

⚡ Entry Protocol (Layered Limit Orders)

🔰 Layer 1: 42,200

🔰 Layer 2: 42,400

🔰 Layer 3: 42,600

🔰 Layer 4: 42,800

💡 Pro Tip: Add more layers based on your risk tolerance and capital allocation

🛑 Stop Loss Configuration

Thief OG SL: 41,800 (Strategic support breach level)

⚠️ Disclaimer: Adjust SL based on your personal risk management rules. This is NOT financial advice.

🎯 Profit-Taking Target

Primary Escape Zone: 44,500 (Take profits before police barricade resistance at 45,000)

Remember: Escape with your stolen money wisely! Partial profits at 43,800 and 44,200 recommended

📈 WHY THIS PLAN? MARKET CONTEXT & ANALYSIS

🎯 Real-Time Index Snapshot (Sep 05, 2025)

Current Price: 43,002.00 (+423.82 / +1.00% 📈)

Monthly Gain: +5.48% (Strong momentum ✅)

Yearly Gain: +18.24% (Bullish trend intact ✅)

All-Time High: 43,876.42 (August 2025 🏆)

😰😊 Market Sentiment: Fear & Greed Index

Current Reading: Greed (Score ~70/100) 😊

Momentum: Strong (Above 125-day MA) 📈

Volatility: Low to Moderate 😌

Safe Haven Demand: Low 🚫

Options Activity: Neutral 📊

✅ Fundamental Drivers (BULLISH CATALYSTS)

🏎️ Trade Policy Win: U.S. auto tariffs reduced to 15% (from 27.5%) - massive boost for Japanese exporters

💰 Wage Growth Breakthrough: Real wages turned positive (+0.5%) for first time since December 2024

💵 Investment Surge: $550B Japanese investments in U.S. projects announced

🌍 Global Liquidity Support: Fed rate cut expectations supporting risk assets

🏢 Corporate Strength: Toyota (+1.98%), Honda (+1.14%), and Mitsubishi UFJ (+0.93%) leading gains

⚠️ Key Risks (BE AWARE)

💴 Yen Appreciation Risk: Potential JPY strength if U.S. accelerates rate cuts

🎯 Inflation Pressure: Consumer inflation at 3.6% (above BoJ's 2% target)

📉 Mixed Economic Signals: Coincident index dropped to 113.3 (from 116.7)

📊 Technical Assessment

🎯 Trend Structure: Bullish above 41,500 support

📊 Momentum: Strong upward trajectory with occasional consolidation

🧱 Resistance Levels: 43,900 (Recent high), 45,000 (Psychological barrier)

🛡️ Support Levels: 41,800 (Strategy SL), 41,200 (Strong weekly support)

🌐 RELATED PAIRS TO WATCH

📊 BULLISH/BEARISH SCORECARD

Technical: 80% Bullish ✅ | 20% Bearish

Fundamental: 75% Bullish ✅ | 25% Bearish

Sentiment: 70% Bullish ✅ | 30% Bearish

Risk/Reward: 80% Favorable ✅ | 20% Unfavorable

OVERALL: 76% BULLISH ✅ | 24% BEARISH

👑 TRADER PERSPECTIVES

🎯 Retail Traders: Optimistic but cautious near ATHs. Watch for breakout above 43,900

🏦 Institutional Flow: Accumulating on dips, focusing on exporters and tech names

🇯🇵 Domestic Investors: Positive on wage growth and trade developments

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ RISK DISCLAIMER

This idea is for educational purposes only. I am not a financial advisor. The "Thief Strategy" is a personal approach and may not suit all traders. Always conduct your own analysis and manage risk appropriately. Past performance doesn't guarantee future results. Trading CFDs carries substantial risk of loss.

#JP225 #Japan225 #NIKKEI #TradingSetup #SwingTrading #DayTrading #TradingStrategy #CFD #MarketAnalysis #TechnicalAnalysis #TradingView #ThiefStrategy #Bullish #Investing #Stocks #Finance

Trade active

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.