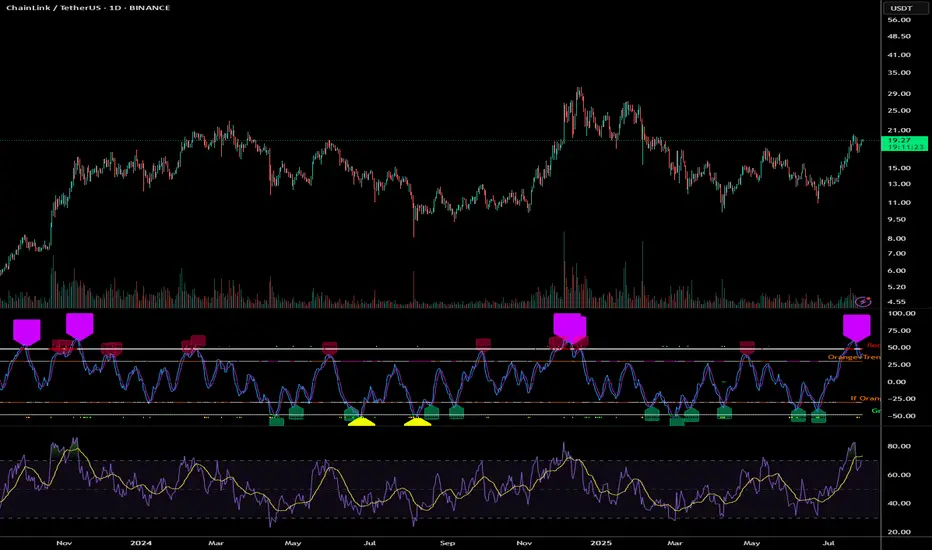

LINK is trading at approximately $19.26. The price has shown significant volatility and upward momentum over the past few months, moving from around $10-11 in early 2025 to the current levels near $19, representing an impressive 80-90% increase.

Technical Indicator Analysis

RSI (Relative Strength Index)

The daily RSI is currently at 61.60, which is in bullish territory but not yet overbought

The 4-hour RSI is showing similar strength at 61.60

This indicates robust momentum without reaching extreme levels that would trigger immediate profit-taking

Historical data shows LINK can sustain RSI readings in the 60-70 range during strong uptrends

Price Action Patterns

LINK has formed a series of higher highs and higher lows since May 2025

The price recently consolidated in the $17-19 range before showing signs of continuation

There was a significant price surge from $13-14 levels to above $19 in mid-July, indicating strong buying pressure

The consolidation after rapid gains suggests healthy market behaviour rather than exhaustion

Volume Analysis

Volume has been increasing during upward price movements

Notable volume spikes occurred during the breakout from $15 to $17 and again during the move above $19

This suggests genuine buying interest rather than a low-volume pump

The Volume-Weighted Average Price (VWAP) continues to slope upward, confirming the strength of the trend

Support and Resistance Levels

Strong support has formed around $17.50-18.00

Previous resistance around $19.00 is now being tested as support

The next major resistance appears to be in the $20-21 range based on previous price action

After that, there's relatively little historical resistance until the $25 level

Fibonacci Projections

Using the recent swing low of approximately $11.45 (May 2025) to the recent high of $19.66:

The 161.8% extension projects a target of approximately $24.70

The 200% extension suggests a move toward $28.00

These Fibonacci levels often serve as magnets for price during strong trend movements

LINK Price Projection

Based on the technical indicators analysed:

Short-term (August-September 2025):

LINK appears poised to break through the $20 psychological barrier

Initial target around $22-23 as the next resistance level

Support should hold around $17.50-18.00 on any pullbacks

The clean break above previous resistance at $18.50-19.00 suggests momentum remains strong

Medium-term (October-November 2025):

If the current trend structure remains intact

LINK could target the $24-25 range, aligning with the 161.8% Fibonacci extension

Previous all-time highs near $30 could come into play by year-end

The steady stair-stepping pattern of rallies followed by consolidation suggests this move would be sustainable

Key Factors to Watch:

Volume on breakouts above $20 and $25

RSI readings for signs of exhaustion or continued strength

Development updates and adoption news specific to Chain-link

Maintenance of the higher lows pattern on any pullbacks

Conclusion

The technical picture for LINK appears bullish, with multiple indicators suggesting continued upward momentum. The price has established a strong uptrend with healthy consolidation periods. The recent price action shows accumulation rather than distribution, with higher lows forming during consolidation phases.

