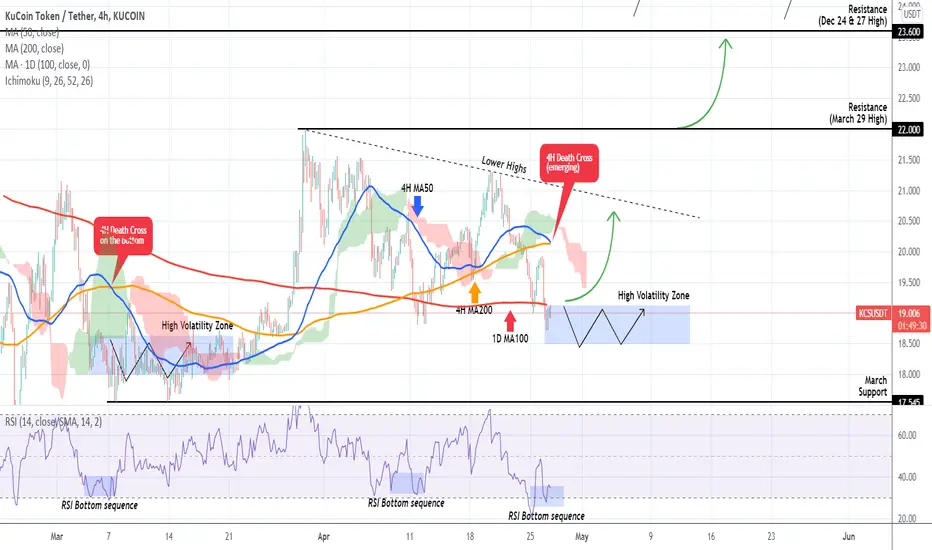

The KuCoin token (KCSUSDT) has been under pressure since the April 20 High but since yesterday we see the first signs of a potential bottom.

** Technical Analysis **

As this 4H chart shows, the token is trading on Lower Highs since the March 29 High that formed the 22.000 Resistance level. A 4H Death Cross (MA50 (blue trend-line) crossing below the MA200 (orange trend-line)) will be formed today, which is a bearish pattern but the last time we saw this (March 07), it was formed on a bottom. In fact it priced the bottom and the token turned sideways into a High Volatility Zone until the late March break-out to the 22.000 Higher High.

With the 4H RSI also forming a bottom sequence, it is possible to have the same pattern again. Notice also that the Ichimoku Cloud has already turned red, which previously has been a solid sign for a buy.

Our strategy is to buy towards the Lower Highs trend-line and then engage on the longer term only when the 22.000 Resistance breaks.

** Fundamental Analysis **

KuCoin manages to keep the bar high in the fundamentals section and this week the talk of twitter is the Spotlight Trial Fund. I won't be getting into more detail on this one but you can find more information on this big event on their twitter page.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

** Technical Analysis **

As this 4H chart shows, the token is trading on Lower Highs since the March 29 High that formed the 22.000 Resistance level. A 4H Death Cross (MA50 (blue trend-line) crossing below the MA200 (orange trend-line)) will be formed today, which is a bearish pattern but the last time we saw this (March 07), it was formed on a bottom. In fact it priced the bottom and the token turned sideways into a High Volatility Zone until the late March break-out to the 22.000 Higher High.

With the 4H RSI also forming a bottom sequence, it is possible to have the same pattern again. Notice also that the Ichimoku Cloud has already turned red, which previously has been a solid sign for a buy.

Our strategy is to buy towards the Lower Highs trend-line and then engage on the longer term only when the 22.000 Resistance breaks.

** Fundamental Analysis **

KuCoin manages to keep the bar high in the fundamentals section and this week the talk of twitter is the Spotlight Trial Fund. I won't be getting into more detail on this one but you can find more information on this big event on their twitter page.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.