The next Litecoin halving is estimated to happen between 7/30/23 - 8/2/23. Litecoin halving is the event where the number of generated Litecoin rewards per block will be halved (divided by 2). The total number of Litecoin mined by miners per block will reduce from 12.5 to 6.25 LTC in the next Litecoin halving. Halving occurs every 840,000 blocks (approximately every 4 years). The next Litecoin Halving is Block #2,520,000.

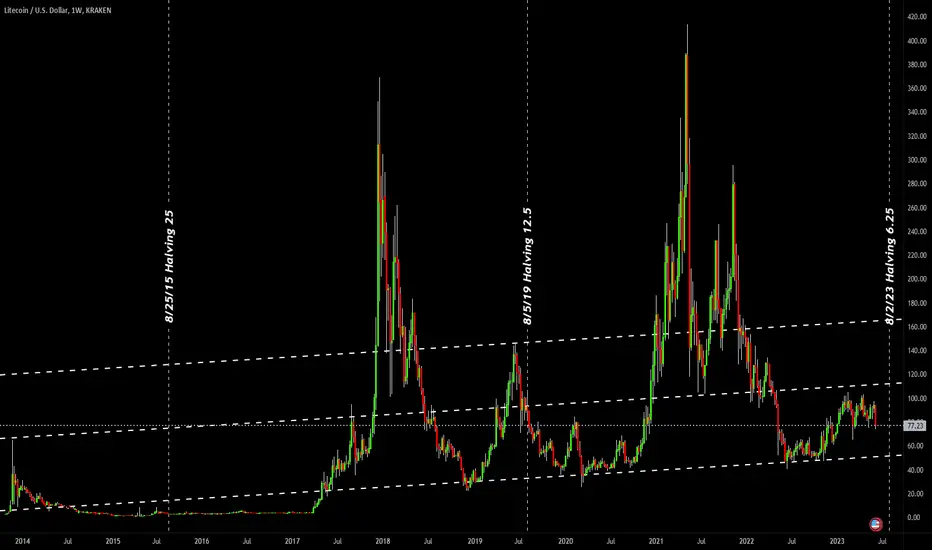

What does this halving mean for Litecoin price action? Some think that the halving is already baked into the current market price. Others believe that the halving should increase the price because the rate of supply is halved. Well, let's see what the charts say about LTC price discovery history. It turns out that LTC has a clear angle of trajectory since 2014. I can get a relative value by aligning this historic angle of trajectory with major support and resistance levels.

By August 2nd, 2023 Litecoin will hit 52 dollars on the downside or 111 bucks on the upside. I think LTC 3rd halving in 52 days will be bearish. Strictly based on a probability from past price discovery patterns. Because LTC 1st halving on 8/25/25 and 2nd halving on 8/5/19 was a bearish event. That doesn't mean it must be a bearish event, it just means the current probability with all historical data to date is pointing down towards 52. If the market does something different this time around, I can see the three main levels are 52, 111 & 165.

In any event, going long LTC from 52 is a very high probability, low risk opportunity if/when it presents itself going forward past August 2nd 2023, for a longer term long trade. Right now, today 6/11/23, LTC is kind of floating around in the middle of these historic angle of trajectory levels in no man's land.

What does this halving mean for Litecoin price action? Some think that the halving is already baked into the current market price. Others believe that the halving should increase the price because the rate of supply is halved. Well, let's see what the charts say about LTC price discovery history. It turns out that LTC has a clear angle of trajectory since 2014. I can get a relative value by aligning this historic angle of trajectory with major support and resistance levels.

By August 2nd, 2023 Litecoin will hit 52 dollars on the downside or 111 bucks on the upside. I think LTC 3rd halving in 52 days will be bearish. Strictly based on a probability from past price discovery patterns. Because LTC 1st halving on 8/25/25 and 2nd halving on 8/5/19 was a bearish event. That doesn't mean it must be a bearish event, it just means the current probability with all historical data to date is pointing down towards 52. If the market does something different this time around, I can see the three main levels are 52, 111 & 165.

In any event, going long LTC from 52 is a very high probability, low risk opportunity if/when it presents itself going forward past August 2nd 2023, for a longer term long trade. Right now, today 6/11/23, LTC is kind of floating around in the middle of these historic angle of trajectory levels in no man's land.

Note

LTC did hit the $111 level today, $111.68 to be exact. So now $165 level is possible before LTC halving on 8/22/23. But after the halving I do expect a downside still.Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.