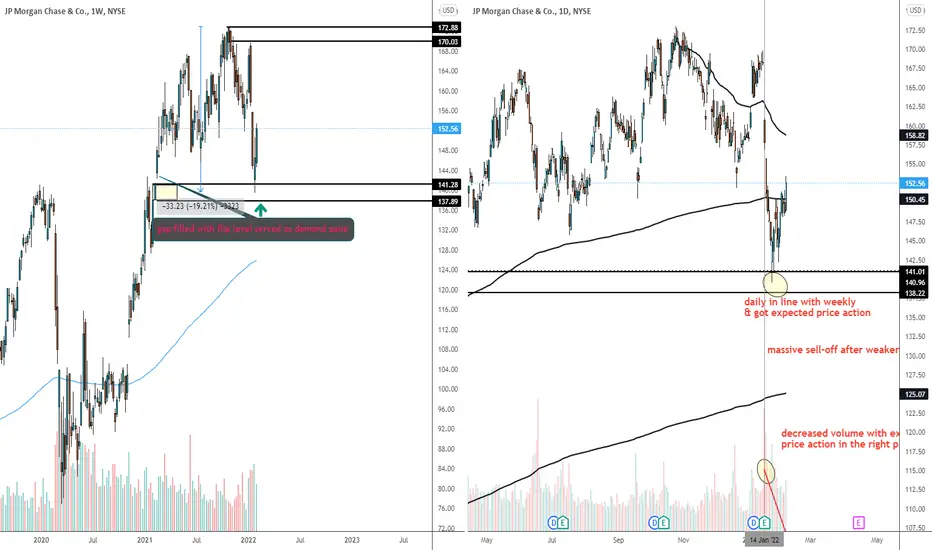

Hello everyone. JPM has been down around 20% on the weaker earning report and market turbulence.

However, it has been bouncing back from key level one weekly. I listed the reasons to be bullish on the daily chart for your reference:

1. VSA 2. Flip 3. multi-timeframe analysis 4. market mood.

Beyond those, the rate hike by FED this year(probably 3-4 times with quickest start on March)also makes JPM preferred assets for investors. I listed reasons in the related idea posted almost one year ago.

I also recommended clients to allocate part of their money in Reits to hedge against the rising inflation.

The only free lunch is diversification. That's the easy money we couldn't miss.

What do you think? Give me a like if you're with me.

However, it has been bouncing back from key level one weekly. I listed the reasons to be bullish on the daily chart for your reference:

1. VSA 2. Flip 3. multi-timeframe analysis 4. market mood.

Beyond those, the rate hike by FED this year(probably 3-4 times with quickest start on March)also makes JPM preferred assets for investors. I listed reasons in the related idea posted almost one year ago.

I also recommended clients to allocate part of their money in Reits to hedge against the rising inflation.

The only free lunch is diversification. That's the easy money we couldn't miss.

What do you think? Give me a like if you're with me.

plan your trade and trade your plan

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

plan your trade and trade your plan

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.