Asset Bubbles

Political Events

Natural Disasters

Bankruptcy

Flash Crashes

The perfect cocktail exists currently as all of the below are relevant:

Asset Bubbles - Valuations are distorted by any Metric.

Political Events - Uncertainty continues to build.

Natural Disasters - Warnings on many potential Events.

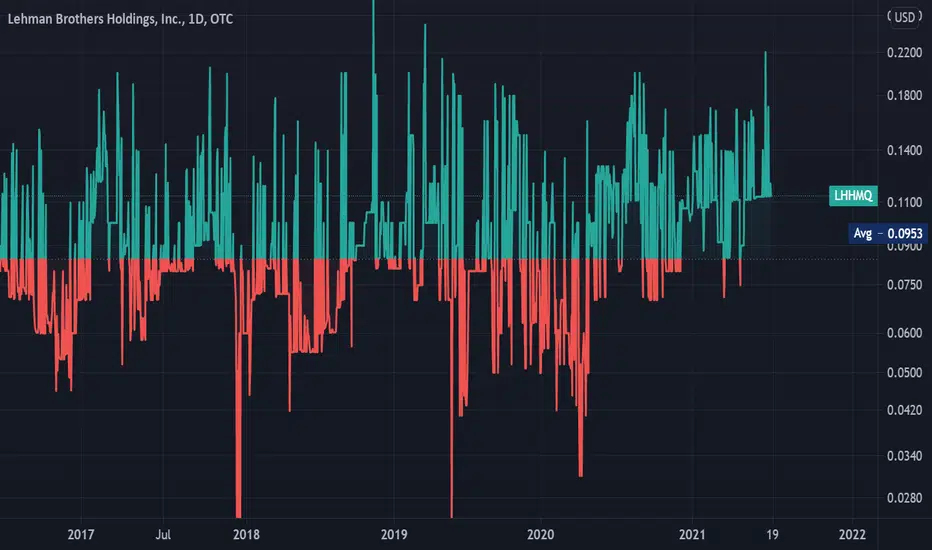

Bankruptcy - The Federal Reserve is buying JUNK.

Flash Crashes - 1962 & 1987: Fear feeds upon itself.

Leverage only serves to create exponential Risk on the downside

as Volumes are outsized.

Both these events had immense support, the Fear overwhelmed intervention.

Political Events

Natural Disasters

Bankruptcy

Flash Crashes

The perfect cocktail exists currently as all of the below are relevant:

Asset Bubbles - Valuations are distorted by any Metric.

Political Events - Uncertainty continues to build.

Natural Disasters - Warnings on many potential Events.

Bankruptcy - The Federal Reserve is buying JUNK.

Flash Crashes - 1962 & 1987: Fear feeds upon itself.

Leverage only serves to create exponential Risk on the downside

as Volumes are outsized.

Both these events had immense support, the Fear overwhelmed intervention.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.