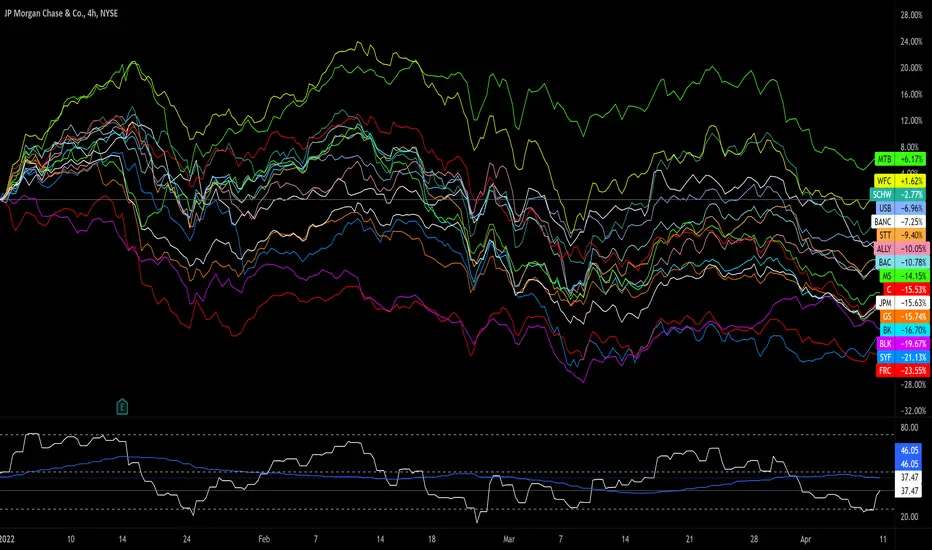

Bank earnings are starting on Wednesday 4/13. Banks have been weak so far this year. In my opinion, Institutional investors are value trapped and hoping to make yield by selling options into earnings IV. Bank earnings guidance can be an important economic indicator for other stocks. Since bank earnings are the first to kick off the earnings season, they will reveal important economic insights that can directly or indirectly affect other stocks. Here's a 16 ticker list of the winners & losers for 2022 YTD and their earnings dates. Also, I have my Signal Blender beta (SigBlendbeta) indicator with RSI slow 40 (blue), VWMA fast 10 (white).

2022 YTD

MTB +6.17%

WFC +1.62%

SCHW -2.77%

USB -6.96%

BANC -7.25%

STT -9.4%

ALLY -10.05%

BAC -10.78%

MS -14.15%

C -15.53%

JPM -15.63%

GS -15.74%

BK -16.70%

BLK -19.67%

SYF -21.13%

FRC - 23.55%

4/13

JPM 7:05am

BLK 6:30am

FRC 7am

4/14

GS 7:30am

WFC 7am

C 8am

MS 7:30am

ALLY 7:25am

USB 6:45am

STT 7:30am

4/18

BAC 6:45am

SCHW 8:45am

BK 6:30am

SYF 6am

4/20

MTB 6:35am

4/21

BANC 6am

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.com/u/growerik/

2022 YTD

MTB +6.17%

WFC +1.62%

SCHW -2.77%

USB -6.96%

BANC -7.25%

STT -9.4%

ALLY -10.05%

BAC -10.78%

MS -14.15%

C -15.53%

JPM -15.63%

GS -15.74%

BK -16.70%

BLK -19.67%

SYF -21.13%

FRC - 23.55%

4/13

JPM 7:05am

BLK 6:30am

FRC 7am

4/14

GS 7:30am

WFC 7am

C 8am

MS 7:30am

ALLY 7:25am

USB 6:45am

STT 7:30am

4/18

BAC 6:45am

SCHW 8:45am

BK 6:30am

SYF 6am

4/20

MTB 6:35am

4/21

BANC 6am

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.com/u/growerik/

Note

Recession likely ???Q4 2023 / Q1 2024

In 2 years???

Why ppl trading like it's tomorrow???

lol

Note

My thesis. Wallstreet 2022 strategy is heavy collar positions at major resistance and flip it long at major support, repeat, to squeeze yield out of range bound +9% year channel.Note

You can't fight Wallstreet. Just pay attention to what they're doing and ride the wave. They use every excuse in the book for market ups and downs to fit their narrative. Except their deliberate positions that literally move the markets. lolNote

Notable market movers short list:Elon Musk

Capital deployment

Social influence

Warren Buffet

Capital deployment

Carter Worth

Technical analyst

Jim Cramer

Social influence

Mohamed Aly El-Erian

Trusted economy professor

Jim Chanos

Short seller

Bofa

Capital deployment

Investor influence

UBS

Capital deployment

Investor influence

Note

I'm so happy I stayed away from trading Bank earnings. So far, as of pre market now, it looks like IV crush for both sides of options holders which is profit for the writers of them ike I anticipated.Note

Banks still trading awfully weak with little to no signs of energy to the upside.Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.