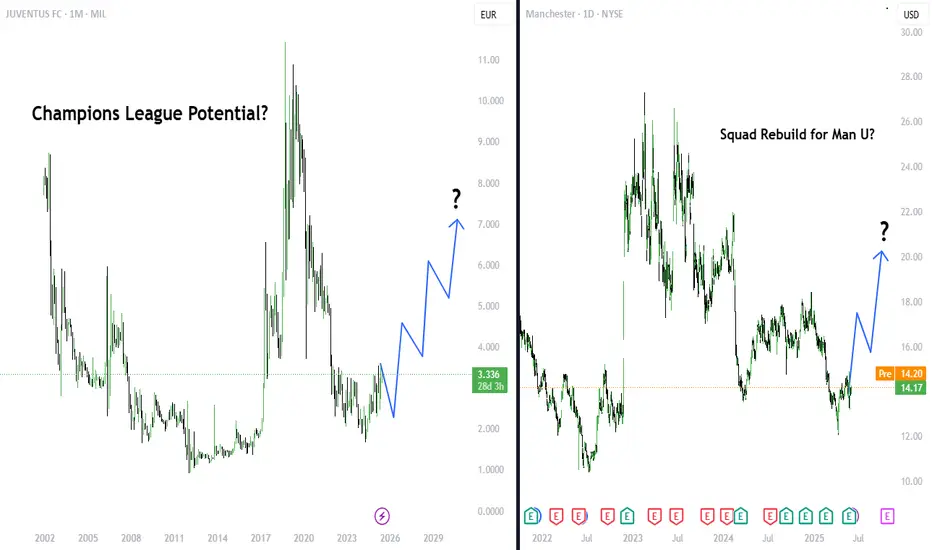

Following this season and the last few seasons, we have seen both clubs drop in form. Man U finishing 15th in the prem and Juv finishing 7th in 2022-2023 season, are signs that these 2 clubs are not in the best shape. Currently, we have seen how PSG managed to become the best team in Europe after their first Champions League trophee. So could both teams make a U-turn and become dominat as they once used to be? Both teams are listed on the stock market and if one beleives that they have seen their worst season so far, could they perform even worse? Because personally, I have never witnessed Man U being ranked 15th in the premier league ever. So, would it be a good investment to speculate on Man U's or Juventus's future, or are both teams far gone from their prime and a return to a new prime is far fetched?

Let's also analyse their stock, depsite their bad few seasons (even though Juventus were 3rd and 4th in Seria A this year and last year):

1)Juventus

Revenue

For the 2023–24 fiscal year, Juventus reported revenues of approximately €395 million. This figure represents a decline from previous years, primarily due to the club's absence from European competitions, which significantly impacted broadcasting and matchday income.

Football Italia

Debt

As of the latest reports, Juventus's total debt stands at around €242 million, a reduction from the previous year's €329 million. The club has undertaken measures to reduce its debt, including cost-cutting strategies and seeking shareholder suppor

2)Manchester United

Revenue

In the 2023–24 season, Manchester United generated revenues of approximately £661.8 million. Despite on-pitch struggles, the club's strong commercial operations and global fanbase have sustained its revenue levels.

Debt

Manchester United's total debt is reported to be around £731.5 million. The club continues to manage its debt obligations, which include servicing interest payments and addressing long-term financial commitments.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

Let's also analyse their stock, depsite their bad few seasons (even though Juventus were 3rd and 4th in Seria A this year and last year):

1)Juventus

Revenue

For the 2023–24 fiscal year, Juventus reported revenues of approximately €395 million. This figure represents a decline from previous years, primarily due to the club's absence from European competitions, which significantly impacted broadcasting and matchday income.

Football Italia

Debt

As of the latest reports, Juventus's total debt stands at around €242 million, a reduction from the previous year's €329 million. The club has undertaken measures to reduce its debt, including cost-cutting strategies and seeking shareholder suppor

2)Manchester United

Revenue

In the 2023–24 season, Manchester United generated revenues of approximately £661.8 million. Despite on-pitch struggles, the club's strong commercial operations and global fanbase have sustained its revenue levels.

Debt

Manchester United's total debt is reported to be around £731.5 million. The club continues to manage its debt obligations, which include servicing interest payments and addressing long-term financial commitments.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.