- JPMorgan broke key resistance level 280.00

- Likely to rise to resistance level 300.00

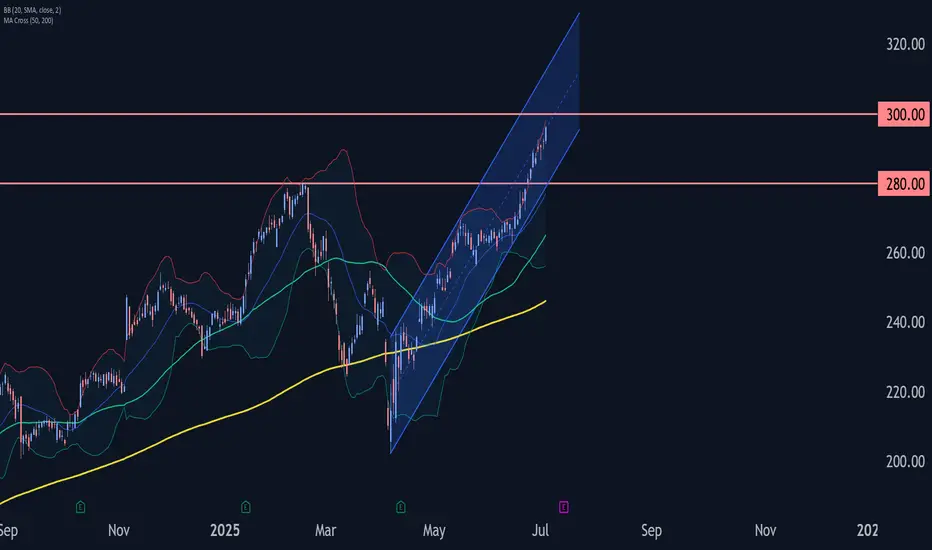

JPMorgan recently broke above the key resistance level 280.00 (which stopped the earlier sharp upward impulse wave (5) in February).

The breakout of the resistance level 280.00 accelerated the active impulse wave 3 of the medium-term impulse wave (5) from May.

Given the clear daily uptrend, JPMorgan can be expected to rise to the next round resistance level 300.00 (target price for the completion of the active impulse wave 3).

- Likely to rise to resistance level 300.00

JPMorgan recently broke above the key resistance level 280.00 (which stopped the earlier sharp upward impulse wave (5) in February).

The breakout of the resistance level 280.00 accelerated the active impulse wave 3 of the medium-term impulse wave (5) from May.

Given the clear daily uptrend, JPMorgan can be expected to rise to the next round resistance level 300.00 (target price for the completion of the active impulse wave 3).

Alexander Kuptsikevich,

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Alexander Kuptsikevich,

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.