The most likely scenario based on current data suggests LINK could reach the $24-25 range in the next 2-3 months, with potential for movement toward $28-30 by the end of 2025, representing a 30-55% increase from current levels. However, investors should monitor key support levels around $17.50-18.00 for any signs of trend reversal.

The clean chart structure, steady volume profile, and measured RSI readings all point to a continuation of the current uptrend, making LINK's technical outlook decidedly positive for the remainder of 2025.

Technical Indicator Analysis

RSI (Relative Strength Index)

The daily RSI is currently at 61.60, which is in bullish territory but not yet overbought

The 4-hour RSI is showing similar strength at 61.60

This indicates robust momentum without reaching extreme levels that would trigger immediate profit-taking

Historical data shows LINK can sustain RSI readings in the 60-70 range during strong uptrends

Price Action Patterns

LINK has formed a series of higher highs and higher lows since May 2025

The price recently consolidated in the $17-19 range before showing signs of continuation

There was a significant price surge from $13-14 levels to above $19 in mid-July, indicating strong buying pressure

The consolidation after rapid gains suggests healthy market behaviour rather than exhaustion

Volume Analysis

Volume has been increasing during upward price movements

Notable volume spikes occurred during the breakout from $15 to $17 and again during the move above $19

This suggests genuine buying interest rather than a low-volume pump

The Volume-Weighted Average Price (VWAP) continues to slope upward, confirming the strength of the trend

Support and Resistance Levels

Strong support has formed around $17.50-18.00

Previous resistance around $19.00 is now being tested as support

The next major resistance appears to be in the $20-21 range based on previous price action

After that, there's relatively little historical resistance until the $25 level

Fibonacci Projections

Using the recent swing low of approximately $11.45 (May 2025) to the recent high of $19.66:

The 161.8% extension projects a target of approximately $24.70

The 200% extension suggests a move toward $28.00

These Fibonacci levels often serve as magnets for price during strong trend movements

LINK Price Projection

Based on the technical indicators analysed:

Short-term (August-September 2025):

LINK appears poised to break through the $20 psychological barrier

Initial target around $22-23 as the next resistance level

Support should hold around $17.50-18.00 on any pullbacks

The clean break above previous resistance at $18.50-19.00 suggests momentum remains strong

Medium-term (October-November 2025):

If the current trend structure remains intact

LINK could target the $24-25 range, aligning with the 161.8% Fibonacci extension

Previous all-time highs near $30 could come into play by year-end

The steady stair-stepping pattern of rallies followed by consolidation suggests this move would be sustainable

Key Factors to Watch:

Volume on breakouts above $20 and $25

RSI readings for signs of exhaustion or continued strength

Development updates and adoption news specific to Chain-link

Maintenance of the higher lows pattern on any pullbacks

Conclusion

The technical picture for LINK appears bullish, with multiple indicators suggesting continued upward momentum. The price has established a strong uptrend with healthy consolidation periods. The recent price action shows accumulation rather than distribution, with higher lows forming during consolidation phases.

The most likely scenario based on current data suggests LINK could reach the $24-25 range in the next 2-3 months, with potential for movement toward $28-30 by the end of 2025, representing a 30-55% increase from current levels. However, investors should monitor key support levels around $17.50-18.00 for any signs of trend reversal.

The clean chart structure, steady volume profile, and measured RSI readings all point to a continuation of the current uptrend, making LINK's technical outlook decidedly positive for the remainder of 2025.

Discord.gg/CryptoIndicators

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Discord.gg/CryptoIndicators

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.