📈 LLY — Eli Lilly & Co.

Ticker: LLY | Sector: Biotech / Pharmaceuticals

Date: July 26, 2025

Current Price: ~$813

Resistance Zone: $825

Support Zone: $740–$750

🧪 Recent Drug News

1. EMA Backs Alzheimer’s Drug Donanemab (Kisunla)

The European Medicines Agency’s advisory committee has issued a positive opinion on donanemab for early Alzheimer's patients with confirmed amyloid pathology and fewer ApoE4 gene copies. This reverses a previous rejection and paves the way for a likely EU approval in the coming months. Data from TRAILBLAZER‑ALZ trials showed slower cognitive decline and improved safety with a modified dosing regimen, while Europe’s Alzheimer’s patient population is projected to nearly double by 2050.

2. Orforglipron Shows Promising Phase 3 Results

Lilly’s investigational oral GLP‑1 therapy, orforglipron, achieved clinically significant results in Phase 3: A1C reductions of 1.3%–1.6% across doses, weight loss averaging 7.9% at the highest dose, and efficacy seen as early as four weeks. The safety profile was consistent with injectable GLP‑1 drugs, offering a powerful oral option for type 2 diabetes management.

⚡ Analyst & Market Recap (Past Week)

HSBC issued a double downgrade, lowering its rating to "Reduce" and cutting its price target from $1,150 to $700, citing valuation concerns and competitive pressure in the weight-loss space.

Erste Group downgraded LLY from “Buy” to “Hold,” slowing expectations around drug pipeline momentum.

Despite this, other analysts maintain a positive outlook, with the average 12-month price target in the $1,012–$1,016 range, spanning a wide band from $700 to $1,190.

Investor sentiment is shifting cautiously due to rising competition and high multiples.

🔍 Technical & Market Structure

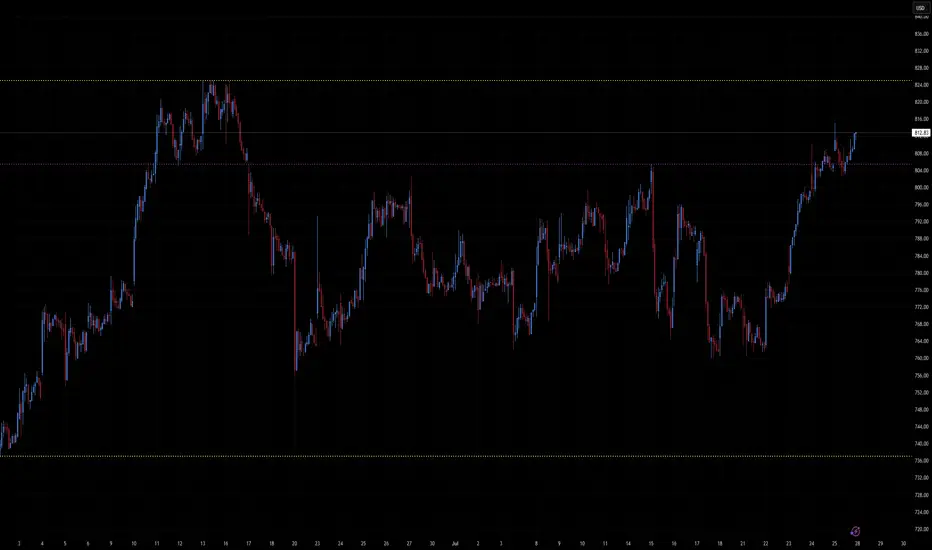

Based on the latest 30-minute chart:

Price remains stuck within a sideways trading range, bounded by a resistance level near $825 and support in the $740–$750 area.

Momentum is building but hasn’t broken through significant technical thresholds yet.

✅ Bullish Scenario

Trigger: Break and hold above $825

Targets: $850 → $900 → $950

Catalysts: Oral GLP‑1 approval prospects, Alzheimers regulatory momentum, and possible drug trial successes

❌ Bearish Scenario

Trigger: Breakdown below $740

Targets: $700 → $670

Risks Include: Rising competition from Novo Nordisk, slowing pipeline news, valuation compression, and analyst downgrades

🧠 Strategic Summary

LLY is operating in a tight technical corridor, with the potential for volatility driven by both clinical and regulatory catalysts. The recent drug developments—donanemab's EMA advancement and orforglipron's strong Phase 3 results—may supply fuel for a bullish breakout if momentum shifts convincingly above $825. Conversely, bearish pressure may intensify if the downside at $740 breaks.

Key levels to watch: breakout above $825 or failure below $740.

Ticker: LLY | Sector: Biotech / Pharmaceuticals

Date: July 26, 2025

Current Price: ~$813

Resistance Zone: $825

Support Zone: $740–$750

🧪 Recent Drug News

1. EMA Backs Alzheimer’s Drug Donanemab (Kisunla)

The European Medicines Agency’s advisory committee has issued a positive opinion on donanemab for early Alzheimer's patients with confirmed amyloid pathology and fewer ApoE4 gene copies. This reverses a previous rejection and paves the way for a likely EU approval in the coming months. Data from TRAILBLAZER‑ALZ trials showed slower cognitive decline and improved safety with a modified dosing regimen, while Europe’s Alzheimer’s patient population is projected to nearly double by 2050.

2. Orforglipron Shows Promising Phase 3 Results

Lilly’s investigational oral GLP‑1 therapy, orforglipron, achieved clinically significant results in Phase 3: A1C reductions of 1.3%–1.6% across doses, weight loss averaging 7.9% at the highest dose, and efficacy seen as early as four weeks. The safety profile was consistent with injectable GLP‑1 drugs, offering a powerful oral option for type 2 diabetes management.

⚡ Analyst & Market Recap (Past Week)

HSBC issued a double downgrade, lowering its rating to "Reduce" and cutting its price target from $1,150 to $700, citing valuation concerns and competitive pressure in the weight-loss space.

Erste Group downgraded LLY from “Buy” to “Hold,” slowing expectations around drug pipeline momentum.

Despite this, other analysts maintain a positive outlook, with the average 12-month price target in the $1,012–$1,016 range, spanning a wide band from $700 to $1,190.

Investor sentiment is shifting cautiously due to rising competition and high multiples.

🔍 Technical & Market Structure

Based on the latest 30-minute chart:

Price remains stuck within a sideways trading range, bounded by a resistance level near $825 and support in the $740–$750 area.

Momentum is building but hasn’t broken through significant technical thresholds yet.

✅ Bullish Scenario

Trigger: Break and hold above $825

Targets: $850 → $900 → $950

Catalysts: Oral GLP‑1 approval prospects, Alzheimers regulatory momentum, and possible drug trial successes

❌ Bearish Scenario

Trigger: Breakdown below $740

Targets: $700 → $670

Risks Include: Rising competition from Novo Nordisk, slowing pipeline news, valuation compression, and analyst downgrades

🧠 Strategic Summary

LLY is operating in a tight technical corridor, with the potential for volatility driven by both clinical and regulatory catalysts. The recent drug developments—donanemab's EMA advancement and orforglipron's strong Phase 3 results—may supply fuel for a bullish breakout if momentum shifts convincingly above $825. Conversely, bearish pressure may intensify if the downside at $740 breaks.

Key levels to watch: breakout above $825 or failure below $740.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.